Global Swimming Pool Market Overview

- The Global Swimming Pool Market is valued at USD 9 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, rapid urbanization, and a strong trend toward outdoor leisure and wellness activities. The market is further supported by rising investments in home improvement and the expansion of the tourism and hospitality sectors, which are fueling demand for both residential and commercial pools .

- Key players in this market include the United States, China, and Australia. The United States leads due to its extensive residential pool base and a culture emphasizing outdoor living and wellness. China is experiencing rapid market expansion, driven by urbanization and increased consumer spending on leisure activities, while Australia benefits from a warm climate and a deeply rooted swimming culture .

- In 2023, the U.S. Consumer Product Safety Commission (CPSC) updated the Pool and Spa Safety Act, requiring that all new residential pools be equipped with compliant safety barriers and alarms. This regulation, formally titled the Virginia Graeme Baker Pool and Spa Safety Act (as amended, CPSC, 2023), mandates specific barrier heights, self-closing gates, and alarm systems to reduce child drowning incidents and enhance public safety standards .

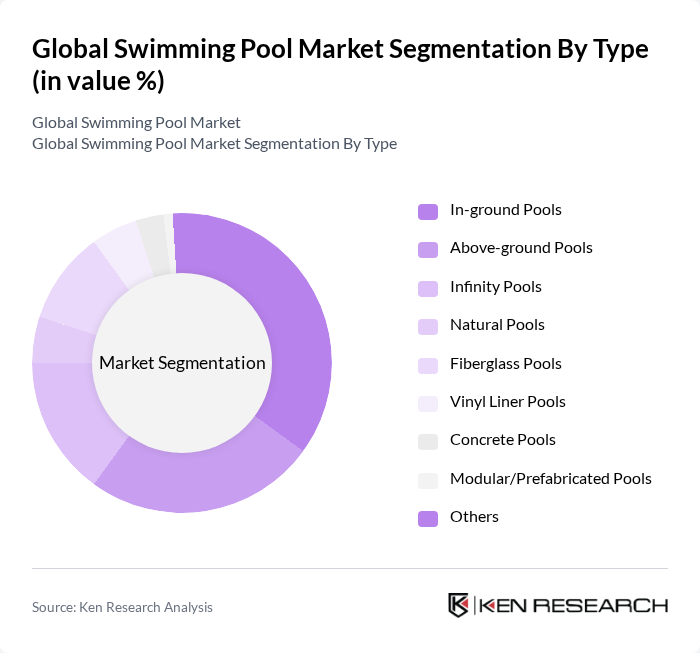

Global Swimming Pool Market Segmentation

By Type:The market is segmented into various types of pools, including In-ground Pools, Above-ground Pools, Infinity Pools, Natural Pools, Fiberglass Pools, Vinyl Liner Pools, Concrete Pools, Modular/Prefabricated Pools, and Others. Each type addresses different consumer preferences, installation requirements, and budget considerations, with in-ground and above-ground pools accounting for the majority of installations due to their versatility and cost-effectiveness .

By End-User:The market is segmented by end-users into Residential, Commercial (Hotels, Resorts, Water Parks, Fitness Centers), and Government & Public Utilities (Municipal Pools, Community Centers). The residential segment dominates, driven by home improvement trends and increased consumer focus on health and wellness, while commercial and public utility segments are supported by tourism growth and municipal investments in recreational infrastructure .

Global Swimming Pool Market Competitive Landscape

The Global Swimming Pool Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hayward Holdings, Inc., Pentair plc, Fluidra S.A., Zodiac Pool Systems LLC, Waterco Ltd., Pleatco LLC, Valterra Products LLC, Therm Products (HydroQuip Inc.), Intex Recreation Corp., Aladdin Equipment Co., Blue Haven Pools & Spas, Premier Pools and Spas, Swimart, Narellan Pools, Pool & Spa Warehouse contribute to innovation, geographic expansion, and service delivery in this space.

Global Swimming Pool Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The rise in disposable income in None has been significant, with an average increase of 5.2% annually, reaching approximately $50,000 per household in future. This financial growth enables consumers to invest in luxury items, including swimming pools. As more households can afford leisure amenities, the demand for residential pools is expected to surge, driving market growth. The correlation between income levels and pool ownership is evident, as higher income brackets typically lead to increased spending on recreational facilities.

- Rising Demand for Leisure and Recreational Activities:The trend towards healthier lifestyles has led to a 20% increase in leisure spending in None, with consumers prioritizing recreational activities. Swimming pools are increasingly viewed as essential for relaxation and fitness, contributing to this demand. In future, the leisure and recreation sector is projected to generate over $250 billion, with a significant portion allocated to home-based leisure facilities. This shift towards personal wellness and leisure activities is a key driver for the swimming pool market.

- Growth in Residential Construction:The residential construction sector in None is projected to grow by 10% in future, with over 1.8 million new housing units expected to be built. This expansion directly correlates with increased swimming pool installations, as new homeowners often seek to enhance their properties with pools. Additionally, the trend of integrating pools into new residential designs is becoming more prevalent, further driving demand. The construction boom is a vital factor in the overall growth of the swimming pool market.

Market Challenges

- High Initial Investment Costs:The average cost of installing a swimming pool in None ranges from $35,000 to $55,000, which can be a significant barrier for many potential buyers. This high initial investment often deters consumers, especially in a fluctuating economic environment. With rising material costs and labor shortages, the financial burden of pool installation remains a critical challenge. As a result, many consumers may opt for alternative leisure activities that require lower upfront costs.

- Seasonal Demand Fluctuations:The swimming pool market in None experiences pronounced seasonal demand fluctuations, with peak sales occurring during the summer months. In future, it is estimated that sales drop by nearly 65% during the winter season. This seasonality can lead to inconsistent revenue streams for manufacturers and installers, complicating financial planning and resource allocation. Companies must develop strategies to mitigate these fluctuations, such as offering winter maintenance services or promoting indoor pool solutions.

Global Swimming Pool Market Future Outlook

The future of the swimming pool market in None appears promising, driven by increasing consumer interest in home leisure activities and advancements in pool technology. As disposable incomes rise, more households are likely to invest in pools, while innovations in energy-efficient and smart pool technologies will enhance user experience. Additionally, the growing trend of eco-friendly solutions will shape market dynamics, encouraging manufacturers to develop sustainable products that align with consumer preferences for environmental responsibility.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in None present significant opportunities for growth, with an estimated 25% increase in pool installations expected in future. As urbanization continues, more consumers in these regions are seeking recreational amenities, including swimming pools, to enhance their lifestyles. This trend offers manufacturers and service providers a chance to tap into new customer bases and expand their market reach.

- Increasing Popularity of Smart Pools:The integration of smart technology in pool management is gaining traction, with a projected 35% increase in smart pool installations in future. Homeowners are increasingly interested in automation features that enhance convenience and energy efficiency. This trend presents a lucrative opportunity for companies to innovate and offer advanced solutions, catering to the growing demand for smart home technologies in the leisure sector.