Region:Global

Author(s):Dev

Product Code:KRAA2579

Pages:90

Published On:August 2025

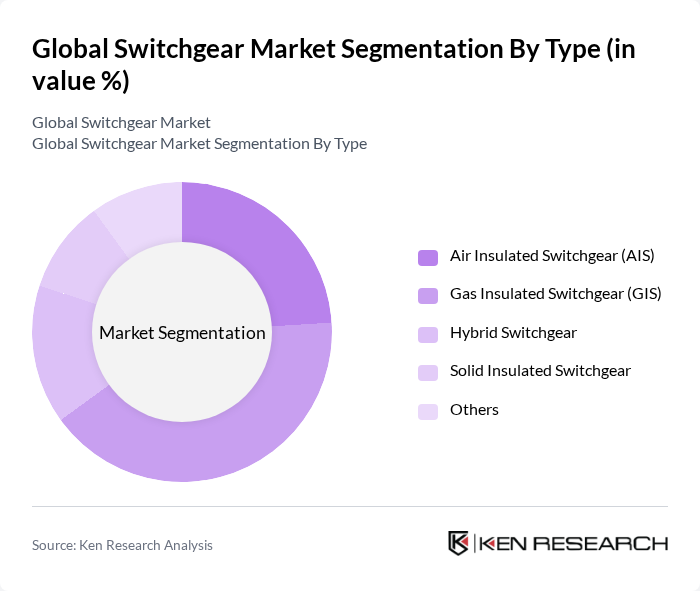

By Type:The switchgear market is segmented into various types, including Air Insulated Switchgear (AIS), Gas Insulated Switchgear (GIS), Hybrid Switchgear, Solid Insulated Switchgear, and Others. Among these,Gas Insulated Switchgear (GIS)is currently dominating the market due to its compact design, high reliability, and suitability for urban environments where space is limited. The increasing adoption of GIS in substations and industrial applications is driven by its ability to operate in harsh conditions, lower maintenance requirements, and enhanced safety features compared to traditional switchgear types.

By Voltage:The market is categorized by voltage levels, including Low Voltage (<1kV), Medium Voltage (1kV–36kV), and High Voltage (>36kV). TheMedium Voltagesegment is leading the market, primarily due to its extensive application in industrial and commercial sectors, as well as its critical role in renewable energy integration and grid modernization. The growing demand for medium voltage switchgear is fueled by the need for efficient power distribution, grid reliability, and the integration of distributed energy resources, which require robust medium voltage solutions for effective energy management.

The Global Switchgear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, ABB Ltd., General Electric Company, Eaton Corporation plc, Mitsubishi Electric Corporation, Hitachi, Ltd., Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd., Legrand S.A., NHP Electrical Engineering Products Pty Ltd., CG Power and Industrial Solutions Limited, Rittal GmbH & Co. KG, Powell Industries, Inc., Lucy Electric Ltd., Larsen & Toubro Limited, Fuji Electric Co., Ltd., Hyosung Heavy Industries Corporation, C&S Electric Limited, Meidensha Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the switchgear market appears promising, driven by the increasing integration of renewable energy sources and advancements in smart technologies. As urbanization continues to rise, the demand for efficient power management systems will grow, prompting investments in modern switchgear solutions. Additionally, the focus on sustainability and energy efficiency will likely lead to the development of eco-friendly switchgear products, enhancing market competitiveness and fostering innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Insulated Switchgear (AIS) Gas Insulated Switchgear (GIS) Hybrid Switchgear Solid Insulated Switchgear Others |

| By Voltage | Low Voltage (<1kV) Medium Voltage (1kV–36kV) High Voltage (>36kV) |

| By End-User | Residential Commercial Industrial Utilities (Power Generation, Transmission & Distribution) Transportation & Infrastructure Others |

| By Application | Power Generation Transmission & Distribution Renewable Energy Integration Data Centers Oil & Gas Railways Others |

| By Component | Circuit Breakers Switches Relays Fuses Busbars Protection Devices Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Sector Switchgear Applications | 120 | Electrical Engineers, Project Managers |

| Industrial Switchgear Installations | 90 | Procurement Managers, Operations Directors |

| Commercial Building Switchgear Solutions | 60 | Facility Managers, Electrical Contractors |

| Renewable Energy Integration | 50 | Energy Analysts, Sustainability Officers |

| Smart Grid Technology Adoption | 70 | IT Managers, Smart Grid Specialists |

The Global Switchgear Market is valued at approximately USD 107 billion, driven by increasing electricity demand, urbanization, renewable energy expansion, and modernization of electrical infrastructure.