Region:Global

Author(s):Geetanshi

Product Code:KRAC8156

Pages:87

Published On:November 2025

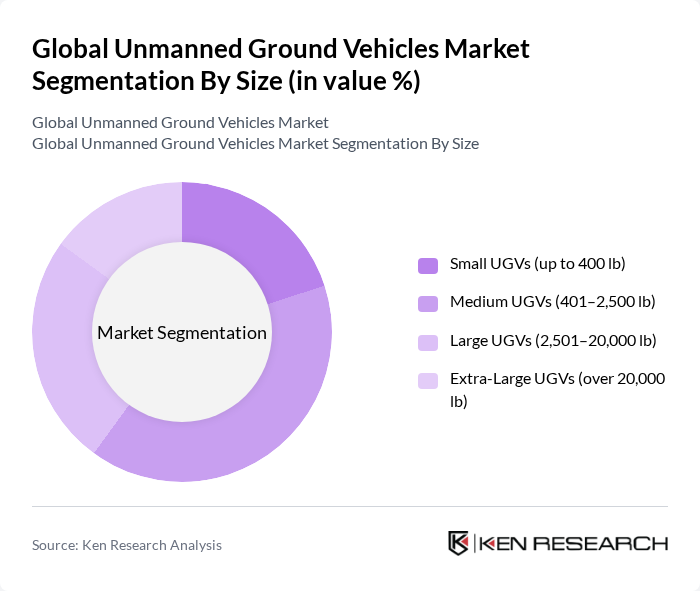

By Size:The market is segmented into four size categories: Small UGVs (up to 400 lb), Medium UGVs (401–2,500 lb), Large UGVs (2,501–20,000 lb), and Extra-Large UGVs (over 20,000 lb). Among these, Medium UGVs are currently leading the market due to their versatility and adaptability across various applications, including military, agriculture, and logistics. The demand for Medium UGVs is driven by their balance of payload capacity and maneuverability, making them suitable for a wide range of tasks.

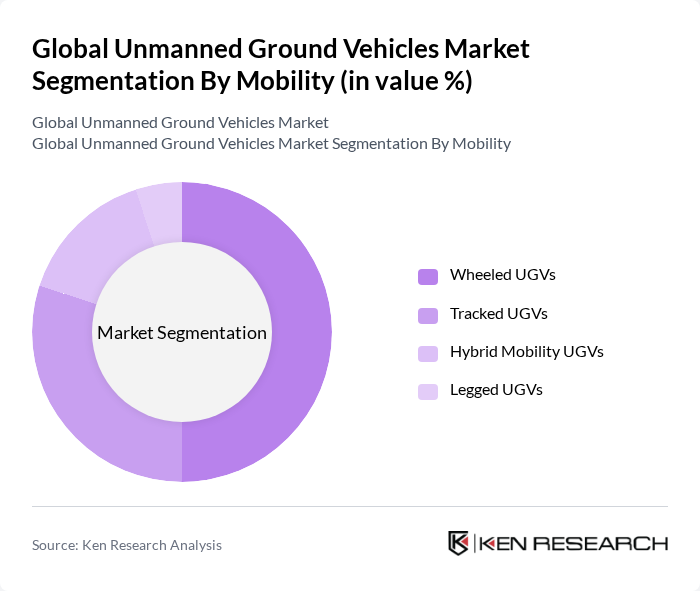

By Mobility:The mobility segment includes Wheeled UGVs, Tracked UGVs, Hybrid Mobility UGVs, and Legged UGVs. Wheeled UGVs dominate the market due to their efficiency and ease of deployment in urban environments. Their lightweight design and lower operational costs make them a preferred choice for various applications, including surveillance and logistics. The increasing focus on urban warfare and reconnaissance missions further drives the demand for Wheeled UGVs.

The Global Unmanned Ground Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation, General Dynamics Corporation, Lockheed Martin Corporation, QinetiQ Group plc, Teledyne FLIR LLC, iRobot Corporation, Clearpath Robotics Inc., Roboteam Ltd., Oshkosh Defense, LLC, Rheinmetall AG, Textron Systems (Textron Inc.), Leonardo DRS (DRS Technologies, Inc.), BAE Systems plc, DroneShield Ltd., Autonomous Solutions, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the unmanned ground vehicles market appears promising, driven by technological advancements and increasing applications across various sectors. As governments and industries prioritize automation, the integration of AI and IoT technologies will enhance UGV capabilities, leading to more efficient operations. Furthermore, the growing focus on sustainability will likely spur innovations in eco-friendly UGV designs, positioning the market for significant growth in the coming years, particularly in logistics and disaster response sectors.

| Segment | Sub-Segments |

|---|---|

| By Size | Small UGVs (up to 400 lb) Medium UGVs (401–2,500 lb) Large UGVs (2,501–20,000 lb) Extra-Large UGVs (over 20,000 lb) |

| By Mobility | Wheeled UGVs Tracked UGVs Hybrid Mobility UGVs Legged UGVs |

| By Mode of Operation | Autonomous UGVs Teleoperated UGVs Tethered UGVs |

| By Application | Defense & Military Commercial Law Enforcement & Federal Agencies Civil (e.g., mining, agriculture, logistics) |

| By End-User | Defense Agriculture Construction Logistics Mining Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Applications of UGVs | 100 | Defense Analysts, Military Procurement Officers |

| Commercial Logistics and Delivery | 80 | Logistics Managers, Operations Directors |

| Agricultural UGV Utilization | 60 | Agronomists, Farm Equipment Managers |

| Research and Development in Robotics | 50 | R&D Engineers, Robotics Specialists |

| Emergency Response and Disaster Management | 40 | Emergency Services Coordinators, Safety Officers |

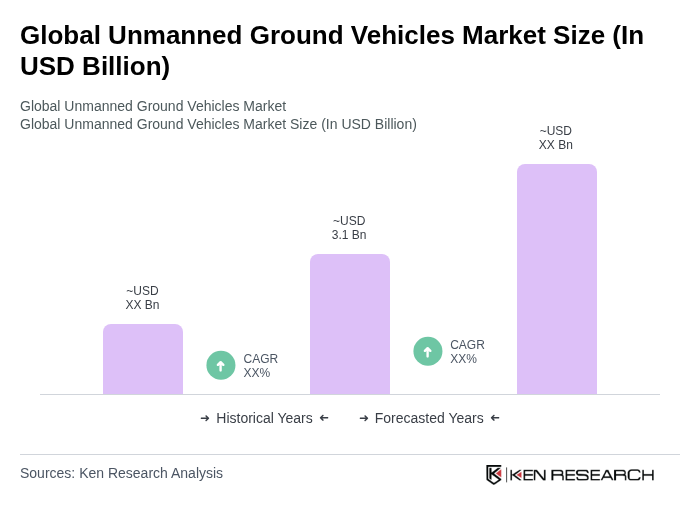

The Global Unmanned Ground Vehicles Market is valued at approximately USD 3.1 billion, driven by advancements in robotics technology and increasing demand for automation across various sectors, particularly in defense applications.