Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8199

Pages:97

Published On:November 2025

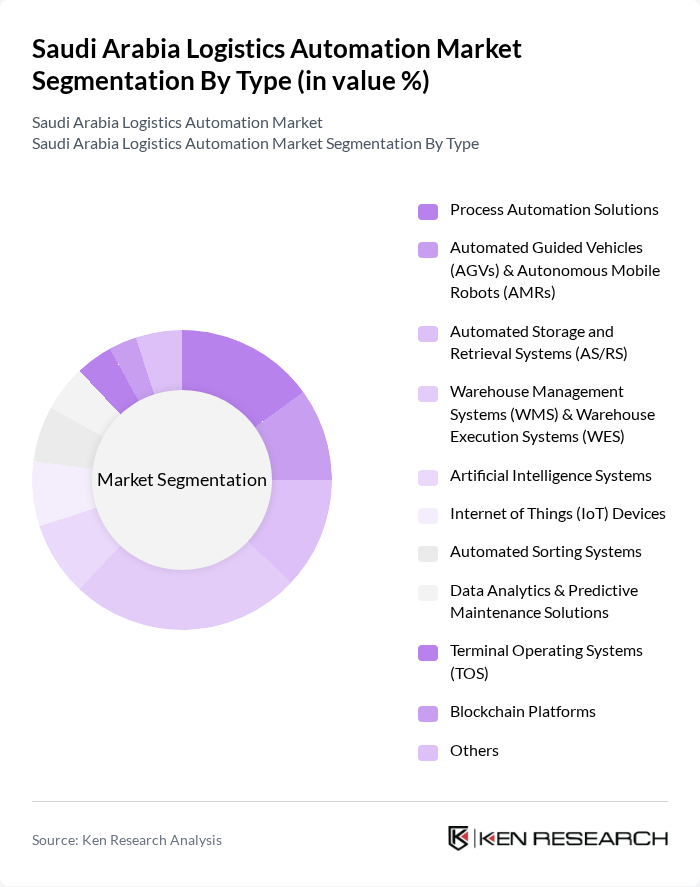

By Type:The logistics automation market can be segmented into various types, including Process Automation Solutions, Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs), Automated Storage and Retrieval Systems (AS/RS), Warehouse Management Systems (WMS) & Warehouse Execution Systems (WES), Artificial Intelligence Systems, Internet of Things (IoT) Devices, Automated Sorting Systems, Data Analytics & Predictive Maintenance Solutions, Terminal Operating Systems (TOS), Blockchain Platforms, and Others. Among these, Warehouse Management Systems (WMS) & Warehouse Execution Systems (WES) are leading the market due to their critical role in optimizing warehouse operations and improving inventory management.

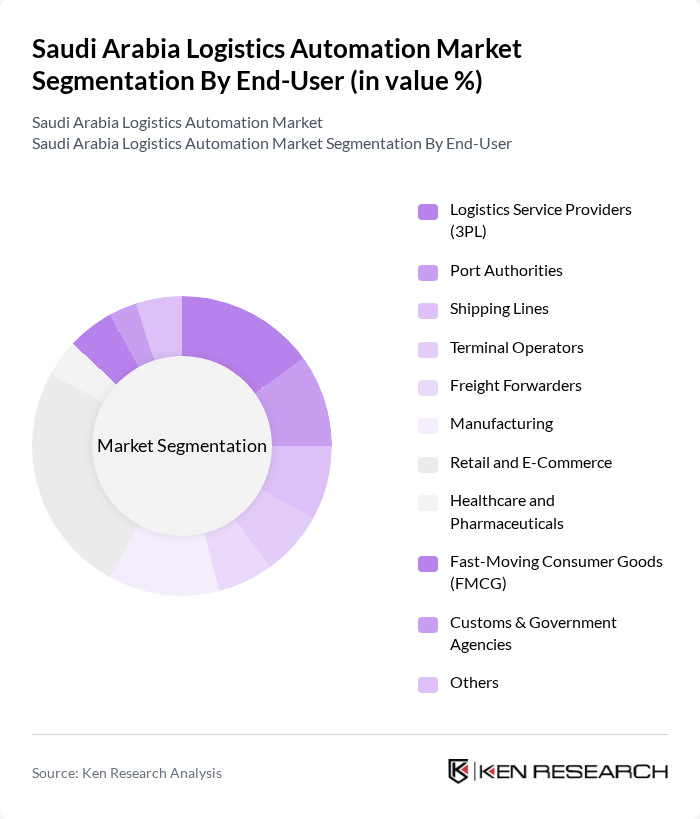

By End-User:The end-user segmentation of the logistics automation market includes Logistics Service Providers (3PL), Port Authorities, Shipping Lines, Terminal Operators, Freight Forwarders, Manufacturing, Retail and E-Commerce, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods (FMCG), Customs & Government Agencies, and Others. The Retail and E-Commerce sector is currently the dominant end-user, driven by the rapid growth of online shopping and the need for efficient order fulfillment and inventory management. This sector's expansion has intensified demand for high-speed, automated logistics systems, with e-commerce players investing heavily in robotics, automated sortation, and artificial intelligence-driven warehousing solutions to support same-day and next-day delivery capabilities.

The Saudi Arabia Logistics Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Aramex, Agility Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, XPO Logistics, FedEx, UPS, Maersk, Saudia Cargo, Smsa Express, Transco Logistics, Bahri (Saudi Shipping Company), Sinotrans Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics automation market in Saudi Arabia appears promising, driven by ongoing technological advancements and government support. As businesses increasingly recognize the importance of automation in enhancing efficiency and reducing costs, the adoption of robotics and AI technologies is expected to rise. Additionally, the integration of IoT solutions will facilitate real-time tracking and data analysis, further optimizing supply chain operations. The market is poised for significant transformation as these trends continue to evolve.

| Segment | Sub-Segments |

|---|---|

| By Type | Process Automation Solutions Automated Guided Vehicles (AGVs) & Autonomous Mobile Robots (AMRs) Automated Storage and Retrieval Systems (AS/RS) Warehouse Management Systems (WMS) & Warehouse Execution Systems (WES) Artificial Intelligence Systems Internet of Things (IoT) Devices Automated Sorting Systems Data Analytics & Predictive Maintenance Solutions Terminal Operating Systems (TOS) Blockchain Platforms Others |

| By End-User | Logistics Service Providers (3PL) Port Authorities Shipping Lines Terminal Operators Freight Forwarders Manufacturing Retail and E-Commerce Healthcare and Pharmaceuticals Fast-Moving Consumer Goods (FMCG) Customs & Government Agencies Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region |

| By Technology | Artificial Intelligence (AI) Internet of Things (IoT) Blockchain Technology Cloud Computing Digital Twins Real-time Data Analytics Others |

| By Application | Warehouse and Storage Management Transportation Management Order Fulfillment and Picking Inventory Management Supply Chain Visibility Last-Mile Delivery Container Terminal Automation Bulk Cargo Management Others |

| By Enterprise Size | Large Enterprises Small and Medium-sized Enterprises (SMEs) |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Automation | 100 | Logistics Managers, Supply Chain Analysts |

| Manufacturing Automation Solutions | 80 | Operations Directors, Automation Engineers |

| Healthcare Supply Chain Automation | 60 | Pharmacy Managers, Supply Chain Coordinators |

| Transportation and Freight Automation | 70 | Fleet Managers, Logistics Coordinators |

| Warehouse Management Systems | 90 | Warehouse Managers, IT Specialists |

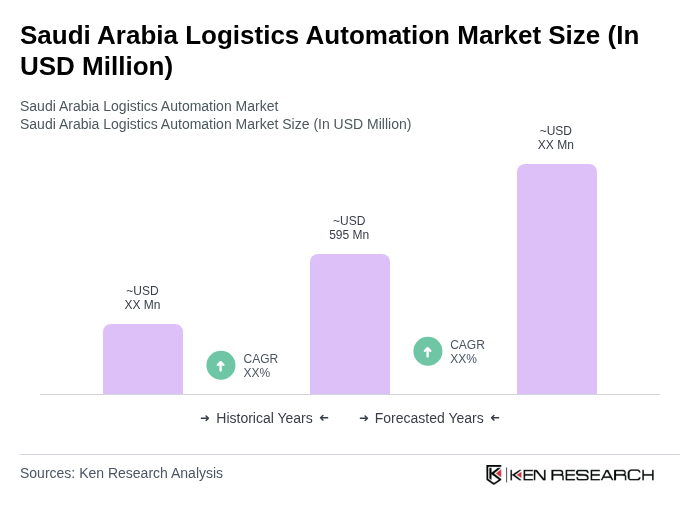

The Saudi Arabia Logistics Automation Market is valued at approximately USD 595 million, driven by the increasing demand for efficient supply chain management and technological advancements in automation.