Region:Global

Author(s):Shubham

Product Code:KRAD5324

Pages:95

Published On:December 2025

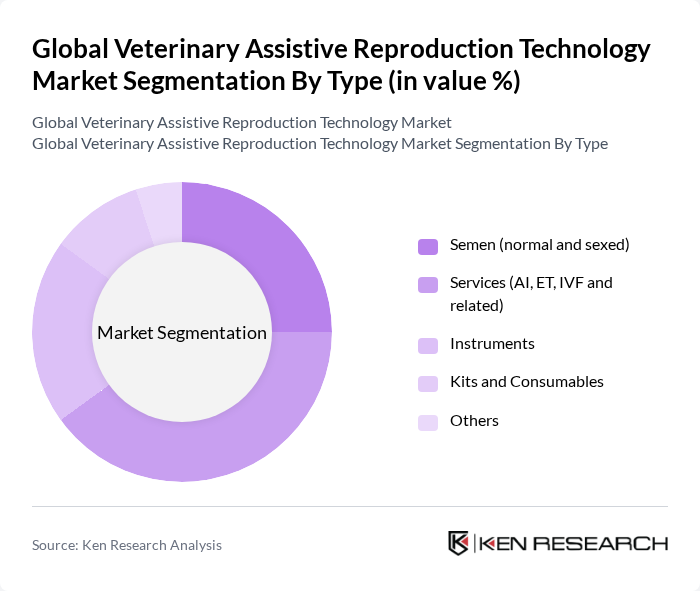

By Type:

The segmentation by type includes various subsegments such as Semen (normal and sexed), Services (AI, ET, IVF and related), Instruments, Kits and Consumables, and Others. This structure is consistent with major industry studies that classify the market into semen, services, instruments, and kits & consumables. Among these, the Services segment, particularly Artificial Insemination (AI) and In Vitro Fertilization (IVF), is a key revenue contributor, supported by the dominant role of AI technologies in commercial breeding programs and organized livestock systems. The growing trend towards genetic improvement, use of sexed semen, and the need for efficient breeding practices are driving the demand for these services, alongside increasing adoption of embryo transfer and IVF in both bovine and companion animals. The Instruments and Semen segments also hold significant market shares, reflecting the essential role of quality reproductive tools (AI guns, catheters, cryopreservation equipment) and high?value genetic materials (conventional and sexed semen) in successful breeding programs.

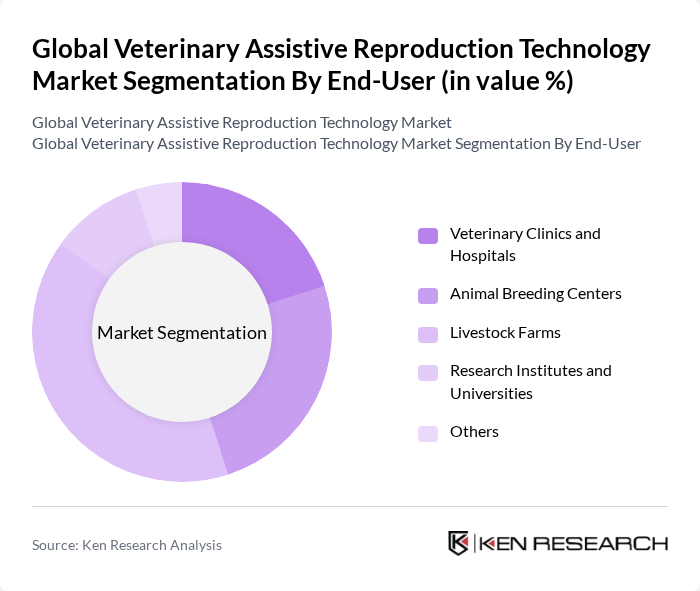

By End-User:

This segmentation includes Veterinary Clinics and Hospitals, Animal Breeding Centers, Livestock Farms, Research Institutes and Universities, and Others. This end?user structure aligns with current market analyses that identify farms, breeding organizations, and veterinary facilities as primary users of assistive reproduction technologies. The Livestock Farms segment is the leading subsegment, driven by the increasing need for efficient breeding practices to enhance productivity and profitability, particularly in dairy and beef cattle, swine, and small ruminants. Livestock farms are increasingly adopting advanced reproductive technologies such as artificial insemination, sexed semen, and embryo transfer to improve herd genetics, optimize calving intervals, increase milk and meat yields, and reduce disease transmission associated with natural mating. Veterinary Clinics and Hospitals also play a crucial role in the market, providing essential services and support for reproductive technologies, including fertility evaluation, synchronization protocols, assisted birthing, and advanced IVF and embryo transfer procedures for both livestock and companion animals.

The Global Veterinary Assistive Reproduction Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (Merck & Co., Inc.), Elanco Animal Health Incorporated, Boehringer Ingelheim Animal Health GmbH, Neogen Corporation, Genus plc, Trans Ova Genetics LC, Select Sires Inc., CRV Holding B.V., Alta Genetics Inc., URUS Group LP (ABS Global, GENEX, etc.), SEMEX Alliance, Cogent Breeding Ltd, IMV Technologies, STgenetics (Sexing Technologies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary assistive reproduction technology market appears promising, driven by technological advancements and increasing consumer demand for ethically produced animal products. As emerging markets expand their veterinary services, the adoption of innovative reproductive technologies is expected to rise significantly. Additionally, the integration of digital solutions in veterinary practices will enhance service delivery, making reproductive technologies more accessible and efficient, ultimately benefiting both livestock producers and pet owners alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Semen (normal and sexed) Services (AI, ET, IVF and related) Instruments Kits and Consumables Others |

| By End-User | Veterinary Clinics and Hospitals Animal Breeding Centers Livestock Farms Research Institutes and Universities Others |

| By Species (Animal Type) | Bovine (Dairy and Beef Cattle) Swine Ovine and Caprine Equine Canine Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Artificial Insemination (AI) In Vitro Fertilization (IVF) Embryo Transfer (MOET and related) Other Assisted Reproductive Technologies |

| By Application | Commercial Breeding Programs Genetic Improvement and Selection Research and Clinical Applications Conservation and Rare/Companion Animal Breeding |

| By Investment Source | Private Investments Government Funding Grants and Subsidies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics Offering Reproductive Services | 120 | Veterinarians, Clinic Owners |

| Livestock Breeders Utilizing Reproductive Technologies | 100 | Farm Managers, Breeding Specialists |

| Research Institutions Focused on Animal Reproduction | 60 | Research Scientists, Academic Professors |

| Pet Breeders and Enthusiasts | 50 | Pet Breeders, Animal Welfare Advocates |

| Veterinary Technology Providers | 40 | Product Managers, Sales Executives |

The Global Veterinary Assistive Reproduction Technology Market is valued at approximately USD 2.7 billion, reflecting a comprehensive analysis of recent global assessments and historical data over the past five years.