Region:Global

Author(s):Geetanshi

Product Code:KRAC0107

Pages:96

Published On:August 2025

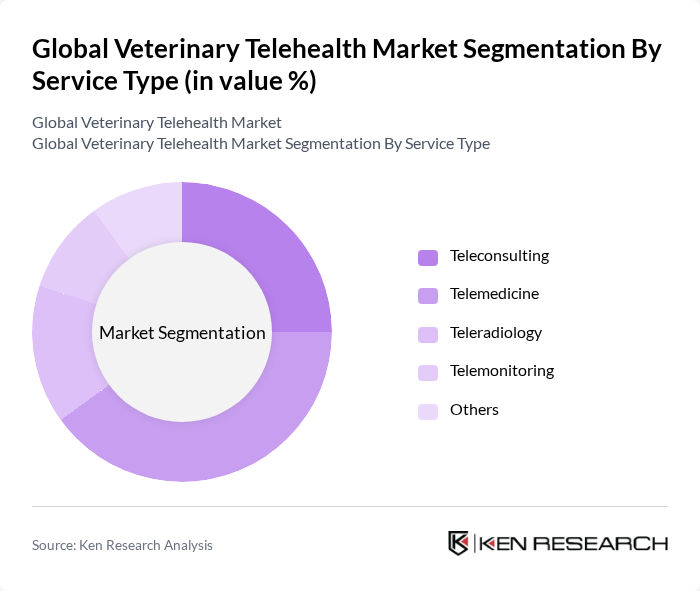

By Service Type:The service type segmentation includes teleconsulting, telemedicine, teleradiology, telemonitoring, and others. Telemedicine is currently the leading sub-segment, driven by the increasing demand for remote consultations, chronic disease management, and the convenience it offers to pet owners. Teleconsulting and telemonitoring are also gaining traction as they provide essential services for ongoing pet care, chronic disease management, and health monitoring. The rise in pet ownership, the need for accessible veterinary care, and the integration of artificial intelligence and digital platforms are key factors influencing this trend .

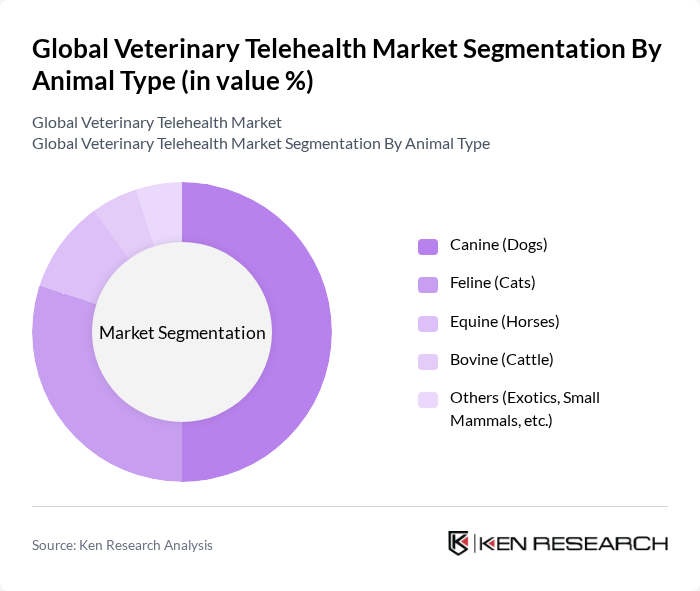

By Animal Type:The animal type segmentation encompasses canine (dogs), feline (cats), equine (horses), bovine (cattle), and others such as exotics and small mammals. The canine segment is the most dominant, reflecting the high number of pet dogs and the increasing willingness of pet owners to seek veterinary care through telehealth services. The feline segment also shows significant growth, driven by the rising number of cat owners and their demand for convenient veterinary consultations. Increased awareness of chronic and zoonotic diseases, as well as the prevalence of obesity and other health conditions in companion animals, further supports the demand for telehealth services .

The Global Veterinary Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vetster, Petcube, TeleVet, VetNOW, Pawp, Fuzzy Pet Health, Vetsource, WhiskerDocs, Petriage, Anipanion, Airvet, GuardianVets, AskVet, FirstVet, Virtuwoof contribute to innovation, geographic expansion, and service delivery in this space.

The future of veterinary telehealth in None appears promising, driven by technological advancements and changing consumer preferences. As pet ownership continues to rise, the demand for accessible veterinary care will likely increase. Innovations in artificial intelligence and mobile applications are expected to enhance service delivery, making telehealth more efficient. Additionally, partnerships with pet insurance companies could facilitate broader adoption, ensuring that telehealth services become an integral part of veterinary care in the region.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Teleconsulting Telemedicine Teleradiology Telemonitoring Others |

| By Animal Type | Canine (Dogs) Feline (Cats) Equine (Horses) Bovine (Cattle) Others (Exotics, Small Mammals, etc.) |

| By Technology Used | Cloud/App-Based Platforms Web-Based Platforms Wearable Devices & IoT Integration |

| By End-User | Pet Owners Veterinary Clinics & Hospitals Animal Shelters & Rescue Organizations Livestock Farmers Research & Academic Institutions |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Practices Utilizing Telehealth | 100 | Veterinarians, Practice Owners |

| Pet Owners Engaging in Telehealth Services | 120 | Pet Owners, Caregivers |

| Telehealth Technology Providers | 60 | Product Managers, Business Development Executives |

| Veterinary Regulatory Bodies | 40 | Regulatory Officers, Policy Makers |

| Veterinary Practice Managers | 50 | Practice Managers, Operations Directors |

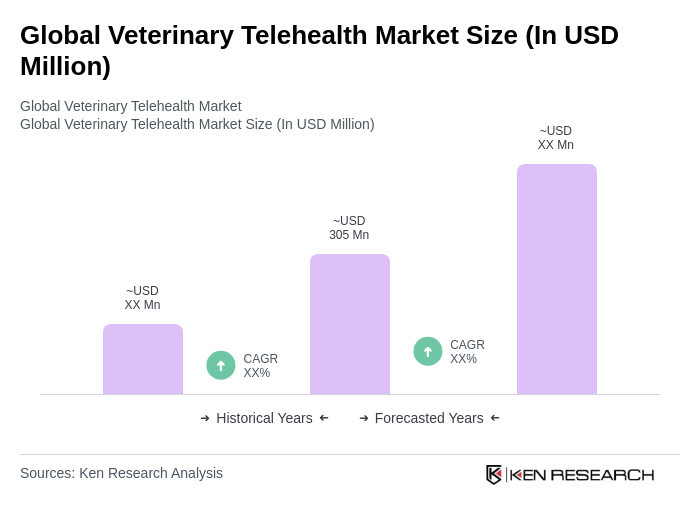

The Global Veterinary Telehealth Market is valued at approximately USD 305 million, reflecting significant growth driven by the increasing adoption of telehealth services among pet owners and veterinary professionals, as well as the demand for remote consultations and monitoring solutions.