Region:Asia

Author(s):Shubham

Product Code:KRAD6767

Pages:100

Published On:December 2025

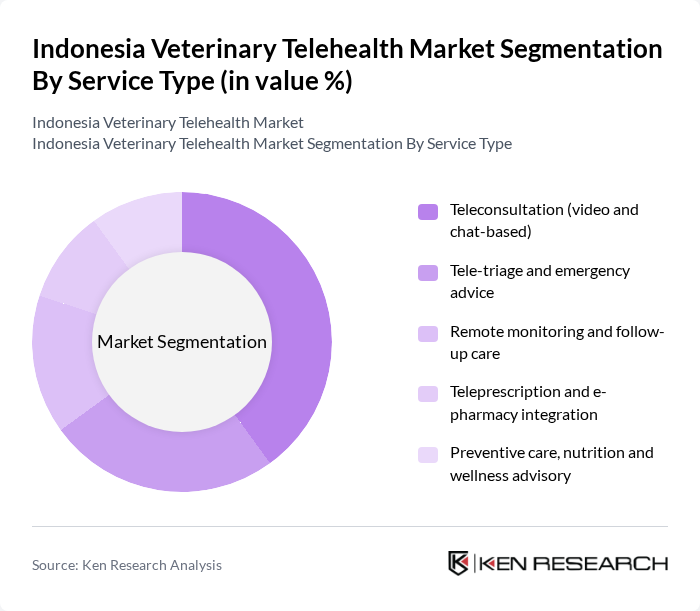

By Service Type:The service type segmentation includes various offerings that cater to the needs of pet owners and veterinary professionals. The dominant sub-segment is teleconsultation (video and chat-based), which has gained popularity due to its convenience and accessibility, mirroring global patterns where teleconsulting and teleadvice account for the largest share of veterinary telehealth use. Pet owners prefer this service for quick consultations without the need to travel, especially for minor ailments, follow?ups, and behavioural or nutrition queries. Other services like tele-triage and emergency advice, remote monitoring, and teleprescription are also gaining traction as they enhance the overall veterinary care experience and integrate with e?pharmacy and home?delivery models that are rapidly expanding in Indonesia’s broader telehealth market.

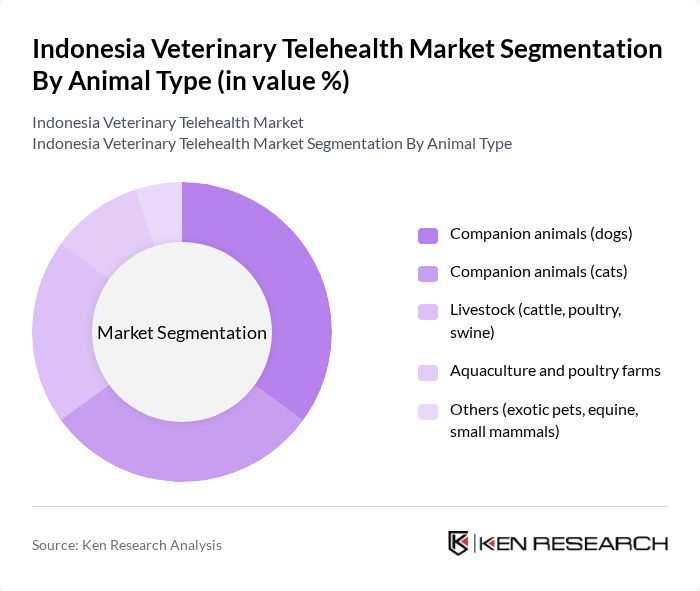

By Animal Type:The animal type segmentation encompasses various categories of animals that benefit from telehealth services. Companion animals, particularly dogs and cats, dominate this market due to the increasing trend of pet ownership in urban areas and the higher willingness of owners to spend on digital veterinary services. Pet owners are more inclined to seek telehealth services for their pets, leading to a higher demand for consultations and care for dermatology, gastrointestinal, and preventive health issues. Livestock and aquaculture also represent significant segments in Indonesia’s wider animal health market, and early use cases of tele-advisory and remote farm support are emerging to improve herd health, biosecurity, and production efficiency.

The Indonesia Veterinary Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halodoc (pet & animal health services via super?app), VETOPIA Indonesia, Pet+ Klinik Hewan & Petshop (hybrid clinic + teleconsult), MyVets Indonesia, Kemenkes Indonesia Digital Health Platform (pilot animal/vet use), Gadjah Mada University Veterinary Telemedicine Program, IPB University (Bogor) Veterinary Teleconsultation Services, Jolly Pet Klinik & Online Consultation, Provet Animal Hospital & Online Consultation, Go-Vet Indonesia (on?demand home & online vet services), TaniHub Group (livestock & farm health advisory), Rebananda Pet Care & Teleconsultation, KlikDokter (pet health content & emerging vet teleconsult), Hewania Vet (online vet consultation platform), PetKlinik Indonesia (multi?location clinic with remote follow?up) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary telehealth market in Indonesia appears promising, driven by increasing pet ownership and technological advancements. As more pet owners seek convenient care options, telehealth services are likely to expand, particularly in urban areas. Additionally, the integration of artificial intelligence in diagnostics and preventive care will enhance service delivery. However, addressing regulatory challenges and improving internet access in rural regions will be essential to fully realize the market's potential and ensure equitable access to veterinary care.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Teleconsultation (video and chat-based) Tele-triage and emergency advice Remote monitoring and follow-up care Teleprescription and e-pharmacy integration Preventive care, nutrition and wellness advisory |

| By Animal Type | Companion animals (dogs) Companion animals (cats) Livestock (cattle, poultry, swine) Aquaculture and poultry farms Others (exotic pets, equine, small mammals) |

| By Revenue Model | One?time / pay?per?consultation Subscription plans for pet owners B2B contracts with clinics and hospitals Corporate / insurance and partnership-led models |

| By Technology / Delivery Mode | Mobile applications and super?apps Web?based portals Messaging and chat platforms (incl. WhatsApp) Integrated practice management & EMR platforms Others (IoT devices, wearables, remote sensors) |

| By Provider Type | Standalone veterinary telehealth platforms Brick?and?mortar clinics offering hybrid care Animal hospitals and university teaching hospitals Agri-tech and livestock health platforms NGOs and government/association programs |

| By End?User | Individual pet owners Commercial farms and livestock cooperatives Veterinary clinics and hospitals Animal shelters and welfare organizations Pet service and pet insurance providers |

| By Geography (Indonesia) | Java (incl. Jakarta, West Java, Central Java, East Java) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara, Papua and other regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Pet Owners | 150 | Pet Owners, Veterinary Clients |

| Rural Pet Owners | 120 | Pet Owners, Community Leaders |

| Veterinary Clinics | 90 | Veterinarians, Clinic Managers |

| Telehealth Service Providers | 60 | Business Development Managers, Technology Officers |

| Pet Care Product Retailers | 70 | Retail Managers, Product Buyers |

The Indonesia Veterinary Telehealth Market is valued at approximately USD 14 million, reflecting significant growth driven by increased pet ownership and the adoption of digital health solutions, particularly in urban areas with better internet access.