Region:Middle East

Author(s):Dev

Product Code:KRAD1824

Pages:94

Published On:November 2025

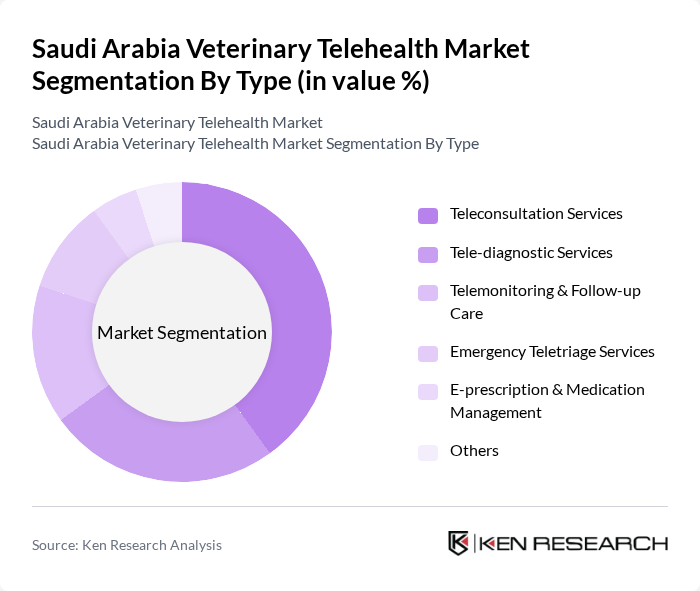

By Type:The market is segmented into various types of services, including Teleconsultation Services, Tele-diagnostic Services, Telemonitoring & Follow-up Care, Emergency Teletriage Services, E-prescription & Medication Management, and Others. Among these,Teleconsultation Servicesare leading the market due to their convenience and accessibility for pet owners seeking immediate veterinary advice. The increasing reliance on digital platforms for health consultations has made this segment particularly popular, as it allows for quick and efficient communication between pet owners and veterinarians.

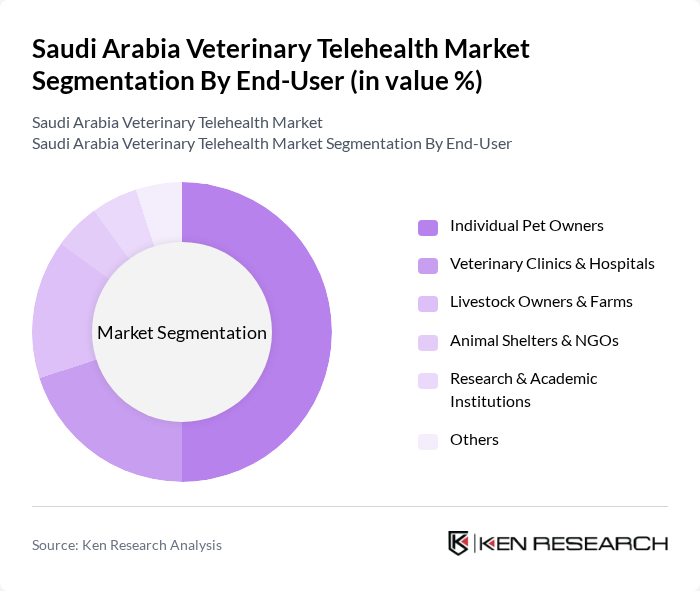

By End-User:The end-user segmentation includes Individual Pet Owners, Veterinary Clinics & Hospitals, Livestock Owners & Farms, Animal Shelters & NGOs, Research & Academic Institutions, and Others.Individual Pet Ownersrepresent the largest segment, driven by the increasing trend of pet ownership and the demand for convenient veterinary services. This segment's growth is fueled by the rising awareness of pet health and the need for timely veterinary consultations, making telehealth an attractive option for pet owners.

The Saudi Arabia Veterinary Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as VetWork, PetWell, Altibbi Vet, Vetwork Arabia, FirstVet, Vetster, Petriage, TeleVet, PawSquad, Vetsie, VetNOW, FidoCure, PetConnect, VetLink, Animalia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the veterinary telehealth market in Saudi Arabia appears promising, driven by increasing pet ownership and technological advancements. As awareness of telehealth services grows, more pet owners are likely to embrace remote consultations. Additionally, the integration of artificial intelligence in diagnostics and the rise of subscription-based services are expected to enhance service offerings. These trends indicate a shift towards more accessible and efficient veterinary care, positioning telehealth as a key component of the veterinary landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Teleconsultation Services Tele-diagnostic Services Telemonitoring & Follow-up Care Emergency Teletriage Services E-prescription & Medication Management Others |

| By End-User | Individual Pet Owners Veterinary Clinics & Hospitals Livestock Owners & Farms Animal Shelters & NGOs Research & Academic Institutions Others |

| By Animal Type | Dogs Cats Livestock (Cattle, Sheep, Goats, Camels) Equine Exotic Pets Others |

| By Service Model | Subscription-Based Pay-Per-Consultation Corporate/Enterprise Plans Membership Plans Others |

| By Technology Used | Video Conferencing Platforms Mobile & Web Applications AI Chatbots & Virtual Assistants Remote Monitoring Devices & Wearables Cloud-based Health Records Others |

| By Geographic Coverage | Major Urban Centers (Riyadh, Jeddah, Dammam, etc.) Secondary Cities Rural & Remote Areas Nationwide Services Others |

| By Customer Segment | Individual Pet Owners Corporate Clients (Farms, Zoos, Kennels) Veterinary Practices Animal Welfare Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics Offering Telehealth | 80 | Veterinarians, Clinic Owners |

| Pet Owners Utilizing Telehealth Services | 120 | Pet Owners, Animal Caregivers |

| Telehealth Technology Providers | 40 | Product Managers, Business Development Executives |

| Regulatory Bodies on Veterinary Practices | 20 | Policy Makers, Regulatory Officers |

| Veterinary Associations and Organizations | 40 | Association Leaders, Veterinary Educators |

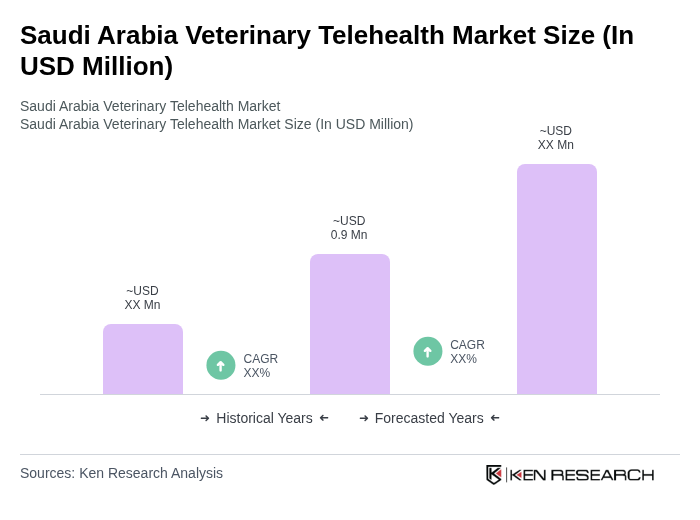

The Saudi Arabia Veterinary Telehealth Market is valued at approximately USD 0.9 million, reflecting a growing trend towards digital health solutions and increased pet ownership, particularly accelerated by the COVID-19 pandemic.