Region:Global

Author(s):Dev

Product Code:KRAA2619

Pages:89

Published On:August 2025

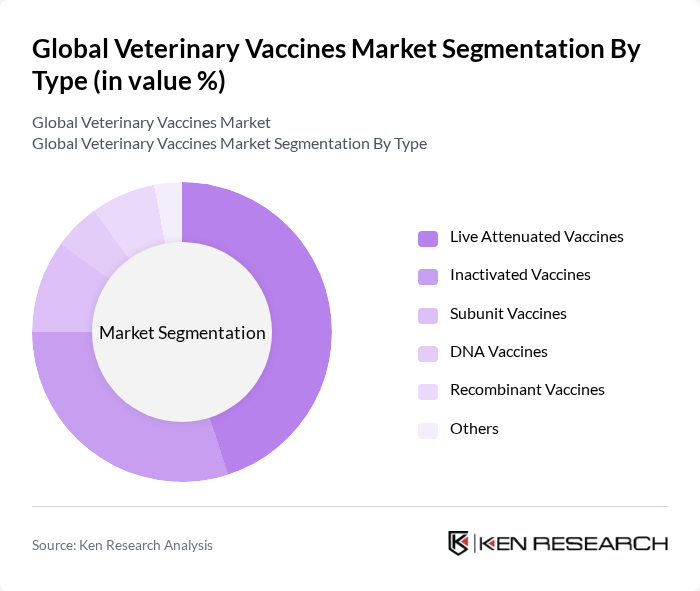

By Type:The market is segmented into various types of vaccines, including Live Attenuated Vaccines, Inactivated Vaccines, Subunit Vaccines, DNA Vaccines, Recombinant Vaccines, and Others. Among these, Live Attenuated Vaccines are the most widely used due to their effectiveness in providing long-lasting immunity and their ability to stimulate a strong immune response. Inactivated Vaccines also hold a significant share, particularly in regions with stringent regulations regarding vaccine safety. The demand for Subunit and Recombinant Vaccines is growing, driven by advancements in biotechnology and the need for safer alternatives. DNA vaccines and novel delivery systems, such as viral vector and nanoparticle-based vaccines, are gaining traction due to their targeted immune responses and improved safety profiles .

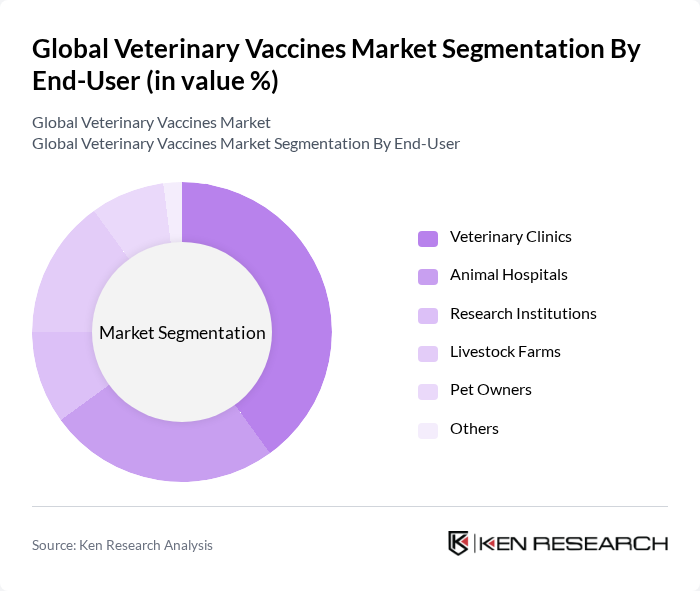

By End-User:The end-user segmentation includes Veterinary Clinics, Animal Hospitals, Research Institutions, Livestock Farms, Pet Owners, and Others. Veterinary Clinics and Animal Hospitals are the primary consumers of veterinary vaccines, driven by the increasing number of pet owners and the rising awareness of animal health. Livestock Farms also represent a significant segment due to the need for disease prevention in livestock, which is crucial for food security. Research Institutions contribute to the market by developing new vaccines and conducting studies on vaccine efficacy. The growing trend of preventive healthcare and the expansion of commercial livestock operations are further supporting demand across these end-user groups .

The Global Veterinary Vaccines Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Ceva Santé Animale, Virbac, Vetoquinol, Neogen Corporation, Indian Immunologicals Limited, Biogenesis Bagó, HIPRA, Phibro Animal Health Corporation, Heska Corporation, Ourofino Saúde Animal, MSD Animal Health (Merck & Co., Inc.) contribute to innovation, geographic expansion, and service delivery in this space .

The veterinary vaccines market is poised for significant growth, driven by increasing awareness of animal health and the rising incidence of zoonotic diseases. Innovations in vaccine technology, such as mRNA platforms, are expected to enhance vaccine efficacy and safety. Additionally, the growing trend towards preventive healthcare will likely lead to increased vaccination rates among pets. As emerging markets expand, the demand for veterinary vaccines will continue to rise, presenting opportunities for companies to innovate and collaborate with veterinary professionals.

| Segment | Sub-Segments |

|---|---|

| By Type | Live Attenuated Vaccines Inactivated Vaccines Subunit Vaccines DNA Vaccines Recombinant Vaccines Others |

| By End-User | Veterinary Clinics Animal Hospitals Research Institutions Livestock Farms Pet Owners Others |

| By Application | Companion Animals Livestock Poultry Aquaculture Wildlife Others |

| By Distribution Channel | Veterinary Clinics Online Pharmacies Distributors Direct Sales Hospital/Clinic Pharmacy E-Commerce Others |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Rest of Europe) Asia-Pacific (China, India, Japan, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Approval Status | Approved Under Review Not Approved |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Animal Health Distributors | 60 | Sales Managers, Product Managers |

| Research Institutions | 40 | Veterinary Researchers, Academic Professors |

| Livestock Farmers | 80 | Farm Owners, Animal Husbandry Managers |

| Pet Owners | 50 | Pet Owners, Veterinary Technicians |

The Global Veterinary Vaccines Market is valued at approximately USD 12.3 billion, reflecting a significant growth driven by factors such as the rising prevalence of zoonotic diseases, increased pet ownership, and advancements in vaccine technology.