Region:Middle East

Author(s):Rebecca

Product Code:KRAC2873

Pages:86

Published On:January 2026

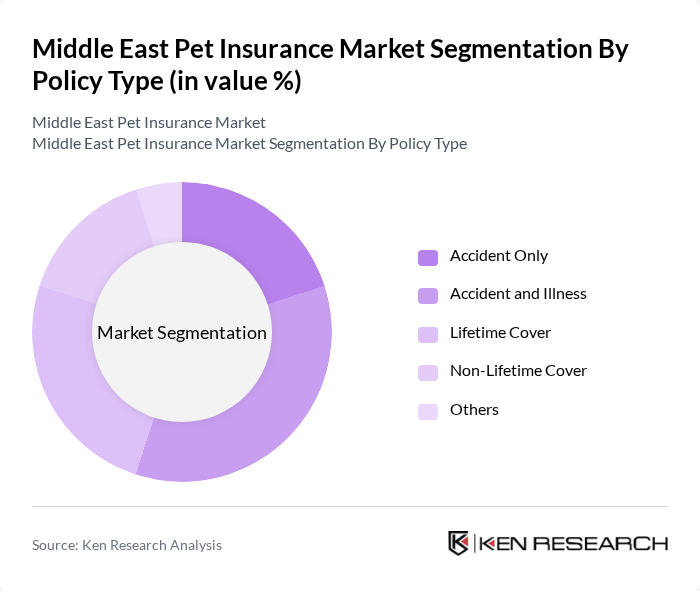

By Policy Type:

The policy type segmentation includes various subsegments such as Accident Only, Accident and Illness, Lifetime Cover, Non-Lifetime Cover, and Others. Among these, the Accident and Illness segment is currently dominating the market due to the increasing awareness among pet owners about the importance of comprehensive coverage. This trend is driven by rising veterinary costs and the growing inclination of pet owners to invest in their pets' health. The Lifetime Cover subsegment is also gaining traction as it offers long-term security for pet owners, ensuring that their pets receive necessary medical care throughout their lives.

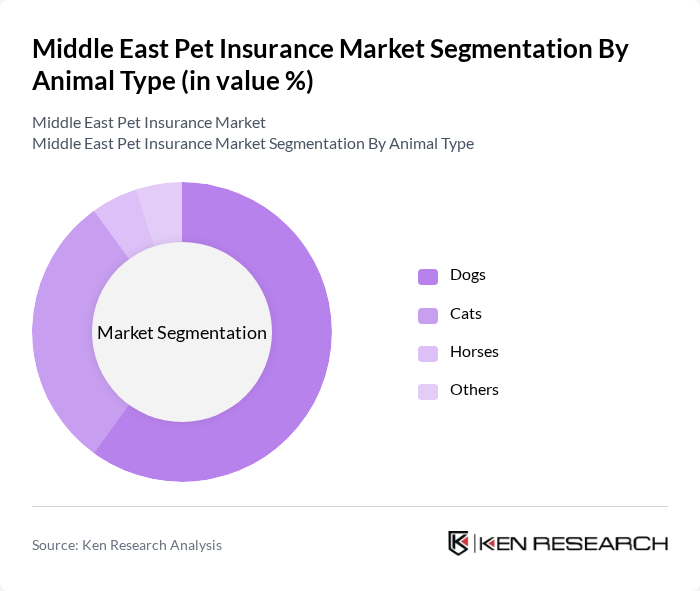

By Animal Type:

This segmentation includes Dogs, Cats, Horses, and Others. The Dogs subsegment is leading the market, primarily due to the high number of dog owners and the increasing trend of dog adoption in urban areas. Pet owners are more inclined to insure their dogs, given their higher veterinary care costs compared to other pets. The Cats subsegment follows closely, as cat ownership is also on the rise, with many owners seeking insurance to cover unexpected health issues. The Horses subsegment, while smaller, is significant in regions with equestrian activities, contributing to the overall market growth.

The Middle East Pet Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agria Pet Insurance, Figo Pet Insurance, Nationwide Pet Insurance, PetFirst Pet Insurance, Petplan Pet Insurance, PetSure, Trupanion, PetHealth, Tree Digital Insurance Agency, OSLO Pet Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East pet insurance market appears promising, driven by increasing pet ownership and a growing emphasis on pet health. As awareness of pet insurance benefits expands, more pet owners are likely to seek coverage. Additionally, technological advancements in telemedicine and claims processing will enhance service delivery. Insurers are expected to innovate product offerings, catering to diverse consumer needs, which will further stimulate market growth and engagement in future.

| Segment | Sub-Segments |

|---|---|

| By Policy Type | Accident Only Accident and Illness Lifetime Cover Non-Lifetime Cover Others |

| By Animal Type | Dogs Cats Horses Others |

| By Distribution Channel | Agents/Brokers Direct Banks Digital Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owners in Urban Areas | 120 | Dog and Cat Owners, Ages 25-55 |

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Pet Insurance Providers | 50 | Product Managers, Underwriters |

| Pet Care Retailers | 45 | Store Owners, Sales Managers |

| Pet Adoption Agencies | 40 | Agency Directors, Adoption Coordinators |

The Middle East Pet Insurance Market is valued at approximately USD 410 million, reflecting significant growth driven by increasing pet ownership, rising awareness of pet health, and innovations in insurtech that facilitate digital policy purchases and claims processing.