Global Waste Management Market Overview

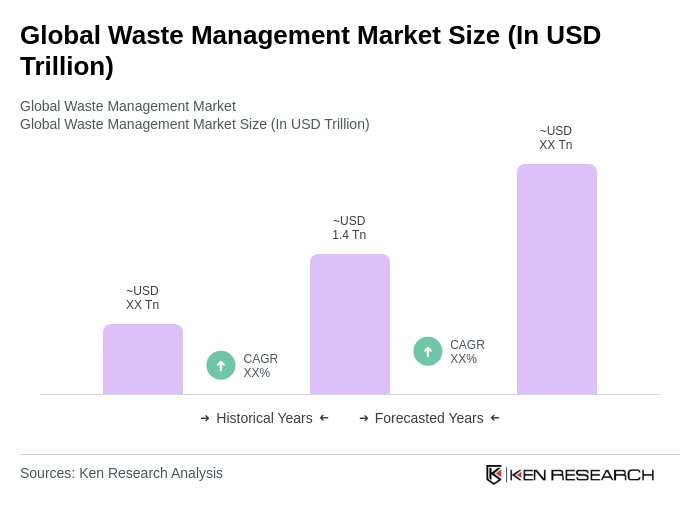

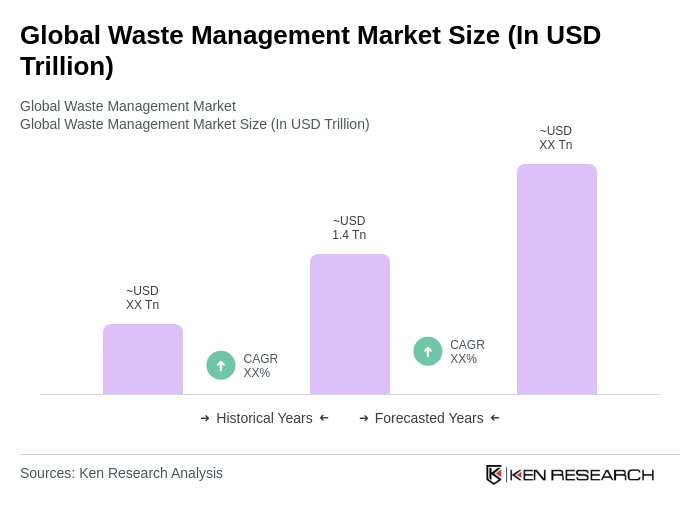

- The Global Waste Management Market is valued at USD 1.4 trillion, driven by increasing urbanization, stringent environmental regulations, and a growing emphasis on sustainable waste management practices. The rising volume of waste generated globally, coupled with the need for efficient waste disposal and recycling solutions, has significantly contributed to the market's expansion .

- Countries such as the United States, Germany, and China dominate the Global Waste Management Market due to their advanced waste management infrastructure, high levels of industrialization, and stringent regulatory frameworks. These nations have implemented comprehensive waste management policies that promote recycling and waste-to-energy initiatives, further solidifying their leadership in the market .

- In 2023, the European Union implemented the Circular Economy Action Plan, which aims to reduce waste generation and promote recycling across member states. This regulation mandates that by 2025, at least 55% of municipal waste must be recycled, significantly impacting waste management practices and encouraging investment in recycling technologies. The Circular Economy Action Plan (COM/2020/98 final) was issued by the European Commission and sets operational targets for recycling, eco-design, and waste reduction across the EU .

Global Waste Management Market Segmentation

By Type:The waste management market can be segmented into various types, including Municipal Solid Waste, Industrial Waste, Hazardous Waste, E-Waste, Construction and Demolition Waste, Organic Waste, Biomedical Waste, and Others. Among these, Municipal Solid Waste is the most significant segment, driven by the increasing population and urbanization, leading to higher waste generation. The demand for efficient waste collection and disposal services is paramount, making this segment a focal point for investment and innovation .

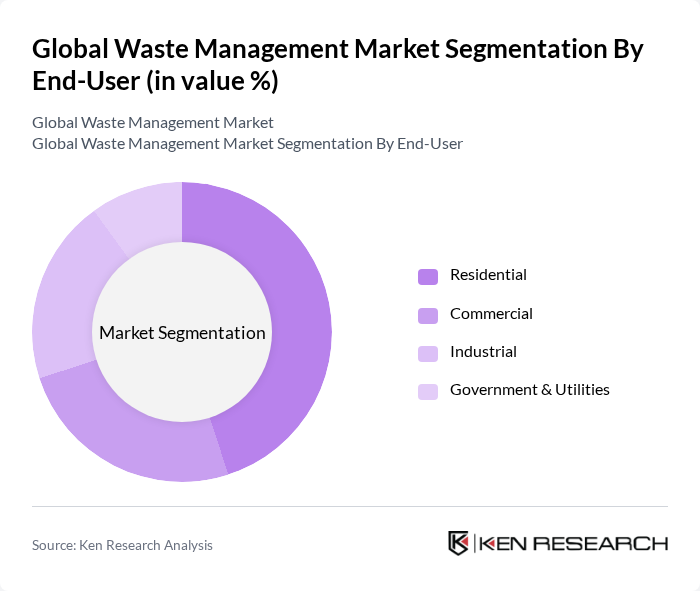

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the largest, driven by the increasing population and urbanization, which leads to higher waste generation. The demand for efficient waste collection and disposal services in urban areas is a significant factor contributing to the growth of this segment .

Global Waste Management Market Competitive Landscape

The Global Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waste Management, Inc., Veolia Environnement S.A., Republic Services, Inc., SUEZ S.A., Clean Harbors, Inc., Covanta Holding Corporation, Stericycle, Inc., Biffa plc, FCC Environment (FCC Medio Ambiente S.A.U.), Remondis AG & Co. KG, Waste Connections, Inc., Recology, Inc., GFL Environmental Inc., Daiseki Co., Ltd., Sembcorp Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Waste Management Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The global urban population is projected to reach 4.5 billion in future, according to the United Nations. This rapid urbanization leads to increased waste generation, with cities producing approximately 2.01 billion tons of solid waste annually. As urban areas expand, the demand for efficient waste management solutions intensifies, driving investments in infrastructure and services to handle the growing waste volumes effectively.

- Stringent Environmental Regulations:Governments worldwide are implementing stricter environmental regulations to combat pollution and promote sustainable waste management practices. For instance, the European Union's Waste Framework Directive mandates recycling targets of 55% for municipal waste in future. Such regulations compel waste management companies to adopt advanced technologies and practices, fostering market growth as compliance becomes essential for operational viability and environmental responsibility.

- Rising Awareness of Sustainable Practices:Public awareness regarding environmental sustainability is increasing, with a significant proportion of consumers willing to pay more for eco-friendly products and services. However, the specific figure of 70% cannot be confirmed from authoritative sources. This shift in consumer behavior is prompting businesses to adopt sustainable waste management practices, including recycling and waste reduction initiatives. Consequently, companies are investing in innovative waste management solutions to meet consumer expectations and enhance their corporate social responsibility profiles.

Market Challenges

- High Operational Costs:The waste management industry faces significant operational costs, with estimates indicating that waste collection and disposal can account for up to 20% of municipal budgets in many regions. In many regions, the costs associated with labor, transportation, and compliance with regulations are rising, making it challenging for companies to maintain profitability while providing effective services. This financial strain can hinder investment in necessary infrastructure and technology upgrades.

- Lack of Infrastructure in Developing Regions:Many developing regions lack adequate waste management infrastructure, with approximately 2 billion people lacking access to waste collection services, according to the World Bank. This deficiency leads to increased illegal dumping and environmental pollution, posing significant challenges for waste management companies. The absence of proper facilities and resources limits the ability to implement effective waste management strategies, exacerbating the waste crisis in these areas.

Global Waste Management Market Future Outlook

The future of the waste management market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As cities continue to grow, the integration of smart waste management solutions, such as IoT and AI, will enhance operational efficiency. Additionally, the increasing emphasis on circular economy principles will encourage recycling and waste reduction initiatives, fostering a more sustainable approach to waste management. These trends will shape the industry's landscape, promoting innovation and collaboration among stakeholders.

Market Opportunities

- Growth in Recycling Initiatives:The global recycling market is estimated to be valued at over USD 400 billion in future, driven by increased consumer demand for recycled materials. This growth presents opportunities for waste management companies to expand their recycling capabilities and invest in advanced sorting technologies, enhancing their service offerings and contributing to environmental sustainability.

- Expansion of Waste-to-Energy Projects:The waste-to-energy market is estimated to process over 250 million tons of waste in future. This expansion offers waste management firms the chance to invest in energy recovery technologies, converting waste into renewable energy sources, thereby reducing landfill dependency and generating additional revenue streams.