Region:Global

Author(s):Dev

Product Code:KRAC0504

Pages:87

Published On:August 2025

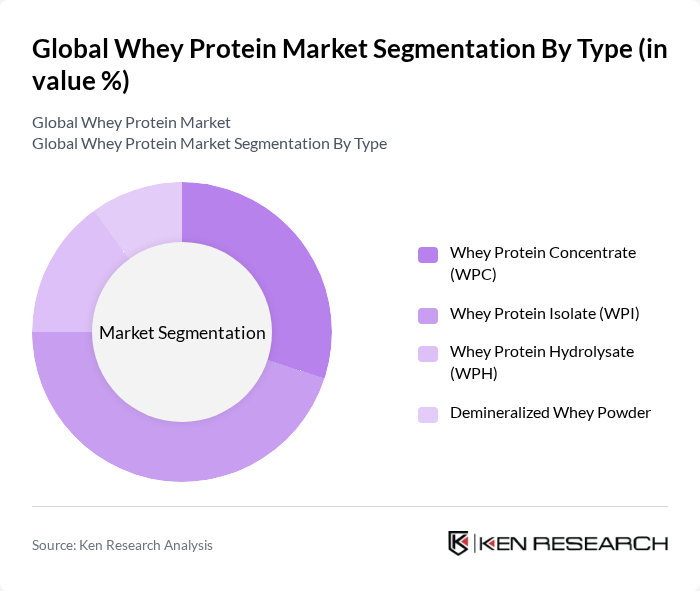

By Type:The whey protein market is segmented into four main types: Whey Protein Concentrate (WPC), Whey Protein Isolate (WPI), Whey Protein Hydrolysate (WPH), and Demineralized Whey Powder. Among these, Whey Protein Isolate (WPI) is widely positioned as a premium subsegment due to its high protein content and low fat and lactose levels, making it a preferred choice for athletes and consumers seeking clean, high-quality protein for muscle recovery and overall health; meanwhile, WPC remains important in mainstream performance nutrition and functional foods due to cost-effectiveness and versatility .

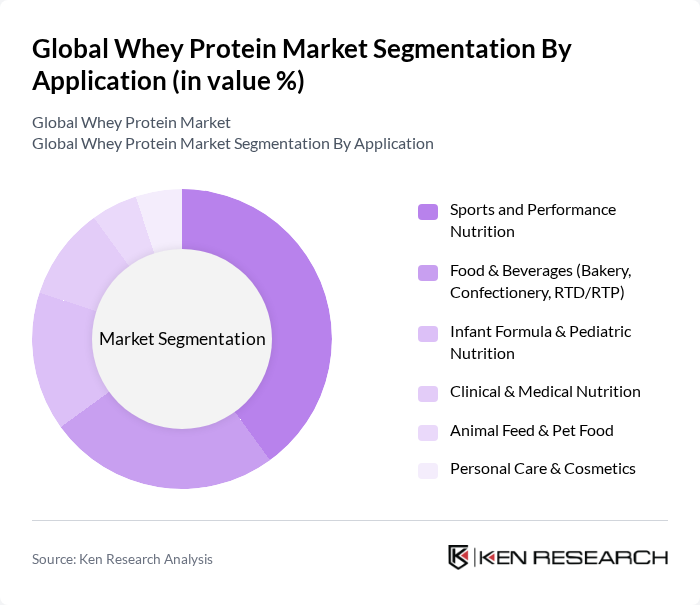

By Application:The applications of whey protein are diverse, including Sports and Performance Nutrition, Food & Beverages (Bakery, Confectionery, RTD/RTP), Infant Formula & Pediatric Nutrition, Clinical & Medical Nutrition, Animal Feed & Pet Food, and Personal Care & Cosmetics. The Sports and Performance Nutrition segment is the most significant, supported by the global fitness and active-lifestyle trend and the established evidence and positioning of whey for muscle recovery and lean mass support, while usage in functional foods and infant nutrition also remains substantial in mature dairy markets .

The Global Whey Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Glanbia plc (Glanbia Nutritionals, Optimum Nutrition), FrieslandCampina Ingredients, Arla Foods Ingredients Group P/S, Fonterra Co-operative Group Limited, Saputo Inc., Hilmar Cheese Company, Inc. (Hilmar Ingredients), Agropur Dairy Cooperative (Agropur Ingredients), Carbery Group (Synergy Flavours), Milk Specialties Global, Kerry Group plc, Davisco Foods International (a business of Agropur), Lactalis Ingredients, Bayer Consumer Health (formerly Schiff/Quest Nutrition brand owner note: Quest Nutrition now part of Simply Good Foods), The Simply Good Foods Company (Quest Nutrition), Dymatize Enterprises, LLC, NOW Foods, NutraBio Labs, Inc., Isagenix International LLC, Myprotein (The Hut Group plc, THG), MuscleTech (Iovate Health Sciences Inc.), Premier Protein (BellRing Brands, Inc.), Ascent Protein (Leprino Foods-backed), WheyCo GmbH, Tera’s Whey (Wisconsin Specialty Protein LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the whey protein market appears promising, driven by innovations in product formulations and the increasing integration of whey protein into functional foods. As consumers seek more personalized nutrition solutions, brands are likely to develop tailored whey protein products that cater to specific dietary needs. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, is expected to create new growth avenues, as rising disposable incomes and health awareness drive demand for protein supplements.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Concentrate (WPC) Whey Protein Isolate (WPI) Whey Protein Hydrolysate (WPH) Demineralized Whey Powder |

| By Application | Sports and Performance Nutrition Food & Beverages (Bakery, Confectionery, RTD/RTP) Infant Formula & Pediatric Nutrition Clinical & Medical Nutrition Animal Feed & Pet Food Personal Care & Cosmetics |

| By End-User | Athletes Bodybuilders Lifestyle & Health-Conscious Consumers Food & Beverage Manufacturers Infant Formula Manufacturers |

| By Distribution Channel | Online Retail (D2C, Marketplaces) Supermarkets/Hypermarkets Specialty Nutrition & Supplement Stores Pharmacies & Drugstores B2B/Industrial Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Bags (15–25 kg) Retail Pouches/Tubs Single-Serve Sachets RTD Bottles & RTM Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Nutrition Retailers | 140 | Store Managers, Product Buyers |

| Health Food Manufacturers | 100 | Product Development Managers, Quality Assurance Officers |

| Fitness Centers and Gyms | 80 | Owners, Personal Trainers |

| Dietary Supplement Distributors | 70 | Sales Managers, Marketing Directors |

| Consumers of Whey Protein Products | 150 | Health-conscious Individuals, Athletes |

The Global Whey Protein Market is valued at approximately USD 10 billion, driven by increasing demand for protein-rich diets and health consciousness among consumers. This market encompasses various applications, including food and beverages, sports nutrition, and infant formula.