Region:Asia

Author(s):Geetanshi

Product Code:KRAD0037

Pages:88

Published On:August 2025

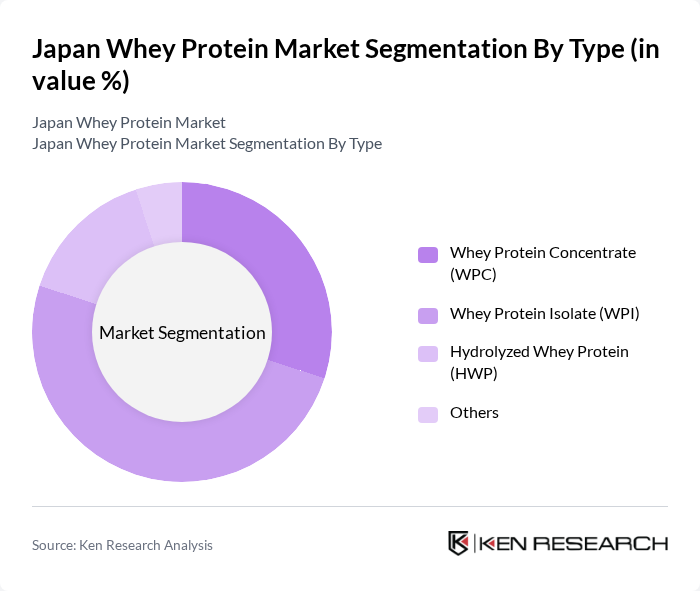

By Type:The market is segmented into Whey Protein Concentrate (WPC), Whey Protein Isolate (WPI), Hydrolyzed Whey Protein (HWP), and Others. Among these, Whey Protein Isolate (WPI) is the leading subsegment due to its high protein content and low fat and lactose levels, making it a preferred choice for health-conscious consumers and athletes. The demand for WPI has surged as consumers increasingly seek high-quality protein sources for muscle recovery and overall health .

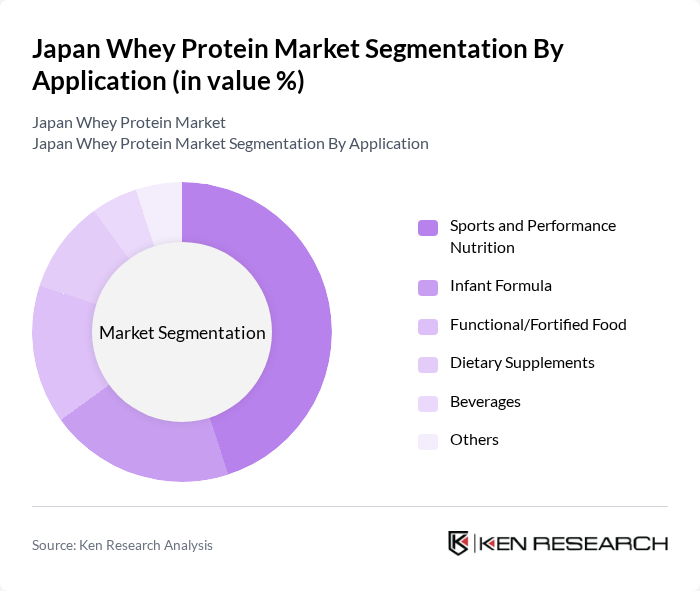

By Application:The applications of whey protein include Sports and Performance Nutrition, Infant Formula, Functional/Fortified Food, Dietary Supplements, Beverages, and Others. The Sports and Performance Nutrition segment is the most dominant, driven by the increasing number of fitness enthusiasts and athletes seeking effective recovery solutions. The trend towards healthier lifestyles and the growing popularity of fitness activities have significantly boosted the demand for whey protein in this application .

The Japan Whey Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meiji Holdings Co., Ltd., Morinaga Milk Industry Co., Ltd., Asahi Group Holdings, Ltd., Yakult Honsha Co., Ltd., Ajinomoto Co., Inc., Nestlé Japan Ltd., Kewpie Corporation, Otsuka Pharmaceutical Co., Ltd., Kirin Holdings Company, Limited, NUProtein Co., Ltd., Protein Wave Corporation, Fonterra Co-operative Group Limited, Glanbia Plc, Arla Foods amba, and Groupe Lactalis contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan whey protein market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly seek high-quality protein sources, the market is likely to witness innovations in product formulations and flavors. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to whey protein products, catering to a broader audience. Companies that adapt to these trends and focus on sustainability will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Concentrate (WPC) Whey Protein Isolate (WPI) Hydrolyzed Whey Protein (HWP) Others |

| By Application | Sports and Performance Nutrition Infant Formula Functional/Fortified Food Dietary Supplements Beverages Others |

| By End-User | Athletes Fitness Enthusiasts Health-Conscious Consumers Elderly Population Others |

| By Sales Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct to Consumer (DTC) Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Others |

| By Price Range | Premium Mid-Range Budget |

| By Brand Positioning | Premium Brands Mid-Tier Brands Value Brands |

| By Region | Kanto Region Kansai/Kinki Region Central/Chubu Region Kyushu-Okinawa Region Tohoku Region Chugoku Region Hokkaido Region Shikoku Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Centers and Gyms | 100 | Owners, Managers, Personal Trainers |

| Health Food Retailers | 60 | Store Managers, Nutrition Advisors |

| Online Supplement Retailers | 50 | eCommerce Managers, Marketing Directors |

| Consumer Focus Groups | 40 | Health-Conscious Consumers, Fitness Enthusiasts |

| Nutritionists and Dietitians | 40 | Registered Dietitians, Sports Nutritionists |

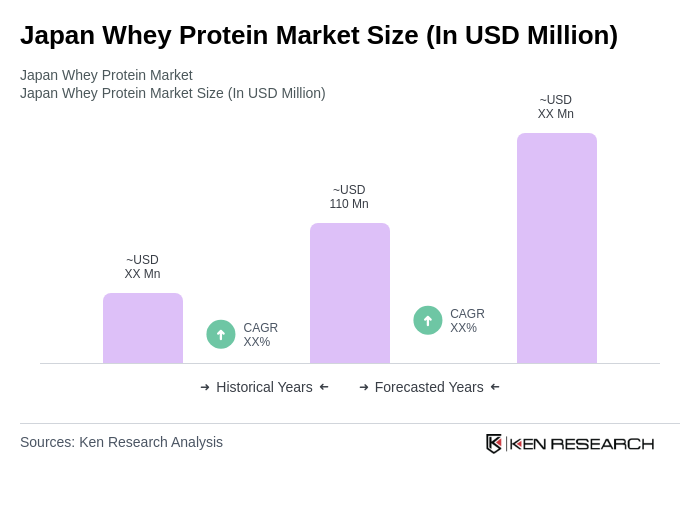

The Japan Whey Protein Market is valued at approximately USD 110 million, reflecting a significant growth trend driven by increasing health consciousness and the rising demand for protein supplements across various food products.