Region:Global

Author(s):Dev

Product Code:KRAA2612

Pages:89

Published On:August 2025

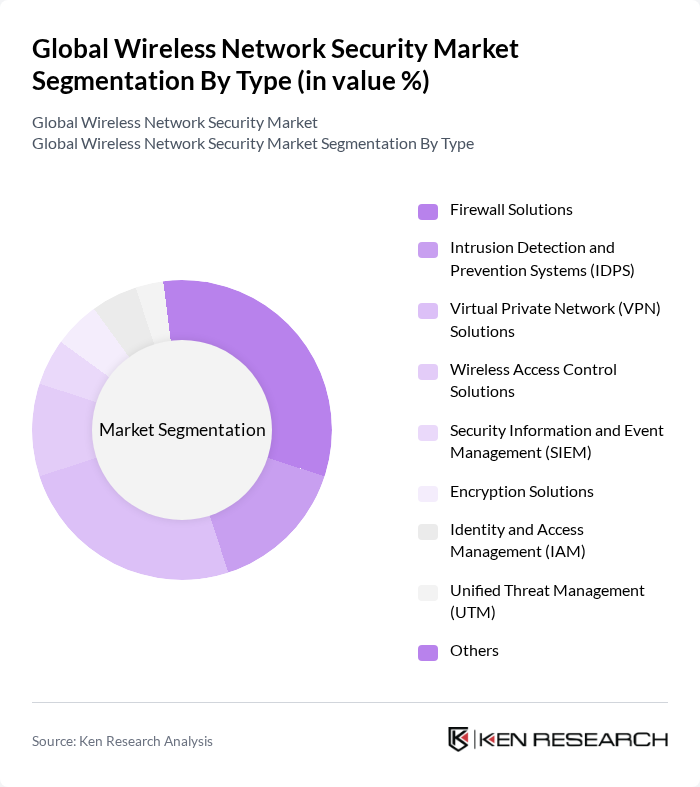

By Type:The market is segmented into various types of wireless network security solutions, including Firewall Solutions, Intrusion Detection and Prevention Systems (IDPS), Virtual Private Network (VPN) Solutions, Wireless Access Control Solutions, Security Information and Event Management (SIEM), Encryption Solutions, Identity and Access Management (IAM), Unified Threat Management (UTM), and Others. Among these, Firewall Solutions and VPN Solutions are particularly dominant due to their critical role in safeguarding network perimeters and ensuring secure remote access. The adoption of AI-powered threat detection and cloud-based security management is also accelerating across all solution types .

By End-User Industry:The wireless network security market is also segmented by end-user industries, including Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Manufacturing, IT and Telecom, Government, Aerospace and Defense, Education, and Others. The BFSI sector is the largest consumer of wireless security solutions due to the sensitive nature of financial data and the stringent regulatory requirements it faces. Healthcare and IT & Telecom sectors are also rapidly increasing their adoption of wireless security solutions in response to rising cyberattacks and the proliferation of connected devices .

The Global Wireless Network Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Juniper Networks, Inc., Aruba Networks (Hewlett Packard Enterprise), SonicWall, Inc., Trend Micro Incorporated, McAfee Corp., Barracuda Networks, Inc., CrowdStrike Holdings, Inc., Zscaler, Inc., Symantec Corporation (Broadcom Inc.), Bitdefender LLC, F5, Inc., WatchGuard Technologies, Inc., Sophos Ltd., Huawei Technologies Co., Ltd., Dell Technologies Inc. (Secureworks), Extreme Networks, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of wireless network security is poised for significant transformation, driven by technological advancements and evolving threat landscapes. As organizations increasingly adopt zero trust security models, the focus will shift towards continuous verification and monitoring of user access. Additionally, the integration of AI and machine learning will enhance threat detection capabilities, enabling proactive responses to potential breaches. The expansion of 5G networks will further necessitate robust security measures, creating a dynamic environment for innovation and investment in wireless security solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Firewall Solutions Intrusion Detection and Prevention Systems (IDPS) Virtual Private Network (VPN) Solutions Wireless Access Control Solutions Security Information and Event Management (SIEM) Encryption Solutions Identity and Access Management (IAM) Unified Threat Management (UTM) Others |

| By End-User Industry | Banking, Financial Services and Insurance (BFSI) Healthcare Retail Manufacturing IT and Telecom Government Aerospace and Defense Education Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales Value-Added Resellers (VARs) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Policy Support | Government Initiatives Industry Standards Cybersecurity Frameworks Incentives for Cybersecurity Investments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Wireless Security Solutions | 100 | IT Security Managers, Compliance Officers |

| Financial Services Network Security | 80 | Network Administrators, Risk Management Executives |

| Retail Wireless Security Implementations | 50 | IT Directors, Security Managers |

| Manufacturing IoT Security Measures | 40 | Operations Managers, Cybersecurity Analysts |

| Telecommunications Security Strategies | 90 | Network Engineers, Security Architects |

The Global Wireless Network Security Market is valued at approximately USD 30 billion, driven by increasing cyber threats, mobile device adoption, and the demand for secure wireless communication across various industries.