Region:Global

Author(s):Dev

Product Code:KRAA2531

Pages:97

Published On:August 2025

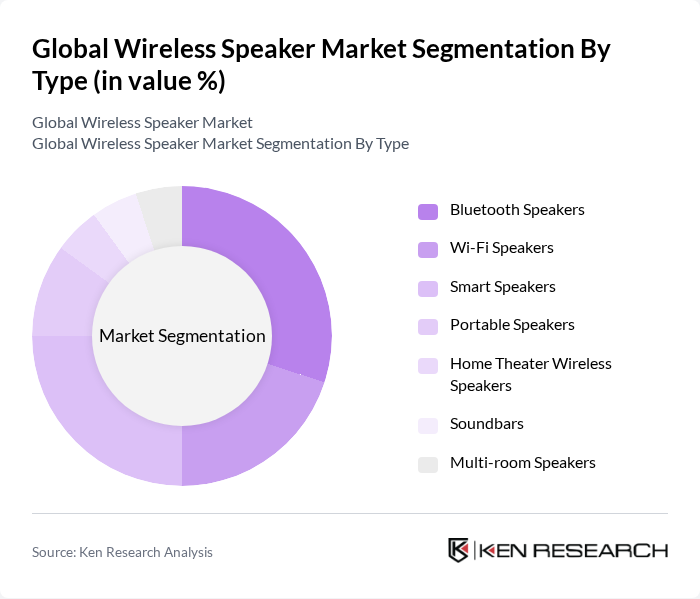

By Type:The market is segmented into various types of wireless speakers, including Bluetooth Speakers, Wi-Fi Speakers, Smart Speakers, Portable Speakers, Home Theater Wireless Speakers, Soundbars, and Multi-room Speakers. Each type caters to different consumer preferences and usage scenarios, influencing their market performance. Bluetooth speakers dominate due to their affordability and compatibility with most devices, while smart speakers are gaining traction with the integration of voice assistants. Wi-Fi speakers and multi-room systems appeal to audiophiles seeking higher sound quality and seamless home integration .

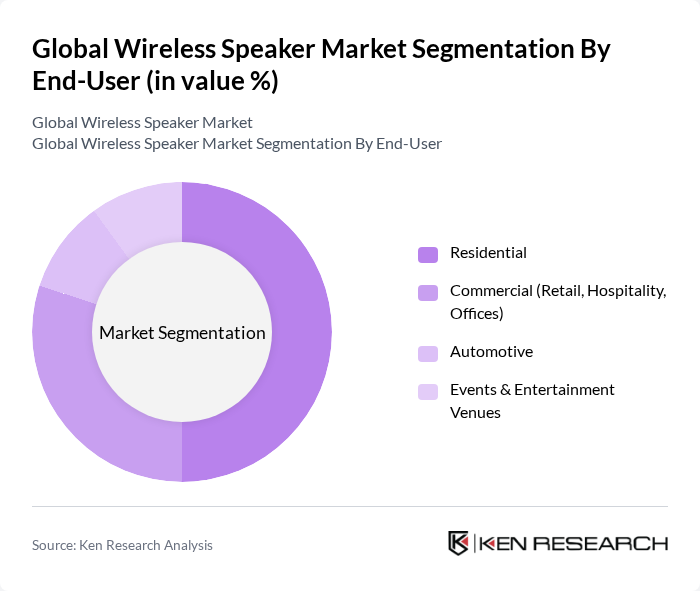

By End-User:The market is segmented by end-user applications, including Residential, Commercial (Retail, Hospitality, Offices), Automotive, and Events & Entertainment Venues. Each segment reflects distinct consumer needs and preferences, shaping the overall market dynamics. Residential users drive the largest share due to the widespread adoption of wireless speakers for home entertainment and smart home integration. The commercial segment is also significant, with wireless speakers increasingly used in retail, hospitality, and office environments for background music and announcements .

The Global Wireless Speaker Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sonos Inc., Bose Corporation, JBL (Harman International), Sony Corporation, Apple Inc., Amazon.com, Inc., Ultimate Ears (Logitech International S.A.), Bang & Olufsen A/S, Anker Innovations Ltd., Samsung Electronics Co., Ltd., LG Electronics Inc., Google LLC, Denon (Masimo Consumer), Klipsch Group, Inc., Marshall Group (Zound Industries International AB) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wireless speaker market appears promising, driven by technological advancements and evolving consumer preferences. As the integration of artificial intelligence and smart home ecosystems becomes more prevalent, wireless speakers are expected to evolve into multifunctional devices. Additionally, the increasing focus on sustainability will likely push manufacturers to innovate eco-friendly products, aligning with consumer demand for environmentally responsible options. This dynamic landscape presents opportunities for growth and differentiation in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Bluetooth Speakers Wi-Fi Speakers Smart Speakers Portable Speakers Home Theater Wireless Speakers Soundbars Multi-room Speakers |

| By End-User | Residential Commercial (Retail, Hospitality, Offices) Automotive Events & Entertainment Venues |

| By Distribution Channel | Online Retail (E-commerce, Brand Stores) Offline Retail (Electronics Stores, Hypermarkets) Direct Sales Distributors/Wholesalers |

| By Price Range | Budget (Below $50) Mid-Range ($50–$200) Premium (Above $200) |

| By Application | Personal/Home Use Professional/Studio Use Outdoor/Travel |

| By Connectivity | Bluetooth Wi-Fi NFC Others (Zigbee, AirPlay, etc.) |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Wireless Speakers | 120 | General Consumers, Audio Enthusiasts |

| Retail Insights on Wireless Speaker Sales | 90 | Retail Managers, Electronics Store Owners |

| Technological Adoption in Audio Devices | 60 | Audio Engineers, Product Developers |

| Market Trends in Portable Wireless Speakers | 50 | Marketing Managers, Brand Strategists |

| Consumer Feedback on Wireless Speaker Features | 70 | Product Users, Tech Reviewers |

The Global Wireless Speaker Market is valued at approximately USD 37 billion, reflecting significant growth driven by the demand for portable audio solutions, advancements in wireless technology, and the increasing popularity of smart home devices.