Region:Europe

Author(s):Rebecca

Product Code:KRAA1433

Pages:97

Published On:August 2025

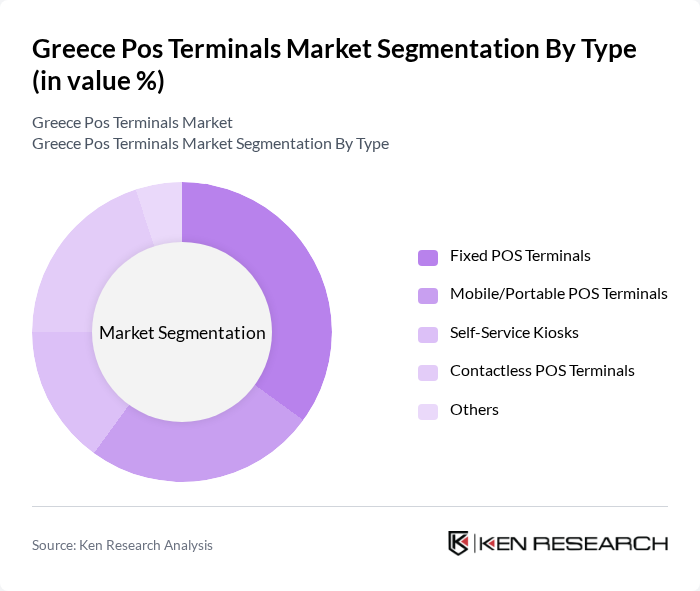

By Type:The market is segmented into various types of POS terminals, including Fixed POS Terminals, Mobile/Portable POS Terminals, Self-Service Kiosks, Contactless POS Terminals, and Others. Each type serves different business needs and consumer preferences, contributing to the overall growth of the market.

The Fixed POS Terminals segment is currently leading the market due to their widespread use in retail environments, where they provide reliable and efficient transaction processing. Businesses prefer fixed terminals for their stability and integration capabilities with existing systems. The increasing demand for enhanced customer experiences and operational efficiency has further solidified the position of fixed POS terminals in the market. Mobile/Portable POS Terminals are also gaining traction, especially among small businesses and service providers, due to their flexibility and ease of use.

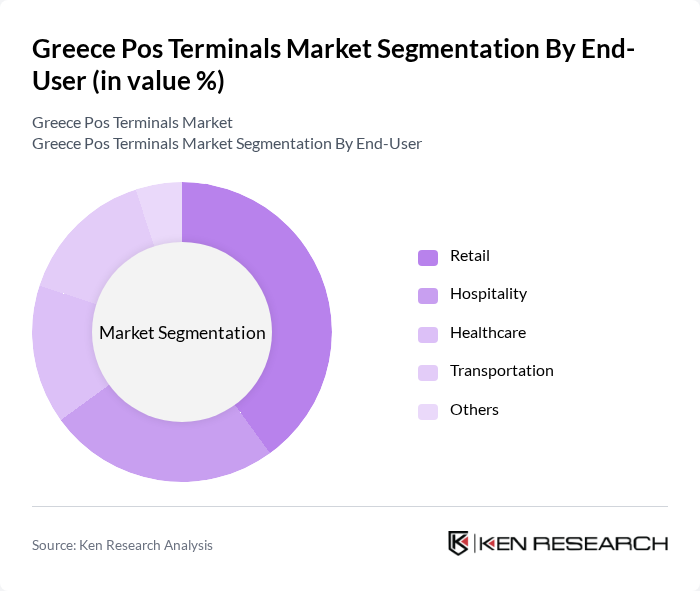

By End-User:The market is segmented by end-user into Retail, Hospitality, Healthcare, Transportation, and Others. Each sector has unique requirements for payment processing, influencing the adoption of various types of POS terminals.

The Retail sector dominates the market, accounting for a significant share due to the high volume of transactions and the need for efficient payment solutions. Retailers are increasingly adopting advanced POS systems to enhance customer service and streamline operations. The Hospitality sector follows closely, driven by the need for quick and reliable payment processing in restaurants and hotels. The Healthcare sector is also witnessing growth as medical facilities upgrade their payment systems to improve patient experiences and operational efficiency.

The Greece POS terminals market is characterized by a dynamic mix of regional and international players. Leading participants such as Cardlink S.A., Worldline S.A., Nayax Ltd., EDPS S.A., Smart POS Software, Verifone Systems, Inc., Ingenico Group, PAX Technology Limited, Diebold Nixdorf, Incorporated, NCR Corporation, QuadraPay, SumUp Limited, PayPal Holdings, Inc., Adyen N.V., Zettle by PayPal contribute to innovation, geographic expansion, and service delivery in this space.

The Greece POS terminals market is poised for significant growth, driven by the increasing shift towards cashless transactions and government support for digital payment initiatives. As consumer preferences evolve, businesses are expected to invest more in advanced payment technologies, enhancing customer experiences. Additionally, the rise of e-commerce and mobile payment solutions will further stimulate market expansion. In future, the integration of AI and machine learning in payment systems is anticipated to streamline operations and improve security, positioning the market for robust development.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed POS Terminals Mobile/Portable POS Terminals Self-Service Kiosks Contactless POS Terminals Others |

| By End-User | Retail Hospitality Healthcare Transportation Others |

| By Application | In-Store Payments Online Payments Mobile Payments Subscription Services Others |

| By Distribution Channel | Direct Sales Online Retailers Distributors Resellers Others |

| By Pricing Model | Subscription-Based One-Time Purchase Pay-Per-Use Others |

| By Region | Attica (Athens) Central Macedonia (Thessaloniki) Crete Thessaly Other Regions |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Institutions Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail POS Terminal Usage | 120 | Store Managers, Retail Operations Directors |

| Hospitality Sector Payment Solutions | 60 | Hotel Managers, Restaurant Owners |

| E-commerce Payment Processing | 50 | E-commerce Managers, Digital Payment Specialists |

| Financial Institutions' POS Deployment | 40 | Banking Executives, Payment System Analysts |

| SME Adoption of POS Systems | 70 | Small Business Owners, Financial Advisors |

The Greece POS terminals market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing adoption of cashless payment solutions and the digital transformation of various sectors, particularly retail and hospitality.