Region:North America

Author(s):Shubham

Product Code:KRAC0593

Pages:95

Published On:August 2025

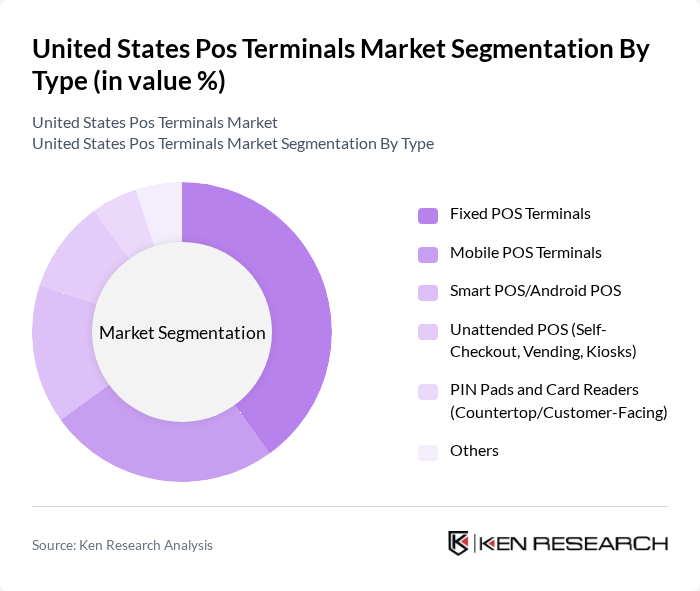

By Type:The segmentation by type includes Fixed POS Terminals, Mobile POS Terminals, Smart POS/Android POS, Unattended POS (Self-Checkout, Vending, Kiosks), PIN Pads and Card Readers (Countertop/Customer-Facing), and Others. Among these, Fixed POS Terminals are the most widely used due to their reliability and integration capabilities in retail environments. Mobile POS Terminals are gaining traction, especially in small businesses and service-oriented sectors, due to their flexibility and ease of use.

By End-User:The end-user segmentation includes Retail, Hospitality (Restaurants, Bars, Hotels), Healthcare, Transportation & Fuel (C-stores, Gas Stations), Entertainment & Gaming (Stadiums, Theaters, Casinos), and Others. The Retail sector is the largest end-user of POS terminals, driven by the need for efficient transaction processing and inventory management. The Hospitality sector is also significant, as restaurants and hotels increasingly adopt advanced payment solutions to enhance customer experience.

The United States Pos Terminals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Block, Inc. (Square), Clover Network, LLC (Fiserv), Toast, Inc., Verifone, Inc., Ingenico (Worldline), PAX Technology, Inc., NCR Voyix Corporation, Fiserv, Inc. (including First Data), PayPal Holdings, Inc. (Zettle), Adyen N.V., Worldpay, LLC (FIS/GTCR), Diebold Nixdorf, Incorporated, Shopify Inc. (Shopify POS), Lightspeed Commerce Inc., Revel Systems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States POS terminals market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt cloud-based solutions, the flexibility and scalability of these systems will likely enhance operational efficiency. Additionally, the integration of AI and machine learning into POS systems is expected to provide valuable insights into consumer behavior, enabling businesses to tailor their offerings. This trend, combined with the growing emphasis on sustainability, will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed POS Terminals Mobile POS Terminals Smart POS/Android POS Unattended POS (Self-Checkout, Vending, Kiosks) PIN Pads and Card Readers (Countertop/Customer-Facing) Others |

| By End-User | Retail Hospitality (Restaurants, Bars, Hotels) Healthcare Transportation & Fuel (C-stores, Gas Stations) Entertainment & Gaming (Stadiums, Theaters, Casinos) Others |

| By Sales Channel | Direct Sales (OEM/ISV) Online Sales Distributors Value-Added Resellers (VARs/ISOs) |

| By Payment Method | EMV Chip & Swipe (Credit/Debit Cards) NFC/Contactless (Apple Pay, Google Pay) QR/Scan-to-Pay ACH/Bank Transfers |

| By Industry Vertical | Grocery & Supermarkets Foodservice & Quick Service Restaurants Apparel & Specialty Retail Electronics & Home Improvement Pharmacies & Healthcare Providers |

| By Deployment Mode | On-Premises Cloud-Managed |

| By Customer Size | Micro & Small Businesses Mid-Market Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail POS Terminal Usage | 150 | Store Managers, IT Directors |

| Hospitality Sector Payment Solutions | 100 | Operations Managers, Front Desk Supervisors |

| Healthcare Payment Processing | 80 | Billing Managers, IT Administrators |

| Mobile Payment Adoption Trends | 70 | Marketing Managers, Product Development Leads |

| Emerging Payment Technologies | 90 | Technology Officers, Innovation Managers |

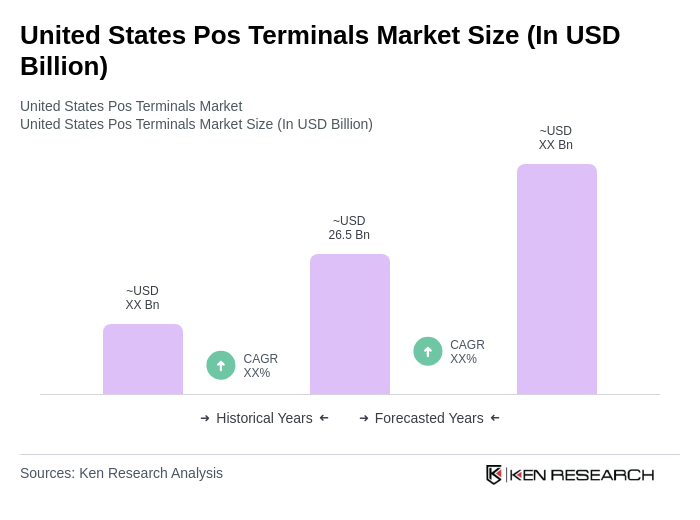

The United States POS terminals market is valued at approximately USD 26.5 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and the demand for contactless payment options, particularly accelerated by the COVID-19 pandemic.