Region:Asia

Author(s):Dev

Product Code:KRAB3623

Pages:86

Published On:October 2025

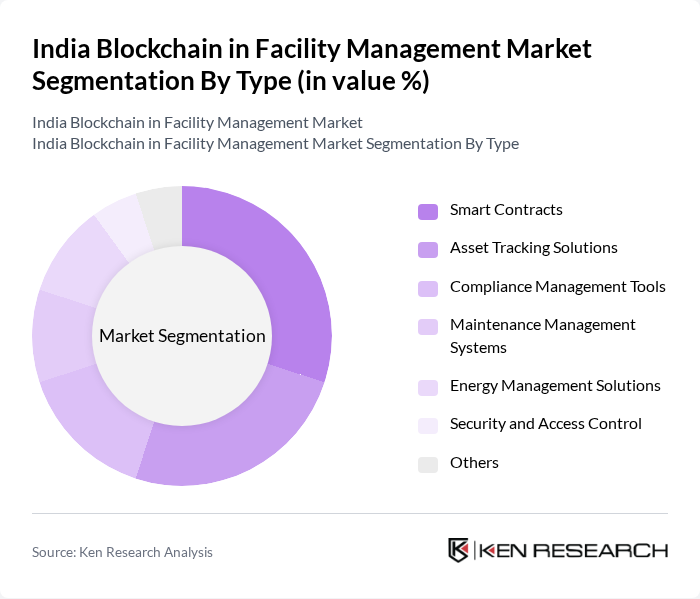

By Type:The market is segmented into various types, including Smart Contracts, Asset Tracking Solutions, Compliance Management Tools, Maintenance Management Systems, Energy Management Solutions, Security and Access Control, and Others. Among these, Smart Contracts are leading the market due to their ability to automate processes and reduce the need for intermediaries, thereby enhancing efficiency and reducing costs. Asset Tracking Solutions are also gaining traction as organizations seek to improve inventory management and asset utilization.

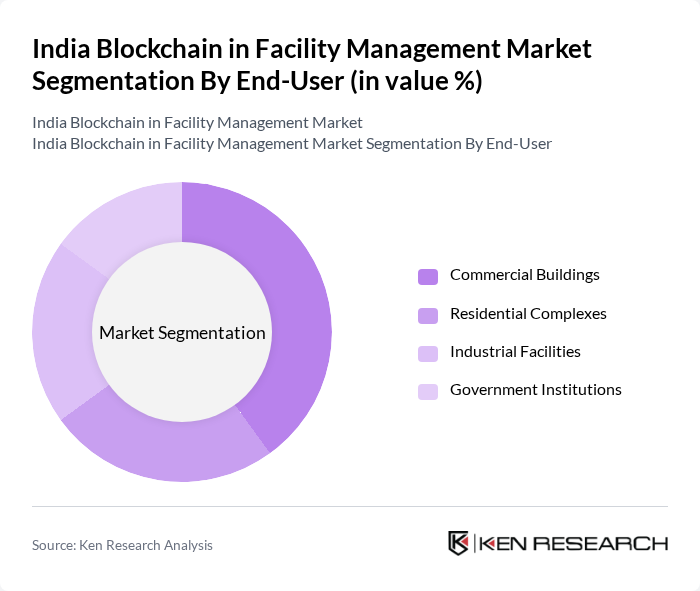

By End-User:The end-user segmentation includes Commercial Buildings, Residential Complexes, Industrial Facilities, and Government Institutions. Commercial Buildings are the dominant segment, driven by the increasing need for efficient management of large office spaces and the growing trend of smart buildings. The demand for innovative solutions in energy management and security is also propelling the adoption of blockchain technology in this sector.

The India Blockchain in Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wipro Limited, Tata Consultancy Services, Infosys Limited, HCL Technologies, Tech Mahindra, IBM India Private Limited, Accenture, Cognizant Technology Solutions, Larsen & Toubro, Capgemini Technology Services India Limited, Zensar Technologies, Minda Corporation Limited, NTT Data Services, Persistent Systems, R Systems International Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blockchain in facility management market in India appears promising, driven by technological advancements and increasing government support. As smart city initiatives gain traction, the integration of blockchain with IoT and AI is expected to enhance operational efficiencies significantly. Furthermore, as awareness grows and regulatory frameworks solidify, more stakeholders are likely to embrace blockchain solutions, leading to a more transparent and efficient facility management landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Contracts Asset Tracking Solutions Compliance Management Tools Maintenance Management Systems Energy Management Solutions Security and Access Control Others |

| By End-User | Commercial Buildings Residential Complexes Industrial Facilities Government Institutions |

| By Region | North India South India East India West India |

| By Technology | Public Blockchain Private Blockchain Consortium Blockchain |

| By Application | Facility Maintenance Space Management Energy Management Security Management |

| By Investment Source | Private Investments Government Funding Venture Capital |

| By Policy Support | Tax Incentives Grants for Technology Adoption Regulatory Support Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Real Estate Management | 80 | Property Managers, Asset Managers |

| Healthcare Facility Management | 70 | Healthcare Administrators, IT Managers |

| Educational Institutions | 60 | Campus Facility Managers, IT Directors |

| Government Facility Management | 50 | Public Sector Facility Managers, Compliance Officers |

The India Blockchain in Facility Management Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of blockchain technology to enhance transparency, security, and efficiency in facility management processes.