Region:Asia

Author(s):Dev

Product Code:KRAB0670

Pages:90

Published On:August 2025

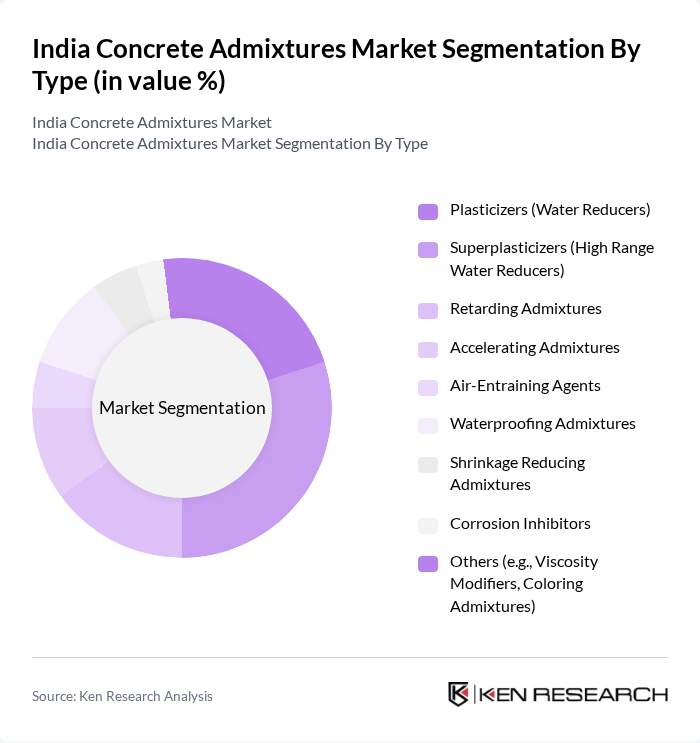

By Type:The market is segmented into various types of concrete admixtures, each serving specific functions in construction. The primary subsegments include Plasticizers (Water Reducers), Superplasticizers (High Range Water Reducers), Retarding Admixtures, Accelerating Admixtures, Air-Entraining Agents, Waterproofing Admixtures, Shrinkage Reducing Admixtures, Corrosion Inhibitors, and Others (e.g., Viscosity Modifiers, Coloring Admixtures). Among these, Superplasticizers are gaining traction due to their ability to enhance workability and strength, making them the preferred choice in high-performance and sustainable concrete applications. The market is witnessing a shift toward eco-friendly admixtures as regulatory standards and green building certifications become more prominent .

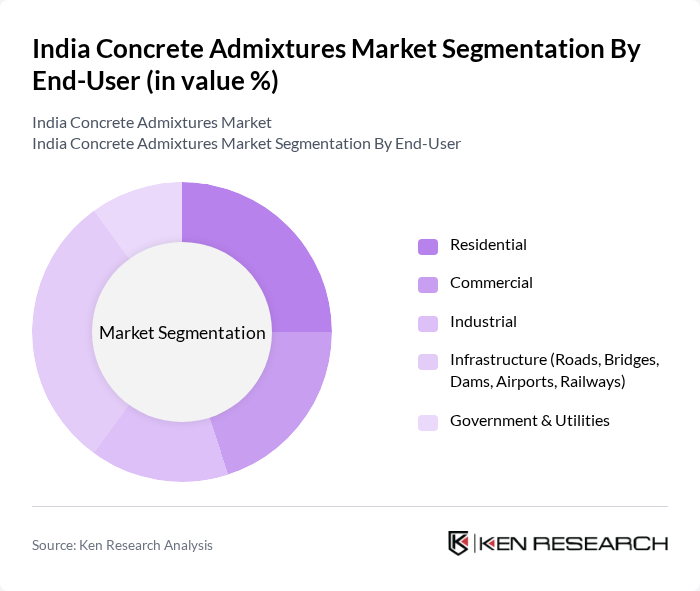

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Infrastructure (Roads, Bridges, Dams, Airports, Railways), and Government & Utilities. The Infrastructure segment is particularly dominant, supported by ongoing government initiatives such as the National Infrastructure Pipeline and Smart Cities Mission, which drive large-scale construction activity. The increasing number of construction projects in urban areas, coupled with the adoption of advanced admixture technologies, further supports this trend and positions infrastructure as a key focus for manufacturers .

The India Concrete Admixtures Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF India Ltd., Sika India Pvt. Ltd., Fosroc Chemicals (India) Pvt. Ltd., Saint-Gobain India Pvt. Ltd. (Weber), UltraTech Cement Ltd., ACC Limited, RMC Readymix (India) Pvt. Ltd., Pidilite Industries Ltd., Master Builders Solutions India Pvt. Ltd., Ambuja Cements Ltd., HeidelbergCement India Ltd., JK Cement Ltd., Shree Cement Ltd., The Ramco Cements Ltd., Chembond Chemicals Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India concrete admixtures market appears promising, driven by increasing urbanization and government initiatives aimed at infrastructure development. As the construction sector evolves, there will be a growing emphasis on sustainable practices and eco-friendly products. Innovations in admixture technology, including smart construction solutions, will further enhance product offerings. The market is expected to adapt to these trends, focusing on quality, performance, and environmental compliance to meet the demands of modern construction projects.

| Segment | Sub-Segments |

|---|---|

| By Type | Plasticizers (Water Reducers) Superplasticizers (High Range Water Reducers) Retarding Admixtures Accelerating Admixtures Air-Entraining Agents Waterproofing Admixtures Shrinkage Reducing Admixtures Corrosion Inhibitors Others (e.g., Viscosity Modifiers, Coloring Admixtures) |

| By End-User | Residential Commercial Industrial Infrastructure (Roads, Bridges, Dams, Airports, Railways) Government & Utilities |

| By Region | North India South India East India West India |

| By Application | Residential Construction Commercial Construction Infrastructure Projects Industrial Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 70 | Construction Managers, Architects |

| Infrastructure Projects (Bridges, Roads) | 60 | Civil Engineers, Procurement Managers |

| Precast Concrete Manufacturing | 50 | Production Managers, Quality Control Officers |

| Admixture Distribution Channels | 80 | Sales Managers, Distribution Coordinators |

The India Concrete Admixtures Market is valued at approximately USD 330 million, driven by urbanization, infrastructure projects, and the demand for high-performance concrete in construction activities.