Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9127

Pages:95

Published On:November 2025

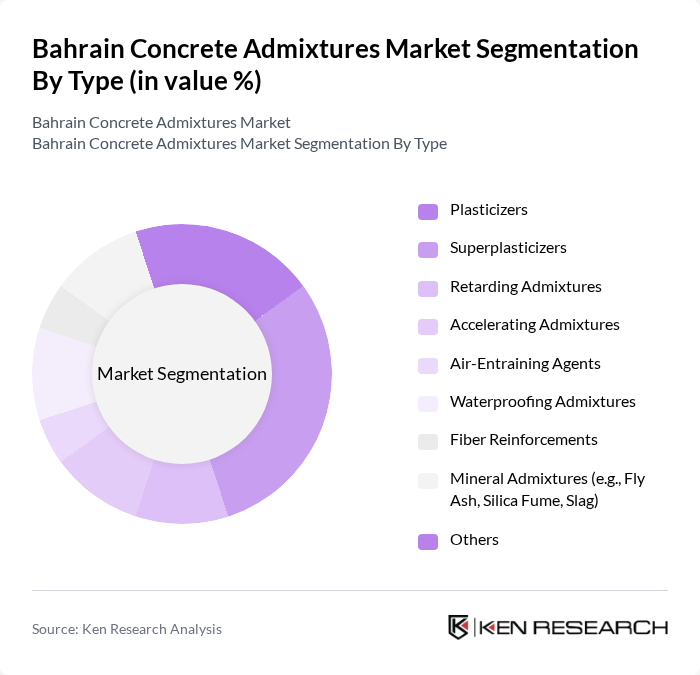

By Type:The market is segmented into various types of concrete admixtures, including plasticizers, superplasticizers, retarding admixtures, accelerating admixtures, air-entraining agents, waterproofing admixtures, fiber reinforcements, mineral admixtures (e.g., fly ash, silica fume, slag), and others. Among these,superplasticizersare gaining traction due to their ability to enhance workability and reduce water content in concrete, making them a preferred choice for high-performance applications. The demand for mineral admixtures is also increasing, driven by sustainability goals and the need for improved durability in harsh environments .

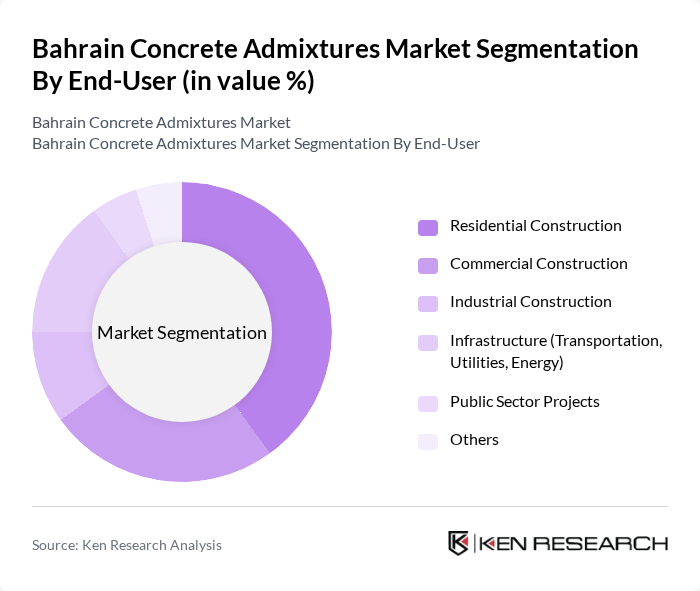

By End-User:The end-user segmentation includes residential construction, commercial construction, industrial construction, infrastructure (transportation, utilities, energy), public sector projects, and others. Theresidential constructionsegment is currently leading the market due to ongoing housing projects and urban development initiatives, which require high-quality concrete solutions to meet modern standards. However, commercial and infrastructure segments are also significant, supported by large-scale urbanization and government investment in public works .

The Bahrain Concrete Admixtures Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, GCP Applied Technologies, CEMEX S.A.B. de C.V., Mapei S.p.A., Fosroc International Limited, RPM International Inc., The Euclid Chemical Company, Saint-Gobain Construction Chemicals, Heidelberg Materials AG, Tarmac (CRH plc), Al Kobaisi Group (Bahrain), UCA United Chemical Admixtures (Bahrain), Al Manaratain Company & Ali Al Shaab Group (Bahrain), Gulf Readymix (Bahrain) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain concrete admixtures market is poised for significant transformation as sustainability and technological advancements take center stage. With the government's focus on infrastructure development and the increasing demand for high-performance concrete, manufacturers are likely to invest in eco-friendly formulations and smart construction technologies. This shift will not only enhance product offerings but also align with global trends towards sustainable construction practices, ensuring a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Plasticizers Superplasticizers Retarding Admixtures Accelerating Admixtures Air-Entraining Agents Waterproofing Admixtures Fiber Reinforcements Mineral Admixtures (e.g., Fly Ash, Silica Fume, Slag) Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure (Transportation, Utilities, Energy) Public Sector Projects Others |

| By Application | Concrete Admixtures Mortar Additives Grouts Waterproofing and Sealants Ready-Mix Concrete Precast Concrete On-Site Concrete Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate |

| By Customer Type | Contractors Builders Government Agencies Others |

| By Product Formulation | Standard Formulations Customized Formulations Hybrid & Specialty Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Architects, Construction Supervisors |

| Infrastructure Projects (Roads, Bridges) | 70 | Civil Engineers, Procurement Managers |

| Concrete Admixture Suppliers | 40 | Sales Managers, Product Development Managers |

| Regulatory Bodies and Standards Organizations | 40 | Policy Makers, Compliance Officers |

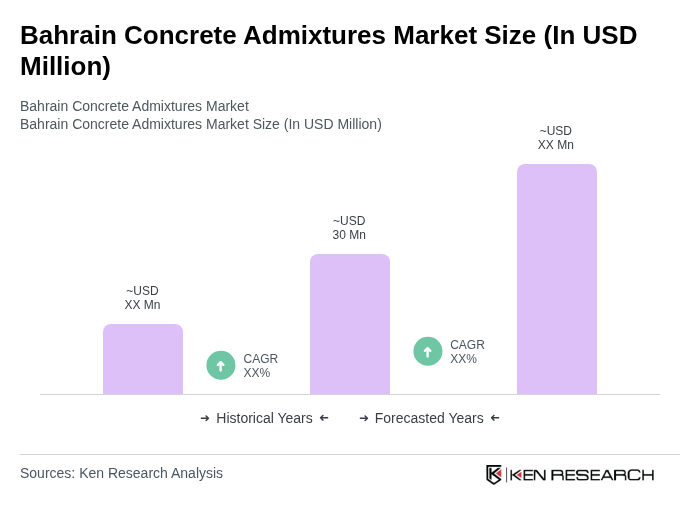

The Bahrain Concrete Admixtures Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for high-performance concrete in various construction projects across the region.