Region:Global

Author(s):Rebecca

Product Code:KRAA2921

Pages:92

Published On:August 2025

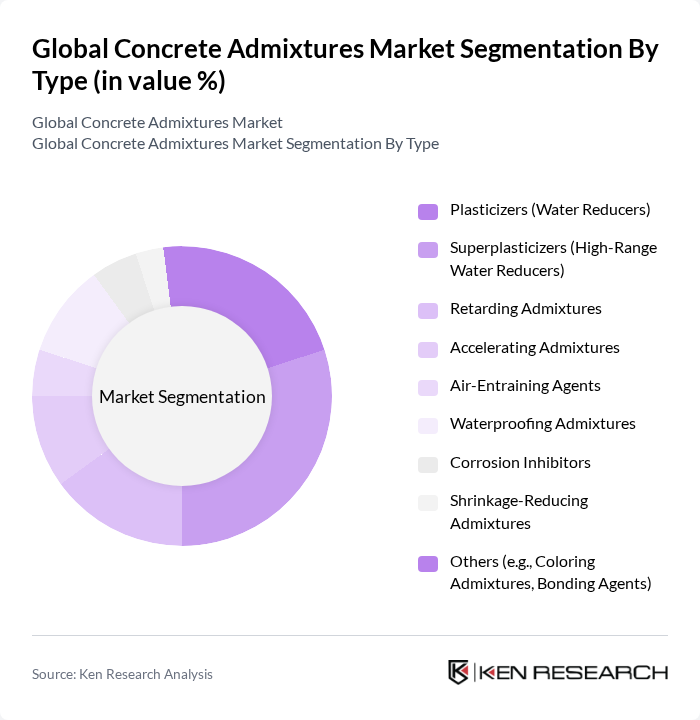

By Type:The market is segmented into various types of concrete admixtures, each serving specific functions in enhancing the properties of concrete. The primary subsegments include Plasticizers (Water Reducers), Superplasticizers (High-Range Water Reducers), Retarding Admixtures, Accelerating Admixtures, Air-Entraining Agents, Waterproofing Admixtures, Corrosion Inhibitors, Shrinkage-Reducing Admixtures, and Others (e.g., Coloring Admixtures, Bonding Agents). Among these, Superplasticizers are currently dominating the market due to their ability to significantly improve the workability and strength of concrete while reducing water content, which is crucial for modern construction practices.

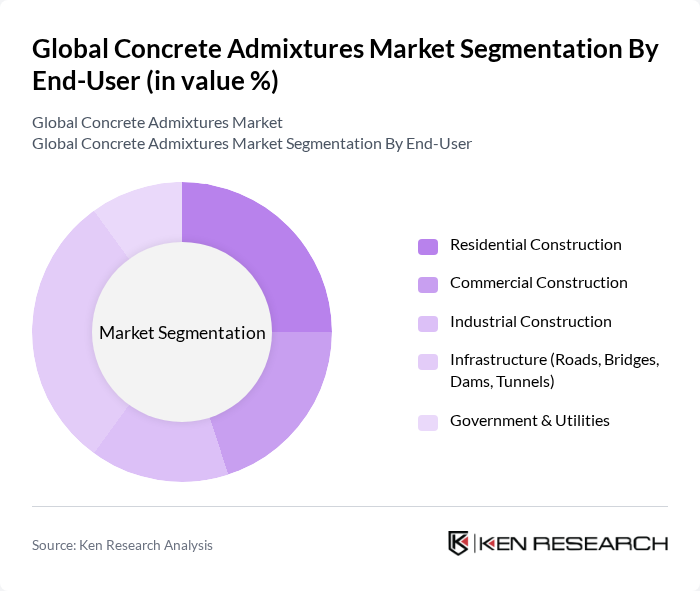

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial Construction, Infrastructure (Roads, Bridges, Dams, Tunnels), and Government & Utilities. The Infrastructure segment is currently leading the market due to increasing investments in public infrastructure projects globally. This trend is driven by government initiatives aimed at improving transportation networks and urban development, which require high-quality concrete solutions to ensure durability and longevity.

The Global Concrete Admixtures Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, GCP Applied Technologies Inc., CEMEX S.A.B. de C.V., RPM International Inc., Fosroc International Limited, Mapei S.p.A., Arkema S.A., CHRYSO Group, MBCC Group, Euclid Chemical Company, W. R. Grace & Co., Boral Limited, Heidelberg Materials AG, and Saint-Gobain Construction Chemicals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the concrete admixtures market appears promising, driven by ongoing technological advancements and a shift towards sustainable construction practices. As urbanization continues to rise, the demand for innovative and high-performance concrete solutions will likely increase. Additionally, the integration of digital technologies in construction processes is expected to enhance efficiency and reduce costs. Companies that invest in research and development of eco-friendly admixtures will be well-positioned to capitalize on emerging market trends and regulatory incentives.

| Segment | Sub-Segments |

|---|---|

| By Type | Plasticizers (Water Reducers) Superplasticizers (High-Range Water Reducers) Retarding Admixtures Accelerating Admixtures Air-Entraining Agents Waterproofing Admixtures Corrosion Inhibitors Shrinkage-Reducing Admixtures Others (e.g., Coloring Admixtures, Bonding Agents) |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure (Roads, Bridges, Dams, Tunnels) Government & Utilities |

| By Application | Ready-Mix Concrete Precast Concrete Shotcrete High-Performance Concrete Self-Compacting Concrete Others (e.g., Mass Concrete, Decorative Concrete) |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Packaging Type | Bags Drums Bulk (Tankers/Containers) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Construction Managers, Architects |

| Infrastructure Projects (Bridges, Roads) | 70 | Civil Engineers, Procurement Managers |

| Precast Concrete Manufacturing | 50 | Production Managers, Quality Control Inspectors |

| Admixture Distribution Channels | 60 | Sales Managers, Supply Chain Coordinators |

The Global Concrete Admixtures Market is valued at approximately USD 19 billion, driven by the increasing demand for high-performance concrete and sustainable building materials, alongside rapid urbanization and infrastructure development.