Region:Asia

Author(s):Dev

Product Code:KRAA7263

Pages:89

Published On:September 2025

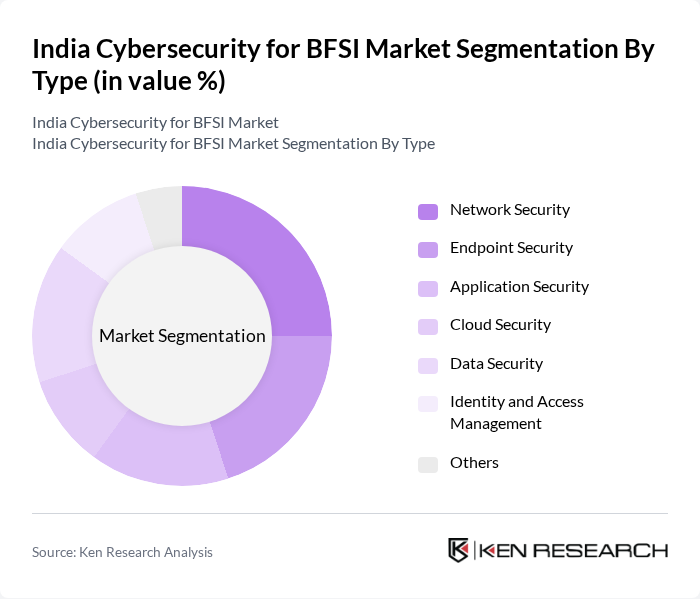

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Each of these sub-segments plays a crucial role in addressing specific security challenges faced by the BFSI sector.

The leading sub-segment in the cybersecurity market for BFSI is Network Security, which accounts for a significant portion of the market share. This dominance is attributed to the increasing number of cyberattacks targeting financial institutions, necessitating robust network protection measures. As organizations continue to digitize their operations, the need for secure network infrastructures becomes paramount, driving investments in advanced network security solutions.

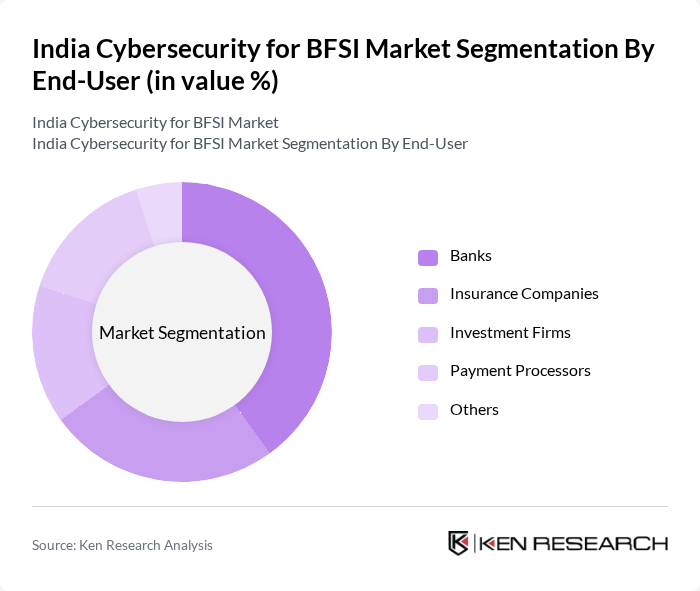

By End-User:The market is segmented by end-users, including Banks, Insurance Companies, Investment Firms, Payment Processors, and Others. Each of these segments has unique cybersecurity needs based on their operational frameworks and regulatory requirements.

Banks represent the largest end-user segment in the cybersecurity market for BFSI, driven by stringent regulatory requirements and the critical need to protect sensitive customer data. The financial sector's high exposure to cyber threats compels banks to invest heavily in cybersecurity measures, ensuring compliance and safeguarding their operations against potential breaches.

The India Cybersecurity for BFSI Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Consultancy Services, Infosys, Wipro, HCL Technologies, Tech Mahindra, Paladion Networks, Quick Heal Technologies, CyberArk Software, Check Point Software Technologies, Palo Alto Networks, Fortinet, McAfee, Symantec, Trend Micro, FireEye contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape in India's BFSI sector appears promising, driven by technological advancements and increasing regulatory pressures. As institutions continue to embrace digital transformation, the demand for innovative cybersecurity solutions will rise. Additionally, the integration of artificial intelligence and machine learning technologies is expected to enhance threat detection and response capabilities, making cybersecurity more proactive. The focus on data privacy and compliance will further shape the market, ensuring that organizations prioritize robust security measures to protect sensitive information.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Others |

| By Region | North India South India East India West India |

| By Technology | Artificial Intelligence Machine Learning Blockchain Encryption Technologies Others |

| By Application | Fraud Detection Risk Management Compliance Management Incident Response Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cybersecurity | 150 | CISOs, IT Security Managers |

| Insurance Industry Cybersecurity | 100 | Risk Management Officers, Compliance Heads |

| Investment Firms Cybersecurity | 80 | IT Directors, Security Analysts |

| Fintech Companies Cybersecurity | 70 | Product Security Managers, CTOs |

| Regulatory Compliance in BFSI | 60 | Compliance Officers, Legal Advisors |

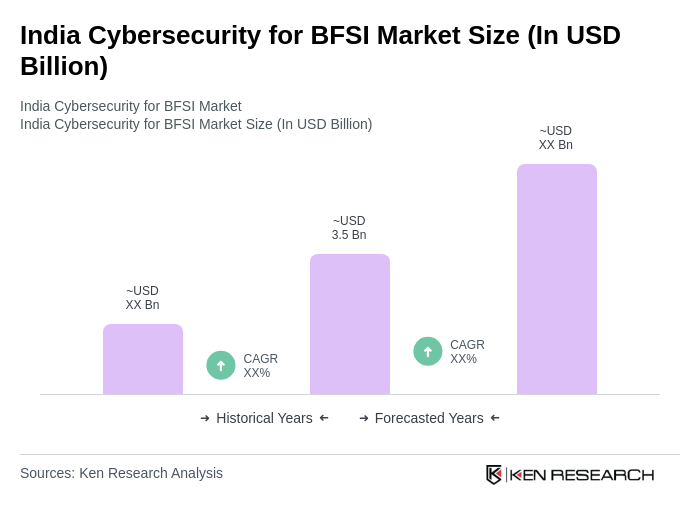

The India Cybersecurity for BFSI Market is valued at approximately USD 3.5 billion, driven by increasing cyber threats, regulatory compliance, and digital transformation in financial services. This market is expected to grow significantly as institutions enhance their cybersecurity measures.