Region:Asia

Author(s):Dev

Product Code:KRAB0946

Pages:89

Published On:October 2025

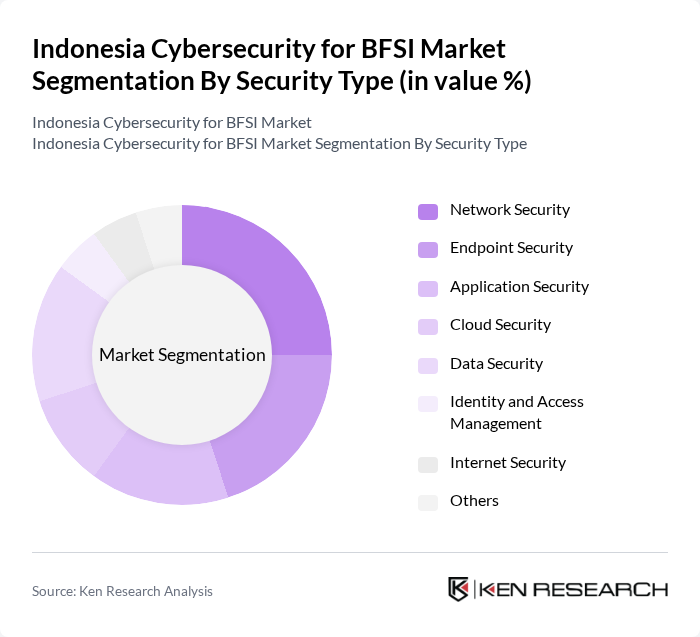

By Security Type:The cybersecurity market is segmented into Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Internet Security, and Others. Each segment plays a critical role in safeguarding financial institutions against evolving cyber threats. Network Security remains the leading subsegment, driven by the need to protect data integrity and confidentiality across increasingly complex banking networks. The expansion of remote work and digital banking has amplified demand for advanced network security solutions, while cloud security is rapidly gaining traction due to the shift toward cloud-based financial services .

Network Security is the dominant segment, essential for protecting the integrity and confidentiality of data transmitted across banking networks. The rise in cyberattacks targeting financial institutions and the increased adoption of remote work and digital banking have made network security a top priority for BFSI organizations. Cloud Security is also experiencing strong growth as institutions migrate to cloud platforms to improve scalability and operational efficiency .

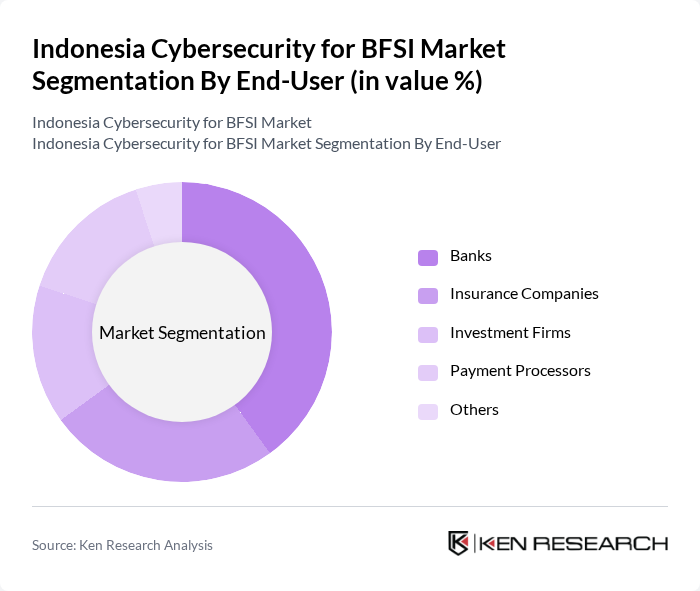

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, Fintech Companies, and Others. Each sector has distinct cybersecurity requirements based on operational complexity and regulatory mandates. Banks represent the largest end-user segment, reflecting their critical need to safeguard customer information and financial transactions. Regulatory compliance, frequent cyberattacks, and digital transformation initiatives drive banks to invest heavily in advanced cybersecurity solutions. Fintech companies and payment processors are also increasing their cybersecurity investments due to rapid growth and heightened exposure to digital threats .

Banks are the largest end-user segment, driven by the imperative to protect sensitive customer data and financial transactions. The increasing frequency and sophistication of cyberattacks, combined with regulatory requirements and the need to maintain customer trust, have led banks to prioritize cybersecurity investments. Fintech companies and payment processors are also expanding their cybersecurity budgets to address the risks associated with digital payments and online financial services .

The Indonesia Cybersecurity for BFSI Market features a dynamic mix of regional and international players. Leading participants such as PT. Cyberindo Aditama (CBN), PT. Vaksincom, PT. Mitra Integrasi Informatika, PT. Synnex Metrodata Indonesia, PT. Indosat Tbk, PT. Telkom Indonesia Tbk, PT. DCI Indonesia Tbk, PT. Multipolar Technology Tbk, PT. Aplikanusa Lintasarta, PT. Solusi247, PT. Cipta Sarana Informatika, PT. Infinys System Indonesia, PT. Bina Insani, PT. Securindo, IBM Indonesia, Cisco Systems Indonesia, Fortinet Indonesia, Dell Technologies Indonesia, Fujitsu Indonesia, Intel Indonesia, and AVG Technologies Indonesia contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cybersecurity landscape in Indonesia's BFSI sector appears promising, driven by increasing investments in advanced technologies and a growing emphasis on regulatory compliance. As institutions adapt to the evolving threat landscape, the integration of artificial intelligence and machine learning into cybersecurity strategies will become more prevalent. Additionally, the collaboration between government agencies and private sectors will enhance the overall cybersecurity framework, fostering a more secure environment for financial transactions and data protection in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Security Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Internet Security Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Fintech Companies Others |

| By Component | Software Hardware Services |

| By Deployment Mode | On-Premises Cloud-Based |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Industry Vertical | Banking Financial Services Insurance Others |

| By Policy Support | Government Initiatives Subsidies Tax Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cybersecurity | 100 | IT Security Managers, Risk Assessment Officers |

| Insurance Companies Cyber Defense | 60 | Compliance Officers, Cybersecurity Analysts |

| Investment Firms Security Protocols | 50 | Chief Information Security Officers, IT Directors |

| Fintech Startups Cybersecurity Measures | 40 | Founders, CTOs, Security Consultants |

| Regulatory Compliance in BFSI | 70 | Legal Advisors, Compliance Managers |

The Indonesia Cybersecurity for BFSI Market is valued at approximately USD 1.4 billion, driven by increasing digitization in banking and financial services, the rise of digital payment platforms, and a growing number of cyber threats targeting sensitive financial data.