Region:Middle East

Author(s):Dev

Product Code:KRAA7247

Pages:86

Published On:September 2025

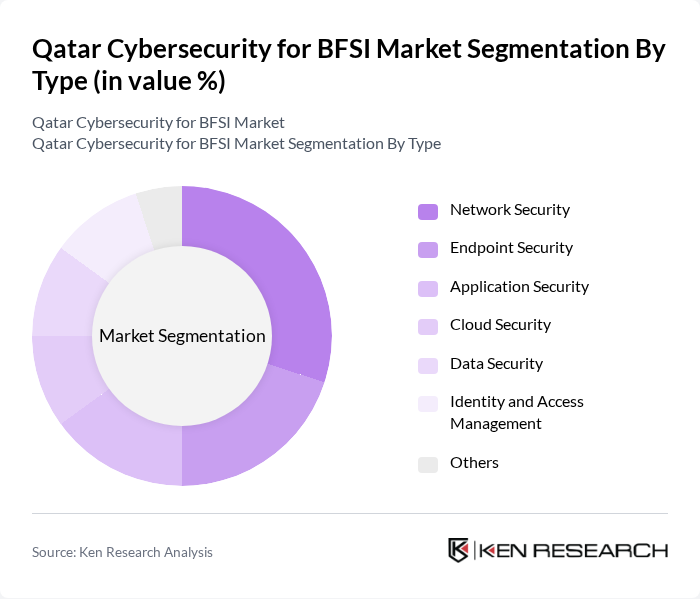

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Among these, Network Security is the leading sub-segment due to the increasing number of cyber threats targeting financial networks. Organizations are investing heavily in network security solutions to safeguard their infrastructure and sensitive data from breaches.

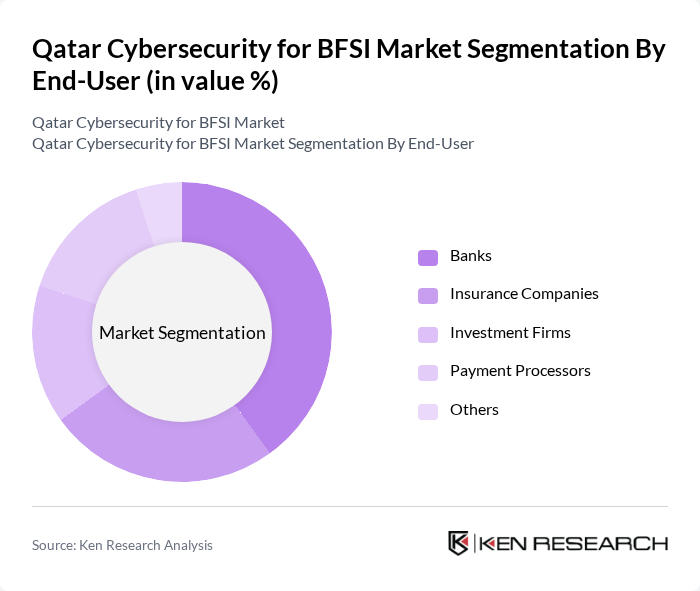

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, and Others. Banks dominate this segment as they are the primary targets for cyberattacks due to the sensitive nature of their operations. The increasing regulatory requirements and the need for secure transactions drive banks to invest significantly in cybersecurity solutions.

The Qatar Cybersecurity for BFSI Market is characterized by a dynamic mix of regional and international players. Leading participants such as QCyber Solutions, CyberQ Technologies, SecureTech Qatar, Qatari Cyber Defense, Gulf Cybersecurity Services, Doha Cyber Solutions, Qatar Financial Cybersecurity, CyberSafe Qatar, Q-Cyber Shield, CyberGuard Qatar, InfoSec Qatar, CyberSecure Solutions, Q-Cyber Defense, Qatar Security Systems, Cyber Intelligence Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar cybersecurity market for BFSI is poised for significant evolution, driven by technological advancements and regulatory pressures. As organizations increasingly adopt AI and machine learning for threat detection, the demand for innovative cybersecurity solutions will rise. Furthermore, the expansion of cloud services will necessitate enhanced security measures, prompting BFSI institutions to invest in scalable and flexible cybersecurity frameworks. This dynamic landscape will foster collaboration between financial institutions and cybersecurity providers, ensuring robust defenses against emerging threats.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Others |

| By Component | Solutions Services |

| By Deployment Mode | On-Premises Cloud-Based |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Industry Vertical | Banking Financial Services Insurance Others |

| By Policy Support | Government Initiatives Financial Incentives Regulatory Compliance Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cybersecurity | 100 | IT Security Managers, Risk Assessment Officers |

| Insurance Industry Cyber Defense | 80 | Compliance Officers, Cybersecurity Analysts |

| Investment Firms Security Protocols | 70 | Chief Information Security Officers, IT Directors |

| Fintech Solutions Security Measures | 60 | Product Managers, Security Architects |

| Regulatory Compliance in BFSI | 90 | Legal Advisors, Regulatory Affairs Managers |

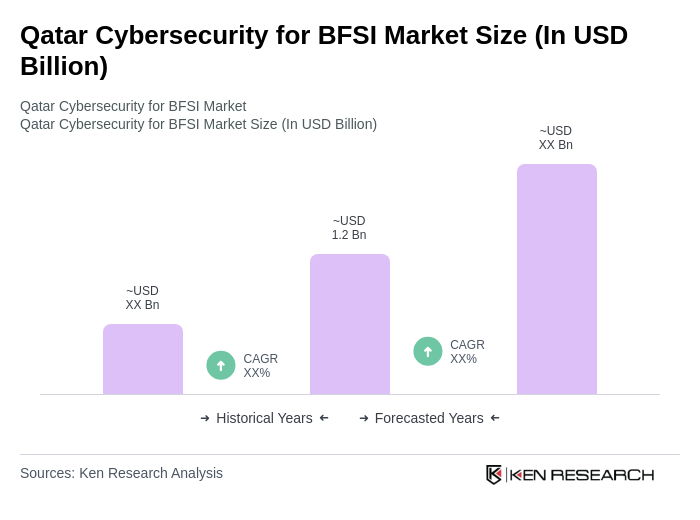

The Qatar Cybersecurity for BFSI Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digitization of financial services, rising cyber threats, and the need for regulatory compliance within the sector.