Region:Asia

Author(s):Dev

Product Code:KRAB3117

Pages:93

Published On:October 2025

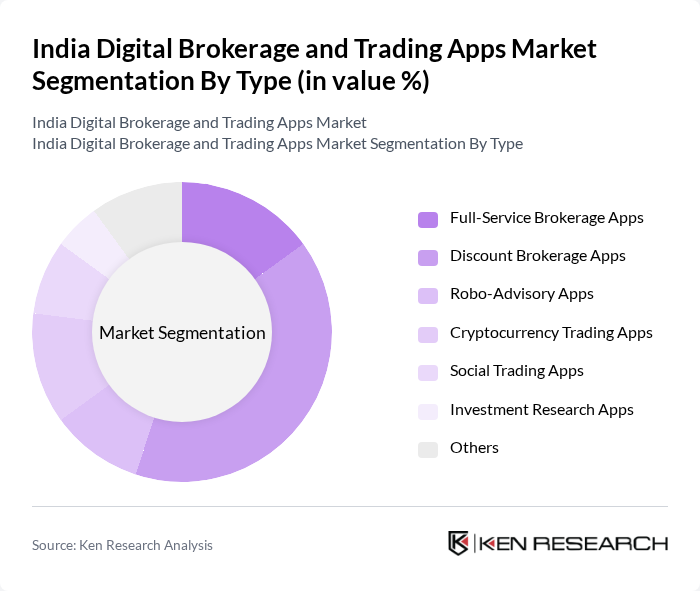

By Type:The market is segmented into various types of digital brokerage and trading apps, including Full-Service Brokerage Apps, Discount Brokerage Apps, Robo-Advisory Apps, Cryptocurrency Trading Apps, Social Trading Apps, Investment Research Apps, and Others. Among these, Discount Brokerage Apps are gaining significant traction due to their cost-effectiveness and ease of use, appealing to a broad range of retail investors.

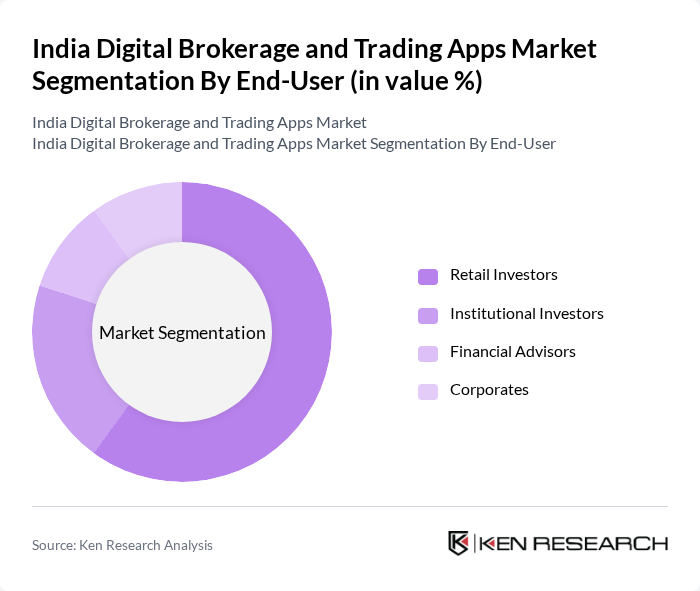

By End-User:The end-user segmentation includes Retail Investors, Institutional Investors, Financial Advisors, and Corporates. Retail Investors dominate the market, driven by the increasing number of individuals participating in stock trading and investment activities, facilitated by user-friendly apps and educational resources.

The India Digital Brokerage and Trading Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zerodha, Upstox, Angel Broking, ICICI Direct, HDFC Securities, Sharekhan, 5Paisa, Motilal Oswal, Axis Direct, Kotak Securities, Groww, Paytm Money, Interactive Brokers, Upstox Pro, Fyers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India digital brokerage and trading apps market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance trading strategies and user experiences. Additionally, the growing trend of social trading platforms will likely attract younger investors, fostering a more engaged trading community. As regulatory frameworks evolve, they will further support innovation and investor protection, creating a conducive environment for market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Brokerage Apps Discount Brokerage Apps Robo-Advisory Apps Cryptocurrency Trading Apps Social Trading Apps Investment Research Apps Others |

| By End-User | Retail Investors Institutional Investors Financial Advisors Corporates |

| By Region | North India South India East India West India |

| By Technology | Mobile Applications Web Platforms API Integrations |

| By Application | Stock Trading Forex Trading Commodity Trading Mutual Funds |

| By Investment Source | Individual Investors Institutional Investors Family Offices |

| By Policy Support | Tax Incentives Regulatory Support Investor Education Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Traders, Retail Investors |

| Brokerage Firm Analysis | 100 | Product Managers, Marketing Heads |

| Financial Advisor Perspectives | 80 | Investment Advisors, Wealth Managers |

| Technology Adoption in Trading | 70 | IT Managers, Fintech Innovators |

| Regulatory Impact Assessment | 60 | Compliance Officers, Legal Advisors |

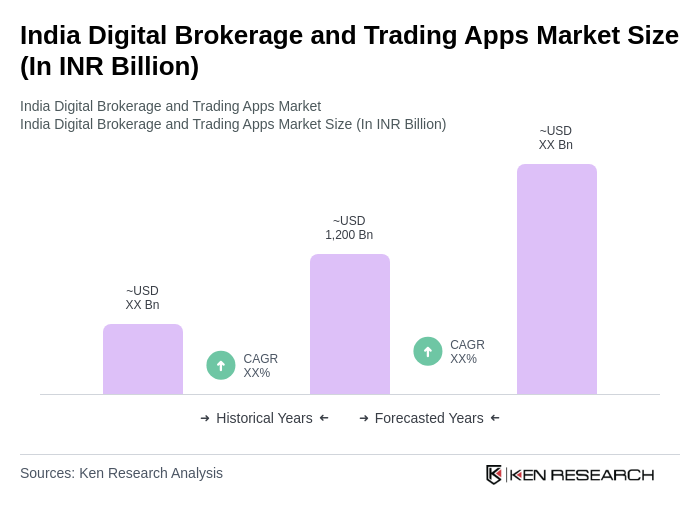

The India Digital Brokerage and Trading Apps Market is valued at approximately INR 1,200 billion, reflecting significant growth driven by technological advancements, increased retail investor participation, and the popularity of mobile trading platforms.