Region:Asia

Author(s):Geetanshi

Product Code:KRAB5804

Pages:82

Published On:October 2025

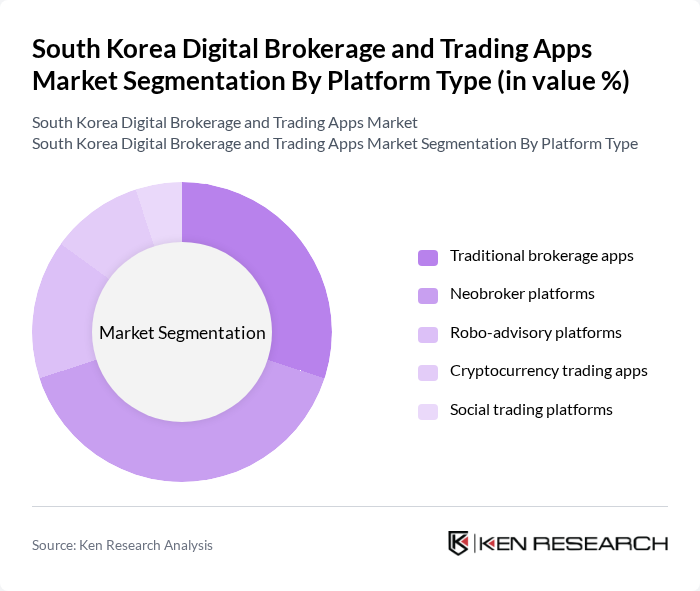

By Platform Type:The platform type segmentation includes various subsegments such as traditional brokerage apps, neobroker platforms, robo-advisory platforms, cryptocurrency trading apps, and social trading platforms. Among these, neobroker platforms are gaining significant traction due to their user-friendly interfaces and low-cost trading options, appealing particularly to younger investors who prefer mobile-first solutions. Traditional brokerage apps continue to hold a substantial market share, but the shift towards digital and automated solutions is evident.

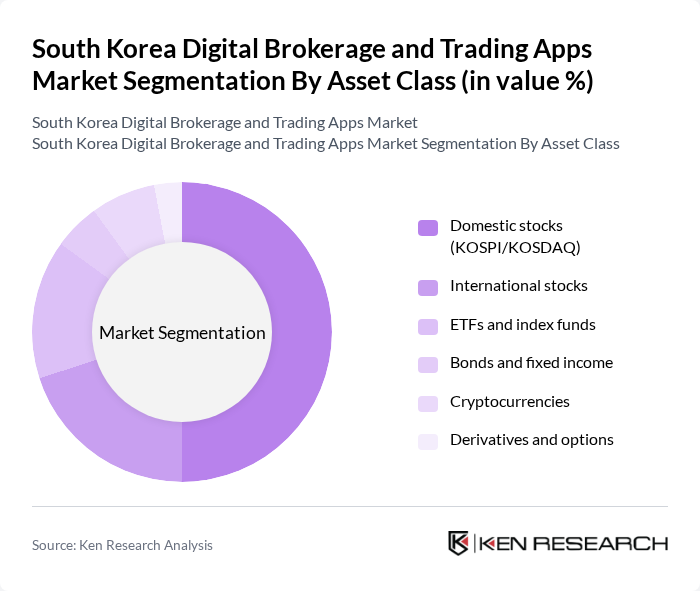

By Asset Class:The asset class segmentation encompasses domestic stocks (KOSPI/KOSDAQ), international stocks, ETFs and index funds, bonds and fixed income, cryptocurrencies, and derivatives and options. Domestic stocks remain the most popular choice among investors, driven by the strong performance of the KOSPI index and the increasing number of retail investors entering the market. Cryptocurrencies are also gaining popularity, particularly among younger demographics seeking alternative investment opportunities.

The South Korea Digital Brokerage and Trading Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kiwoom Securities Co., Ltd., Samsung Securities Co., Ltd., Mirae Asset Securities Co., Ltd., KB Securities Co., Ltd., NH Investment & Securities Co., Ltd., Korea Investment & Securities Co., Ltd., Hanwha Investment & Securities Co., Ltd., Shinhan Investment Corp., Daishin Securities Co., Ltd., Toss Securities, Kakao Pay Securities, Upbit (Dunamu Inc.), Bithumb Korea Co., Ltd., Coinone Co., Ltd., Korbit Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean digital brokerage and trading apps market is poised for continued evolution, driven by technological advancements and changing investor behaviors. The integration of AI and machine learning will enhance trading efficiency, while the growing trend of ESG investing will attract socially conscious investors. Additionally, the rise of mobile-first trading solutions will cater to the increasing demand for convenience. As regulatory frameworks adapt to these changes, the market is expected to become more accessible and innovative, fostering a dynamic trading environment.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Traditional brokerage apps Neobroker platforms Robo-advisory platforms Cryptocurrency trading apps Social trading platforms |

| By Asset Class | Domestic stocks (KOSPI/KOSDAQ) International stocks ETFs and index funds Bonds and fixed income Cryptocurrencies Derivatives and options |

| By User Demographics | Millennials (25-40 years) Gen Z (18-24 years) Gen X (41-56 years) Baby Boomers (57+ years) |

| By Investment Experience Level | Beginner investors Intermediate traders Advanced/professional traders |

| By Revenue Model | Commission-based trading Zero-commission models Subscription-based premium services Payment for order flow |

| By Device Platform | Mobile applications (iOS/Android) Web-based platforms Desktop applications |

| By Service Integration | Banking-integrated platforms Standalone trading apps Wealth management integrated |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Usage Patterns | 100 | Individual Traders, Retail Investors |

| Institutional Investor Insights | 60 | Portfolio Managers, Investment Analysts |

| App User Experience Feedback | 50 | Active Users, New Users |

| Regulatory Impact Assessment | 40 | Compliance Officers, Legal Advisors |

| Fintech Expert Opinions | 40 | Industry Analysts, Fintech Consultants |

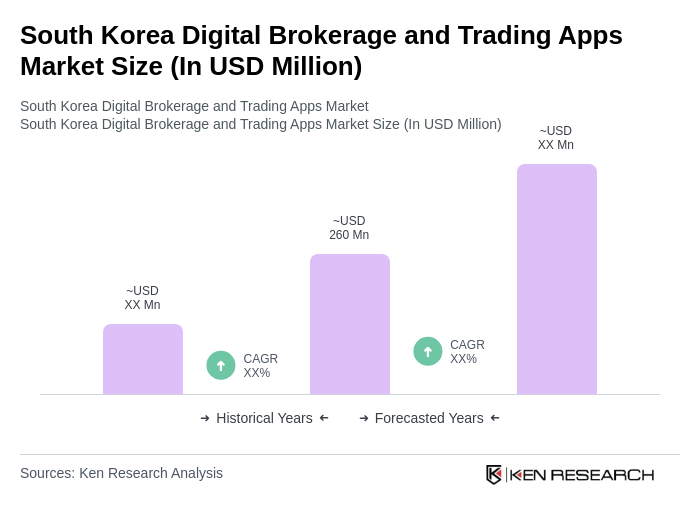

The South Korea Digital Brokerage and Trading Apps Market is valued at approximately USD 260 million, reflecting significant growth driven by mobile technology adoption, increased retail investor participation, and fintech innovations enhancing trading experiences.