Region:Middle East

Author(s):Dev

Product Code:KRAA2224

Pages:99

Published On:August 2025

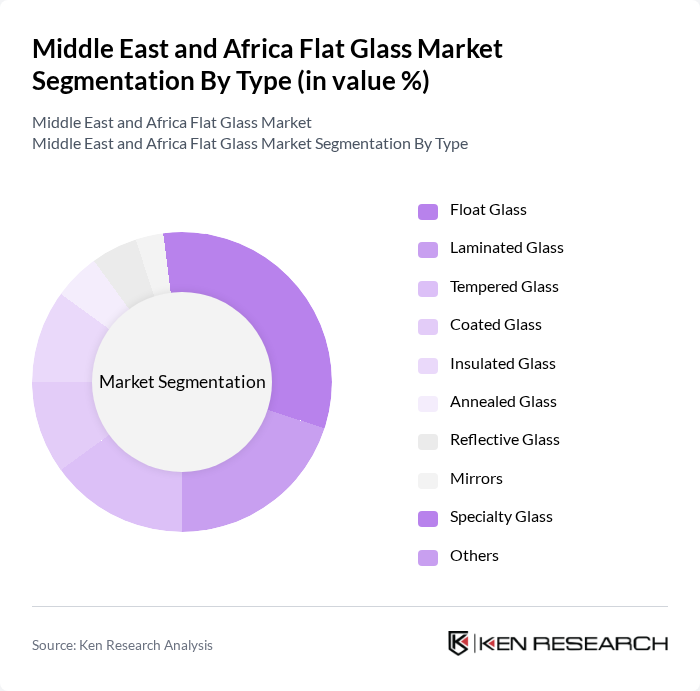

By Type:The flat glass market can be segmented into various types, including Float Glass, Laminated Glass, Tempered Glass, Coated Glass, Insulated Glass, Annealed Glass, Reflective Glass, Mirrors, Specialty Glass, and Others. Each type serves distinct applications and industries, contributing to the overall market dynamics. Float glass remains the most widely used type due to its versatility in construction and automotive sectors, while coated and insulated glass are gaining traction for their energy efficiency and solar control properties .

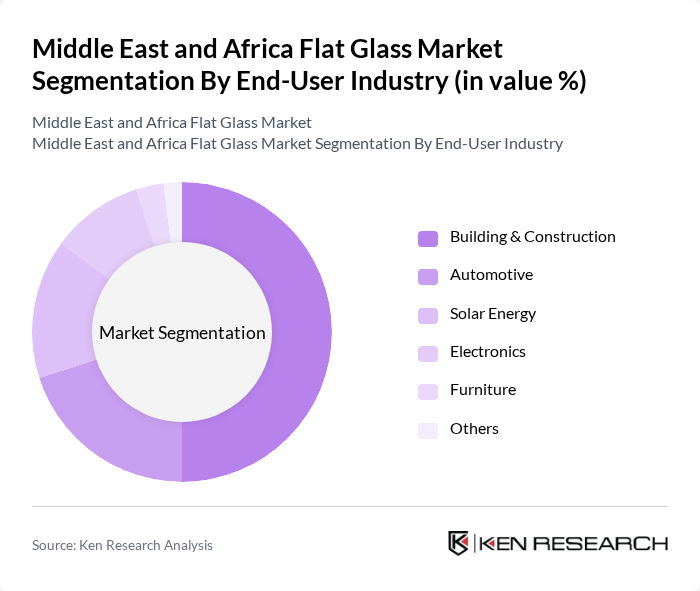

By End-User Industry:The flat glass market is segmented by end-user industries, including Building & Construction, Automotive, Solar Energy, Electronics, Furniture, and Others. Each industry has unique requirements and applications for flat glass, influencing market trends and growth. Building and construction remain the largest end-user segment, driven by ongoing urbanization and infrastructure investments, while the automotive and solar energy sectors are experiencing robust growth due to increased vehicle production and renewable energy projects .

The Middle East and Africa Flat Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain, Guardian Glass (Guardian Industries), AGC Inc. (Asahi Glass Company), Nippon Sheet Glass Co., Ltd. (NSG Group), ?i?ecam, PFG Building Glass (PG Group, South Africa), Emirates Float Glass LLC, Saudi Guardian International Float Glass Co. Ltd. (GulfGuard), Cairo Glass Company S.A.E., Sisecam Flat Glass South Africa (Pty) Ltd, Glass & Allied (G&A) Industries Ltd., Trulite Glass & Aluminum Solutions, Vitro Architectural Glass, CSG Holding Co., Ltd., Jinjing Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the flat glass market in the Middle East and Africa appears promising, driven by ongoing urbanization and technological advancements. As cities expand, the demand for innovative glass solutions will likely increase, particularly in smart buildings and energy-efficient designs. Furthermore, the integration of smart technologies in glass products is expected to enhance functionality and appeal, positioning the market for robust growth. The focus on sustainability will also shape product development, aligning with global trends towards eco-friendly materials.

| Segment | Sub-Segments |

|---|---|

| By Type | Float Glass Laminated Glass Tempered Glass Coated Glass Insulated Glass Annealed Glass Reflective Glass Mirrors Specialty Glass Others |

| By End-User Industry | Building & Construction Automotive Solar Energy Electronics Furniture Others |

| By Application | Windows & Facades Doors & Partitions Automotive Glazing Solar Panels Mirrors & Decorative Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Retail Outlets Online Sales |

| By Price Range | Economy Mid-Range Premium |

| By Region | North Africa Sub-Saharan Africa Middle East (GCC, Levant, Iran, etc.) |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Architectural Glass Applications | 100 | Architects, Project Managers |

| Automotive Glass Manufacturing | 60 | Production Managers, Quality Control Engineers |

| Solar Glass Market | 40 | Renewable Energy Specialists, Product Developers |

| Construction Industry Usage | 90 | Construction Managers, Procurement Officers |

| Flat Glass Recycling Initiatives | 50 | Sustainability Managers, Environmental Consultants |

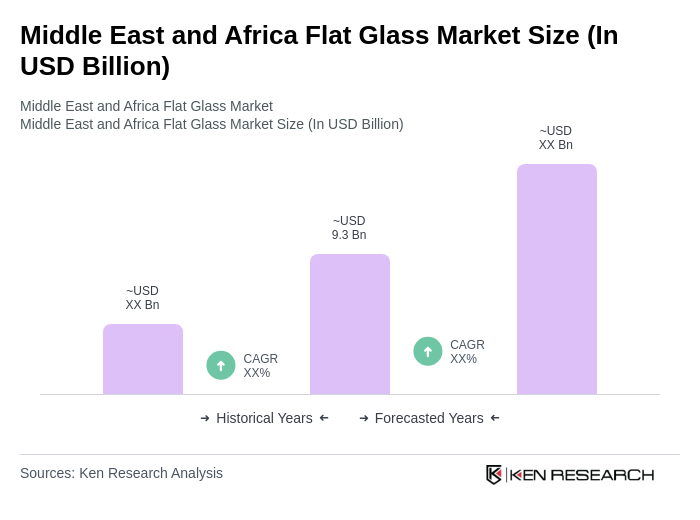

The Middle East and Africa Flat Glass Market is valued at approximately USD 9.3 billion, driven by factors such as urbanization, construction growth, and demand for energy-efficient materials.