Region:Asia

Author(s):Rebecca

Product Code:KRAC0182

Pages:81

Published On:August 2025

By Product:The product segmentation of the market includes various categories such as Bed Linen, Bath Linen, Kitchen Linen, Upholstery, and Floor Covering. Among these, Bed Linen is the most dominant segment, driven by the increasing trend of home decor, the growing preference for premium quality bedding products, and rising consumer expenditure on luxury and personalized home textiles. Consumers are increasingly investing in high-quality bed linens that offer comfort, durability, and aesthetic appeal, leading to a surge in demand for this category .

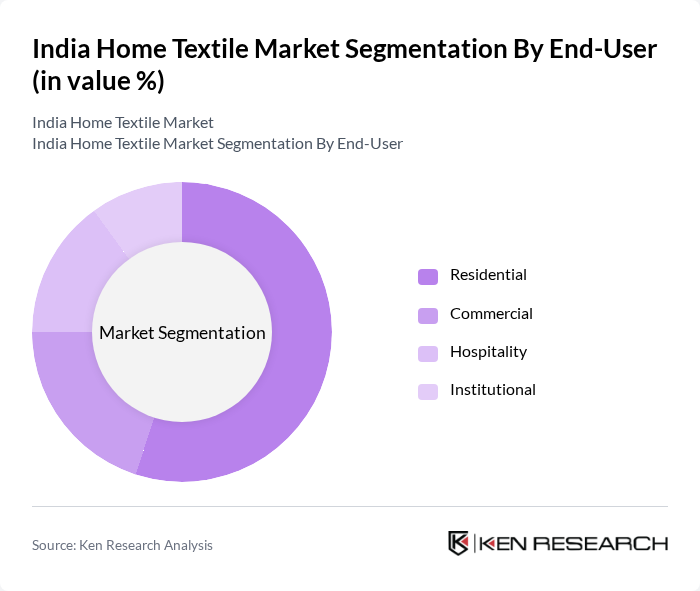

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, and Institutional categories. The Residential segment is the leading category, driven by the increasing number of households, urbanization, and the growing trend of home improvement and interior decoration. Consumers are more inclined to invest in home textiles that enhance their living spaces, with a notable rise in demand for premium and customized products in urban markets .

The India Home Textile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trident Group, Welspun India Ltd., Dicitex Decor Pvt. Ltd., Bombay Dyeing, Indo Count Industries Ltd., Alok Industries Ltd., Swayam India, Himatsingka Seide Ltd., Fabindia, Raymond Ltd., Vardhman Textiles Ltd., Kurlon Enterprises Ltd., Texport Industries Pvt. Ltd., DCM Textiles, S. Kumars Nationwide Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India home textile market appears promising, driven by technological advancements and changing consumer preferences. The integration of smart textiles, which offer functionalities like temperature regulation and stain resistance, is expected to gain traction. Additionally, the increasing focus on sustainability will likely lead to a rise in eco-friendly products, aligning with global trends. As consumers become more environmentally conscious, brands that prioritize sustainable practices will have a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product | Bed Linen Bath Linen Kitchen Linen Upholstery Floor Covering |

| By End-User | Residential Commercial Hospitality Institutional |

| By Region | North India South India East India West India |

| By Application | Home Decor Functional Use Seasonal Use |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Stores Online Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium |

| By Material | Cotton Polyester Linen Blends |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Home Textile Sales | 100 | Store Managers, Retail Buyers |

| Consumer Preferences in Home Textiles | 120 | Homeowners, Renters |

| Online Home Textile Purchases | 90 | E-commerce Managers, Digital Marketing Specialists |

| Trends in Sustainable Textiles | 80 | Sustainability Consultants, Product Designers |

| Market Insights from Interior Designers | 70 | Interior Designers, Home Decorators |

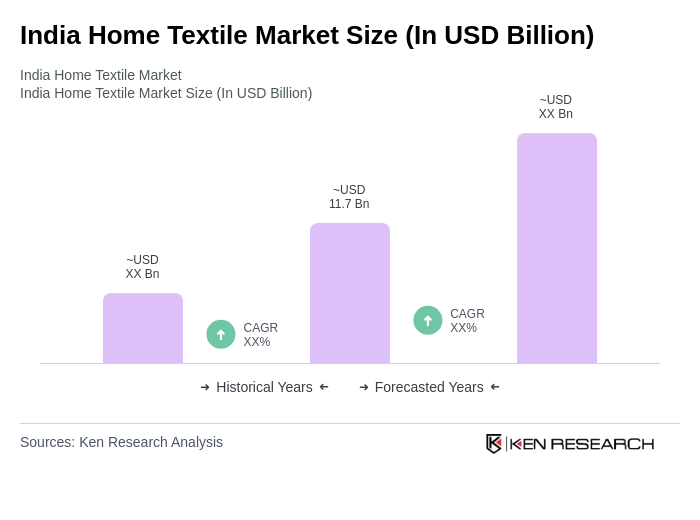

The India Home Textile Market is valued at approximately USD 11.7 billion, driven by increasing consumer demand for home furnishings, rising disposable incomes, and a growing trend towards home decor and aesthetics.