Region:Middle East

Author(s):Rebecca

Product Code:KRAC0224

Pages:92

Published On:August 2025

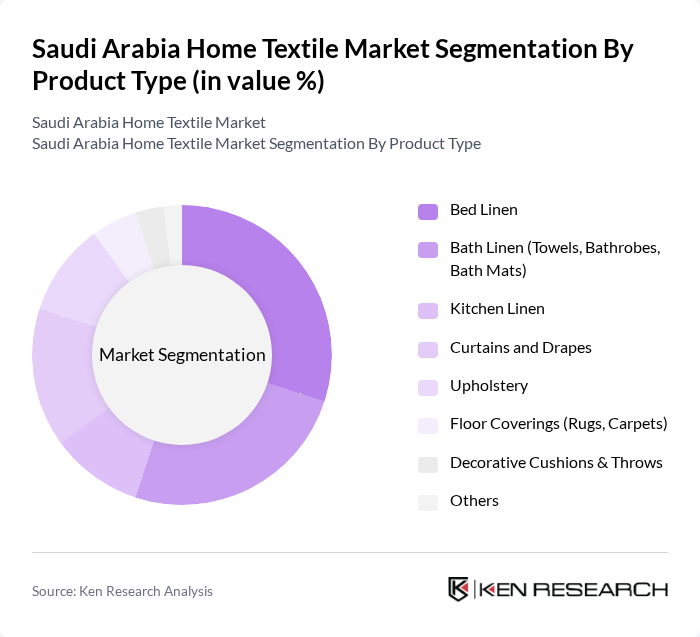

By Product Type:The product type segmentation includes various categories such as bed linen, bath linen, kitchen linen, curtains and drapes, upholstery, floor coverings, decorative cushions and throws, and others. Among these, bed linen and bath linen are the most prominent segments, driven by consumer preferences for comfort and aesthetics in home settings.

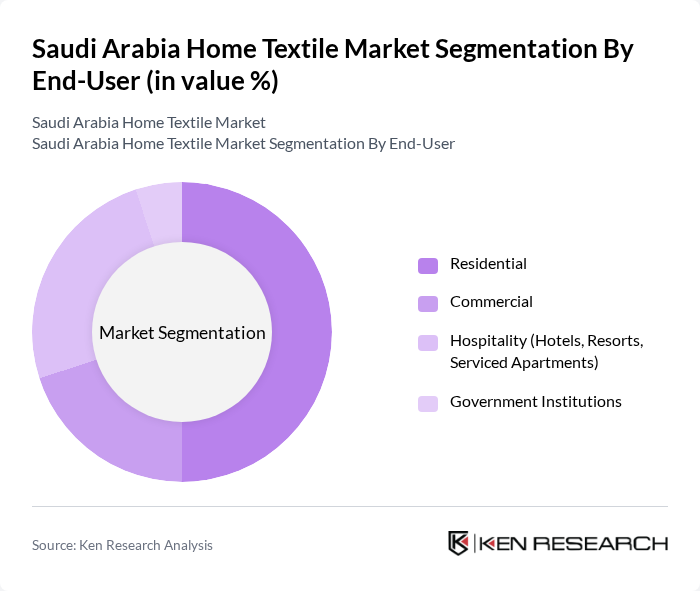

By End-User:The end-user segmentation encompasses residential, commercial, hospitality, and government institutions. The residential segment leads the market, driven by increasing home ownership, rising disposable income, and heightened consumer interest in home improvement and luxury living. The hospitality sector also shows significant demand due to the growing tourism industry and expansion of hotels and serviced apartments in Saudi Arabia.

The Saudi Arabia Home Textile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Abdullatif Industrial Investment Company, Al Sorayai Group, Almutlaq Furniture (Home Centre Saudi Arabia), IKEA Saudi Arabia (Ghassan Ahmed Al Sulaiman Furniture Trading Co. Ltd.), Bed Quarter, Al Rugaib Furniture, Al Jedaie Fabrics, Danube Home, Home Box Saudi Arabia, Al Amer Stores, Al Ajlan & Bros. Co., Al Hokair Group (Home Furnishing Division), Al Othaim Markets (Home Textiles Section), Carrefour Saudi Arabia (Home Textile Section), Redtag contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia home textile market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly materials and production processes. Additionally, the integration of smart home technology will influence product development, leading to innovative textile solutions. The hospitality sector's growth will further create demand for high-quality textiles, while the expansion of e-commerce will continue to reshape retail dynamics, enhancing accessibility for consumers across the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bed Linen Bath Linen (Towels, Bathrobes, Bath Mats) Kitchen Linen Curtains and Drapes Upholstery Floor Coverings (Rugs, Carpets) Decorative Cushions & Throws Others |

| By End-User | Residential Commercial Hospitality (Hotels, Resorts, Serviced Apartments) Government Institutions |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Stores Online Stores Other Distribution Channels |

| By Price Range | Economy Mid-range Premium |

| By Material | Cotton Polyester Linen Silk Blends & Others |

| By Design | Traditional Modern Customized |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Home Textile Sales | 100 | Store Managers, Sales Executives |

| Consumer Preferences in Home Textiles | 150 | Homeowners, Renters |

| Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Interior Design Trends | 60 | Interior Designers, Home Decorators |

| Online Shopping Behavior | 90 | E-commerce Managers, Digital Marketing Specialists |

The Saudi Arabia Home Textile Market is valued at approximately USD 1.2 billion, driven by increasing consumer spending on home decor, urbanization, and a preference for premium quality textiles.