Japan Home Textile Market Overview

- The Japan Home Textile Market is valued at USD 5.7 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for high-quality textiles, a rise in home renovation activities, and a growing trend towards sustainable and eco-friendly products. The market has seen a shift towards premium and luxury segments, reflecting changing consumer preferences and lifestyle choices. Recent trends also highlight the adoption of smart textiles and energy-efficient materials, as well as a growing emphasis on technologically advanced and functional home textile products .

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Home Textile Market. Tokyo, as the capital, leads in innovation and design trends, while Osaka and Yokohama benefit from their strong retail infrastructure and consumer base. These cities are also home to numerous textile manufacturers and retailers, contributing to their market dominance. Other major cities such as Sapporo, Hiroshima, and Kyoto also play significant roles in driving home textile sales due to increasing urbanization and residential development .

- In 2023, the Japanese government implemented regulations aimed at promoting sustainable practices in the textile industry. This includes guidelines for reducing waste and encouraging the use of recycled materials in home textiles. The initiative is part of a broader strategy to enhance environmental sustainability and reduce the carbon footprint of the textile sector. These efforts align with Japan's national sustainability goals and the global movement towards eco-friendly manufacturing .

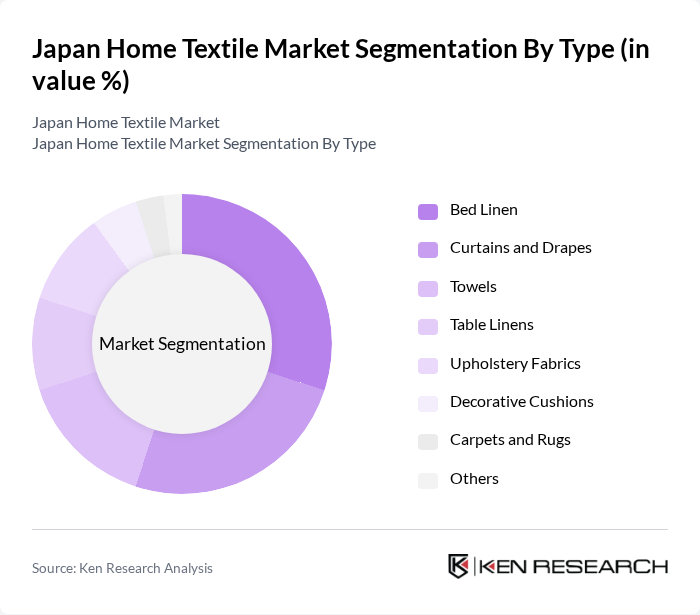

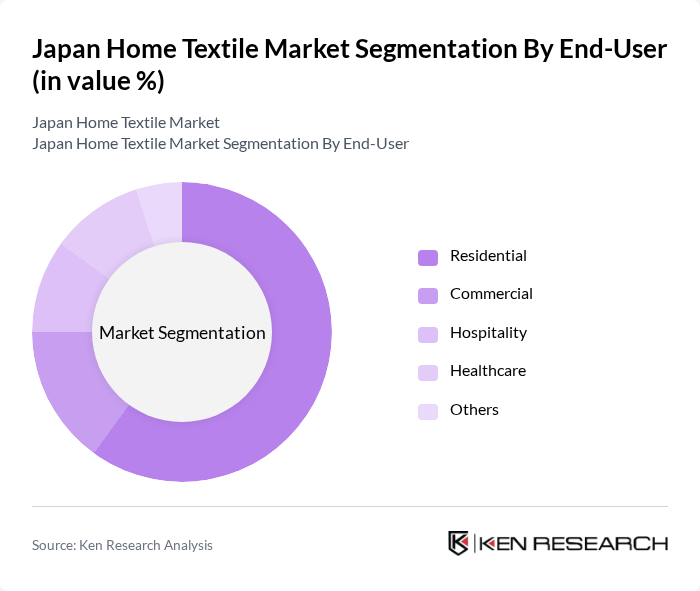

Japan Home Textile Market Segmentation

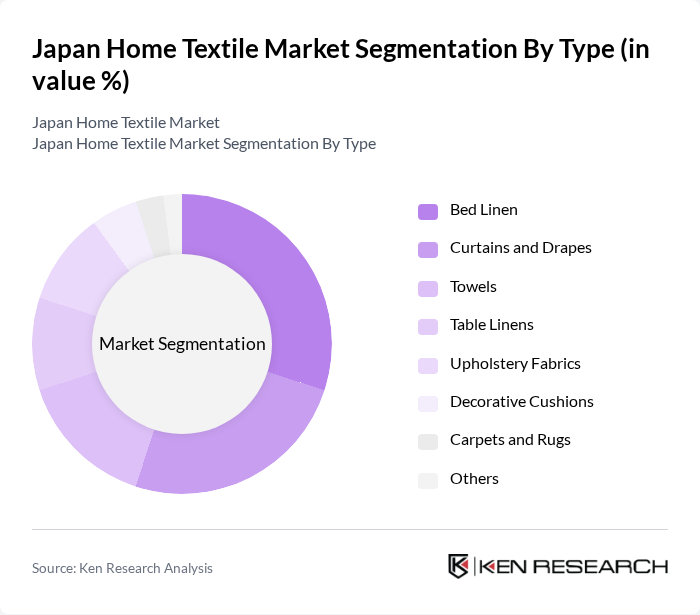

By Type:The home textile market is segmented into various types, including bed linen, curtains and drapes, towels, table linens, upholstery fabrics, decorative cushions, carpets and rugs, and others. Among these, bed linen and curtains and drapes are the most significant segments, driven by consumer preferences for aesthetics and comfort in home decor. The demand for high-quality, stylish bed linen has surged, reflecting a trend towards personalized home environments. Home textiles such as bedding, towels, and curtains are essential for both functional and decorative purposes, with a growing focus on innovative materials and designs .

By End-User:The end-user segmentation includes residential, commercial, hospitality, healthcare, and others. The residential segment dominates the market, driven by increasing home ownership and renovation activities. Consumers are increasingly investing in home textiles to enhance their living spaces, leading to a surge in demand for various textile products tailored for home use. The commercial and hospitality segments are also growing, supported by rising demand for premium and functional textiles in hotels, offices, and healthcare facilities .

Japan Home Textile Market Competitive Landscape

The Japan Home Textile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nishikawa Co., Ltd., Toyoshima & Co., Ltd., Maruhachi Holdings Co., Ltd., Nitori Holdings Co., Ltd., Francfranc Corporation, Uchino Co., Ltd., Muji (Ryohin Keikaku Co., Ltd.), Sangetsu Corporation, Kawashima Selkon Textiles Co., Ltd., Ralph Lauren Corporation, Veken Holding Group Co., Ltd., Evezary Co., Ltd., KB Textile Co., Ltd., Suminoe Textile Co., Ltd., Teijin Limited contribute to innovation, geographic expansion, and service delivery in this space .

Japan Home Textile Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Sustainable Products:The Japanese home textile market is witnessing a significant shift towards sustainability, with 70% of consumers prioritizing eco-friendly materials in their purchases. This trend is supported by the government's commitment to reducing carbon emissions by 46% in future, encouraging manufacturers to adopt sustainable practices. Additionally, the global market for sustainable textiles is projected to reach $10.5 billion in future, indicating a robust demand that Japanese companies can capitalize on.

- Rising Disposable Income:Japan's disposable income is projected to reach ¥3.5 million per household in future, up from ¥3.1 million. This increase allows consumers to spend more on home textiles, particularly premium products. The growth in disposable income is driven by a stable employment rate of 2.5% and a low inflation rate of 1.5%, which together enhance consumer purchasing power and willingness to invest in quality home textiles.

- Growth in E-commerce Platforms:The e-commerce sector in Japan is expected to grow to ¥25 trillion in future, up from ¥18 trillion. This growth is fueled by increased internet penetration, which reached 95% in future, and a shift in consumer behavior towards online shopping. As more consumers prefer the convenience of online purchases, home textile brands are expanding their digital presence, leading to increased sales and market reach.

Market Challenges

- Intense Competition:The Japanese home textile market is characterized by intense competition, with over 1,800 companies vying for market share. Major players like Nishikawa and Takashimaya dominate, making it challenging for new entrants to establish themselves. This competitive landscape pressures companies to innovate continuously and invest in marketing strategies, which can strain financial resources and impact profitability.

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a significant challenge for the home textile industry. For instance, cotton prices surged by 25% in future due to supply chain disruptions and climate change impacts. Such fluctuations can lead to increased production costs, forcing manufacturers to either absorb the costs or pass them onto consumers, potentially affecting sales and market stability.

Japan Home Textile Market Future Outlook

The future of the Japan home textile market appears promising, driven by a growing emphasis on sustainability and technological integration. As consumers increasingly seek eco-friendly products, manufacturers are likely to innovate in sustainable materials and smart textiles. Additionally, the rise of e-commerce will continue to reshape retail strategies, enabling brands to reach a broader audience. These trends suggest a dynamic market landscape that will adapt to evolving consumer preferences and technological advancements.

Market Opportunities

- Growth in Smart Home Textiles:The integration of technology into home textiles presents a lucrative opportunity, with the smart textiles market projected to reach ¥2 billion in future. Innovations such as temperature-regulating fabrics and smart bedding can attract tech-savvy consumers, enhancing comfort and convenience in home environments.

- Customization and Personalization Trends:The demand for personalized home textiles is on the rise, with 50% of consumers expressing interest in customized products. This trend allows companies to differentiate themselves in a crowded market, offering tailored solutions that meet individual consumer preferences, thereby enhancing customer loyalty and satisfaction.