Region:Asia

Author(s):Geetanshi

Product Code:KRAA1195

Pages:80

Published On:August 2025

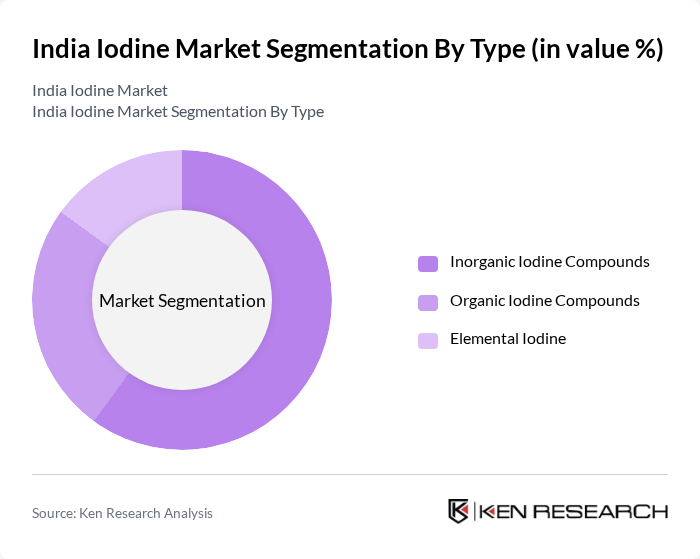

By Type:The iodine market can be segmented into three main types: Inorganic Iodine Compounds, Organic Iodine Compounds, and Elemental Iodine. Inorganic iodine compounds are widely used in pharmaceuticals and chemical applications, including antiseptics, contrast agents, and animal feed additives. Organic iodine compounds find their use in industrial applications such as specialty chemicals and dyes. Elemental iodine is primarily utilized in medical applications and as a disinfectant. The inorganic iodine compounds segment is currently leading the market due to their extensive use in the pharmaceutical and healthcare industries.

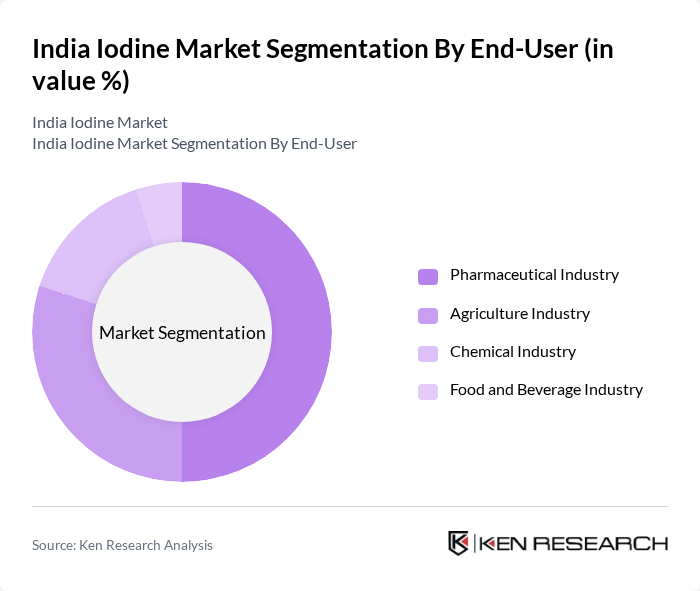

By End-User:The iodine market is segmented based on end-users, including the Pharmaceutical Industry, Agriculture Industry, Chemical Industry, and Food and Beverage Industry. The pharmaceutical industry is the largest consumer of iodine, utilizing it in medications, diagnostic imaging, and nutritional supplements. The agriculture industry uses iodine in animal feed supplements and crop protection. The chemical industry applies iodine in specialty chemicals and industrial reagents, while the food and beverage industry uses it for fortification and preservation. The pharmaceutical industry dominates the market due to the increasing prevalence of iodine deficiency disorders and the growing demand for iodine-based medications and diagnostic agents.

The India Iodine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iofina PLC, SQM S.A., Alkali Metals Limited, GODO SHIGEN CO., LTD., Tata Chemicals Limited, Merck KGaA, American Elements, Hikal Limited, Nippoh Chemicals Co., Ltd., Deepak Fertilisers and Petrochemicals Corporation Limited, Jubilant Ingrevia Limited, Nanjing Chemical Industry Group, Jiangsu Huachang Chemical Co., Ltd., Kanto Chemical Co., Inc., Hubei Xingfa Chemicals Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodine market in India appears promising, driven by increasing healthcare demands and a growing focus on nutritional health. As the government intensifies its efforts to combat iodine deficiency, the market is likely to see enhanced product innovation and regulatory support. Additionally, the rise of e-commerce platforms is expected to facilitate wider distribution of iodine-based products, making them more accessible to consumers. Overall, the market is poised for significant growth, reflecting broader health trends and consumer awareness.

| Segment | Sub-Segments |

|---|---|

| By Type | Inorganic Iodine Compounds Organic Iodine Compounds Elemental Iodine |

| By End-User | Pharmaceutical Industry Agriculture Industry Chemical Industry Food and Beverage Industry |

| By Source | Underground Brine Caliche Ore Recycling Seaweeds |

| By Application | Pharmaceuticals X-ray Contrast Media Animal Feed Supplements Iodophors and Disinfectants Catalysts Biocides Optical Polarizing Films Fluorochemicals Nylon Other Applications |

| By Region | North India South India East India West India |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Industry Usage | 100 | Product Managers, Quality Assurance Officers |

| Food Fortification Sector | 80 | Nutritionists, Food Safety Inspectors |

| Industrial Applications | 70 | Procurement Managers, Production Supervisors |

| Research and Development | 50 | R&D Scientists, Laboratory Managers |

| Retail Distribution Channels | 90 | Sales Managers, Supply Chain Coordinators |

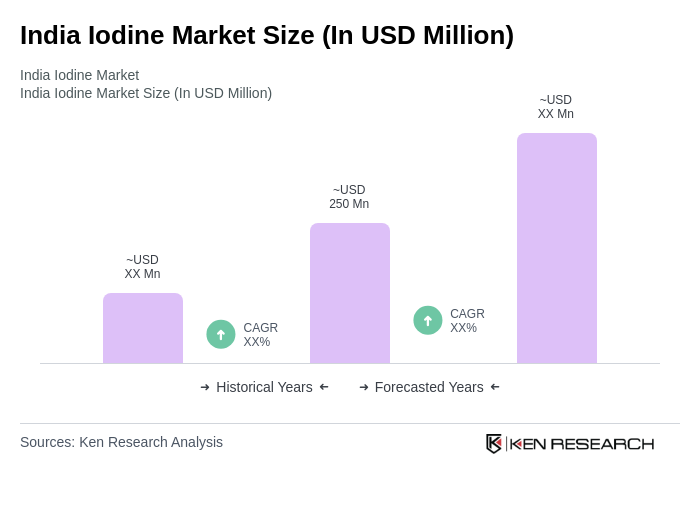

The India Iodine Market is valued at approximately USD 250 million, driven by increasing demand across pharmaceutical, chemical, and agricultural sectors, as well as rising awareness of iodine deficiency disorders.