Region:Middle East

Author(s):Shubham

Product Code:KRAD3605

Pages:96

Published On:November 2025

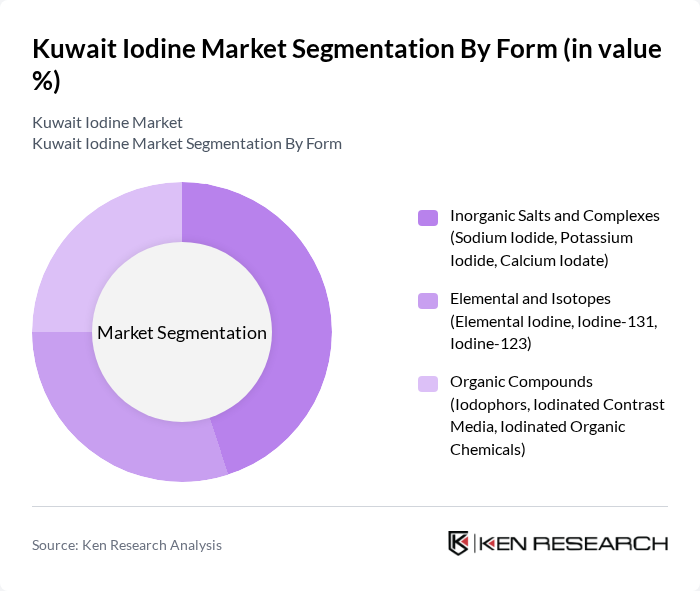

By Form:The iodine market is segmented into three primary forms: Inorganic Salts and Complexes, Elemental and Isotopes, and Organic Compounds. Inorganic salts, such as sodium iodide and potassium iodide, are widely used in pharmaceuticals, nutrition, and as feed additives. Elemental iodine and its isotopes, including iodine-131 and iodine-123, are crucial in medical imaging, diagnostics, and cancer therapy. Organic compounds, such as iodophors and iodinated contrast media, are essential in disinfection, diagnostics, and radiology applications .

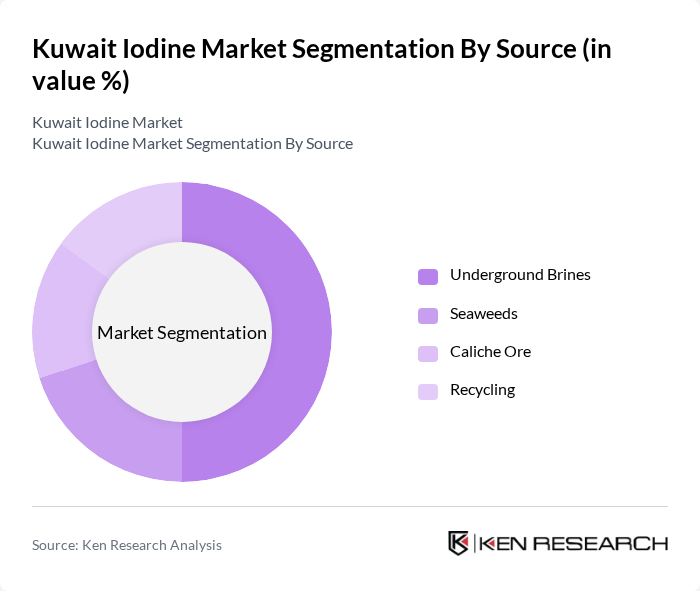

By Source:The iodine market is also segmented by source, including Underground Brines, Seaweeds, Caliche Ore, and Recycling. Underground brines are a significant source due to their high iodine concentration and cost-effective extraction. Seaweeds are a natural and renewable source, increasingly utilized for organic iodine production, especially in the nutraceutical sector. Caliche ore, primarily mined in Chile, is a major global source for industrial iodine. Recycling processes are gaining traction as sustainability and circular economy practices become a priority in the chemical industry .

The Kuwait Iodine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iofina PLC, SQM (Sociedad Química y Minera de Chile), GODO SHIGEN Co., Ltd., Albemarle Corporation, Merck KGaA, Tetra Technologies, Inc., Deepwater Chemicals, Inc., KMG Chemicals, Astaris LLC, Jiangsu Huachang Chemical Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Jiangxi Deyu Iodine Industry Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the iodine market in Kuwait appears promising, driven by increasing health awareness and the expansion of the pharmaceutical and chemical industries. As the government continues to promote iodine supplementation and public health initiatives, demand is expected to rise. Furthermore, technological advancements in extraction methods and sustainable sourcing practices will likely enhance production efficiency, making iodine more accessible. This evolving landscape presents opportunities for growth and innovation in the market, positioning Kuwait as a key player in the regional iodine supply chain.

| Segment | Sub-Segments |

|---|---|

| By Form | Inorganic Salts and Complexes (Sodium Iodide, Potassium Iodide, Calcium Iodate) Elemental and Isotopes (Elemental Iodine, Iodine-131, Iodine-123) Organic Compounds (Iodophors, Iodinated Contrast Media, Iodinated Organic Chemicals) |

| By Source | Underground Brines Seaweeds Caliche Ore Recycling |

| By Application | Pharmaceuticals X-Ray Contrast Media Biocides and Disinfectants Catalyst in Polymer Processing Human Nutrition and Animal Feed Optical Polarizing Films Fluorochemicals Other Applications |

| By End-User | Healthcare and Pharmaceuticals Chemical Manufacturing Food and Beverage Industry Agriculture and Veterinary Water Treatment Others |

| By Distribution Channel | Direct Sales to Industrial Users Pharmaceutical Distributors Chemical Wholesalers Online Retail Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Industry Insights | 60 | Pharmaceutical Managers, Product Development Leads |

| Food Fortification Practices | 50 | Food Scientists, Quality Assurance Managers |

| Health and Nutrition Awareness | 70 | Nutritionists, Health Educators |

| Retail Market Dynamics | 40 | Retail Managers, Supply Chain Coordinators |

| Animal Feed Sector Analysis | 40 | Veterinarians, Animal Nutritionists |

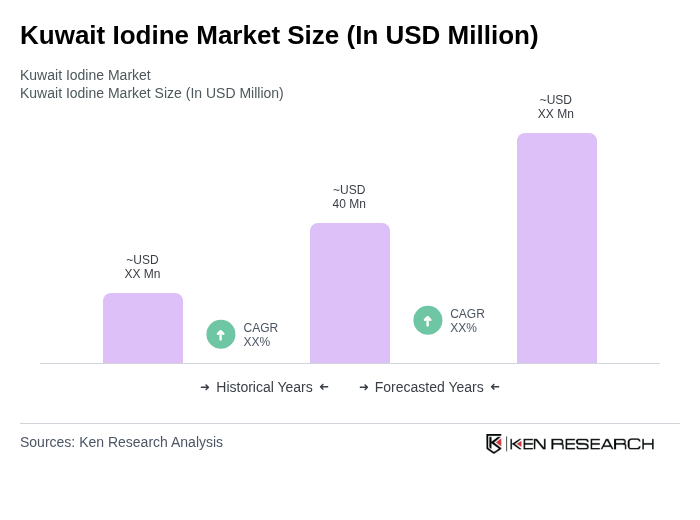

The Kuwait Iodine Market is valued at approximately USD 40 million, driven by increasing demand in pharmaceuticals, nutrition, and industrial applications, particularly in medical imaging and nutritional supplements.