Region:North America

Author(s):Shubham

Product Code:KRAC0751

Pages:98

Published On:August 2025

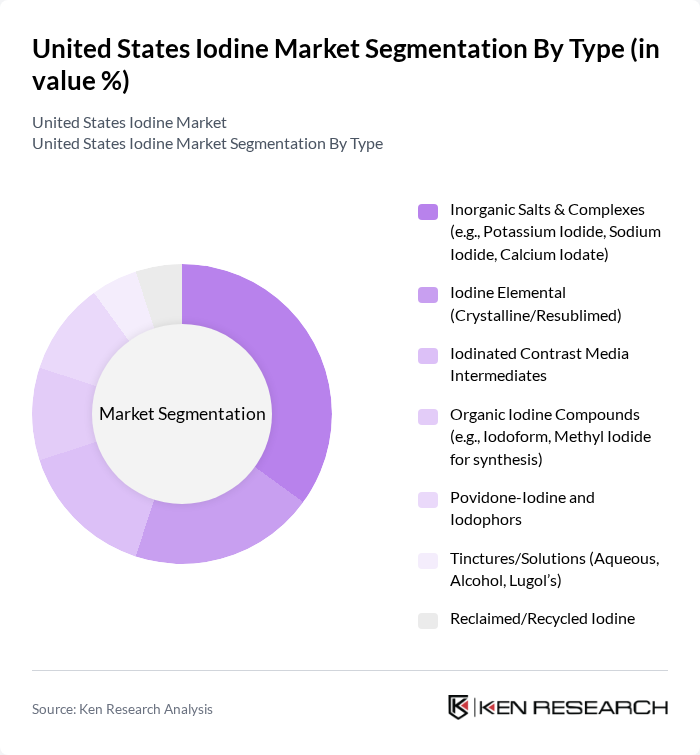

By Type:The iodine market can be segmented into various types, including inorganic salts and complexes, iodine elemental, iodinated contrast media intermediates, organic iodine compounds, povidone-iodine and iodophors, tinctures/solutions, and reclaimed/recycled iodine. Among these, inorganic salts and complexes are leading due to their extensive use in pharmaceuticals and animal feed, driven by their effectiveness and cost-efficiency; industry sources consistently highlight the prominence of iodide/iodate salts in pharma, disinfectants, and feed applications.

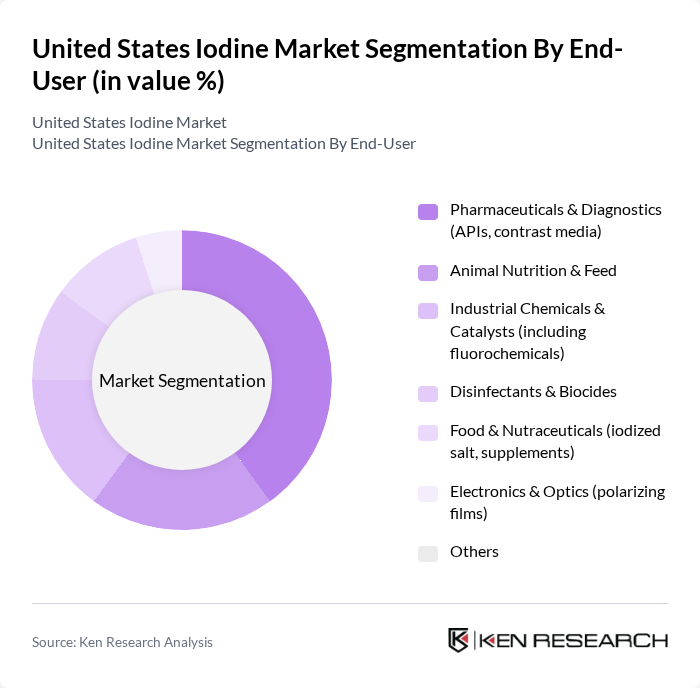

By End-User:The iodine market is segmented by end-user into pharmaceuticals and diagnostics, animal nutrition and feed, industrial chemicals and catalysts, disinfectants and biocides, food and nutraceuticals, electronics and optics, and others. The pharmaceuticals and diagnostics segment is the most significant, driven by the increasing use of iodine in medical imaging and as an antiseptic, reflecting growing healthcare utilization; analysts identify contrast media and healthcare-related iodides as key value drivers, alongside stable demand from animal feed and biocides.

The United States Iodine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iofina plc, IOCHEM Corporation, Woodward Iodine Corporation, KIVA Holding, Inc. (KIVA Iodine), SQM S.A. (Sociedad Química y Minera de Chile S.A.), ISE Chemicals Corporation, Deepwater Chemicals, Inc., American Elements, Merck KGaA (MilliporeSigma in the U.S.), Thermo Fisher Scientific Inc., TETRA Technologies, Inc., Honeywell International Inc. (Fluorine/Process Chemicals), Spectrum Chemical Mfg. Corp., GODO SHIGEN Co., Ltd., Aarti Industries Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. iodine market appears promising, driven by increasing health awareness and technological advancements. As consumers become more health-conscious, the demand for iodine in supplements and pharmaceuticals is expected to rise. Additionally, innovations in extraction technologies may enhance production efficiency, reducing costs. The market is likely to see a shift towards sustainable practices, aligning with broader environmental goals, which could further stimulate growth and attract investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Inorganic Salts & Complexes (e.g., Potassium Iodide, Sodium Iodide, Calcium Iodate) Iodine Elemental (Crystalline/Resublimed) Iodinated Contrast Media Intermediates Organic Iodine Compounds (e.g., Iodoform, Methyl Iodide for synthesis) Povidone-Iodine and Iodophors Tinctures/Solutions (Aqueous, Alcohol, Lugol’s) Reclaimed/Recycled Iodine |

| By End-User | Pharmaceuticals & Diagnostics (APIs, contrast media) Animal Nutrition & Feed Industrial Chemicals & Catalysts (including fluorochemicals) Disinfectants & Biocides Food & Nutraceuticals (iodized salt, supplements) Electronics & Optics (polarizing films) Others |

| By Application | X?ray/CT Contrast Media Antiseptics & Wound Care Animal Feed Additives (iodates/iodides) Water Treatment & Sanitation Chemical Synthesis & Catalysis Fluorochemicals and Polymers Others |

| By Distribution Channel | Direct (Producer-to-Industrial/Healthcare) Authorized Distributors Chemical Merchants/Wholesalers E-commerce/Online B2B Retail Pharmacy & OTC (limited consumer formats) |

| By Pricing Strategy | Long-term Contracts (Index-linked) Spot Pricing Value-added Premiums (GMP/USP grades) Volume/Tiered Discounts Others |

| By Packaging Type | Bulk Drums/IBCs Intermediate Containers (carboys, cans) Small Packs (lab/reagent, clinical) Custom/Returnable Packaging |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dietary Supplement Manufacturers | 120 | Product Development Managers, Quality Assurance Officers |

| Pharmaceutical Companies | 90 | Regulatory Affairs Specialists, R&D Directors |

| Food Industry Stakeholders | 100 | Food Safety Managers, Nutritionists |

| Health and Wellness Experts | 80 | Dietitians, Public Health Officials |

| Industrial Users of Iodine | 70 | Procurement Managers, Operations Directors |

The United States iodine market is valued at approximately USD 220 million, reflecting steady demand across various sectors, including pharmaceuticals, diagnostics, and animal nutrition, driven by the essential role of iodine in health and nutrition.