India Mattress & Sleep Wellness Market Overview

- The India Mattress & Sleep Wellness Market is valued at USD 2.7 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness regarding sleep health, rising disposable incomes—especially among urban millennials—and the expansion of e-commerce platforms that facilitate mattress purchases. The market has seen a surge in demand for innovative sleep solutions, including memory foam and hybrid mattresses, as well as a growing preference for orthopedic and ergonomic formats, catering to diverse consumer preferences and health-conscious buyers .

- Key cities dominating the market include metropolitan areas such as Mumbai, Delhi, and Bengaluru. These cities are characterized by high population density, rapid urbanization, and a growing middle class with increased spending power. The presence of numerous retail outlets and online platforms in these regions further enhances accessibility to a wide range of mattress products, contributing to their market dominance. E-commerce penetration is also expanding into Tier-II and Tier-III cities, broadening the consumer base .

- In 2023, the Indian government implemented the “Bureau of Indian Standards (BIS) Quality Control Order for Mattresses, 2023” issued by the Ministry of Consumer Affairs, Food & Public Distribution. This regulation mandates that all mattresses manufactured or imported for sale in India must conform to BIS standards for durability, safety, and performance, and requires manufacturers to obtain BIS certification, thereby enhancing consumer trust and promoting healthier sleep environments .

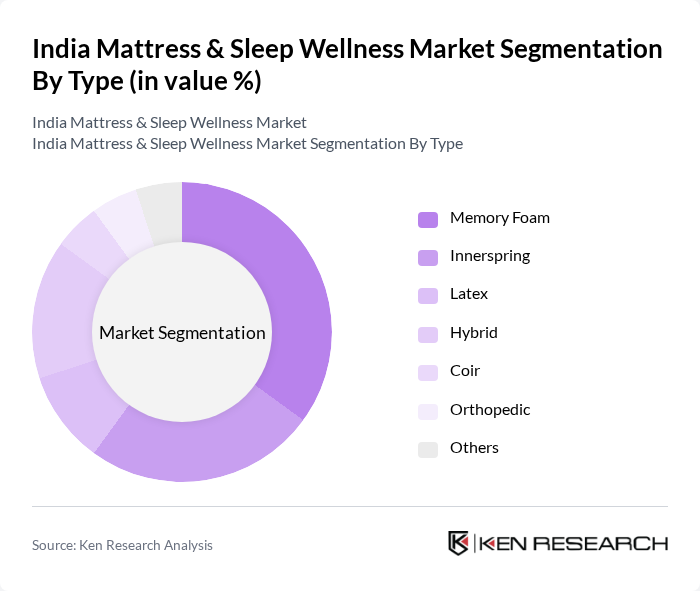

India Mattress & Sleep Wellness Market Segmentation

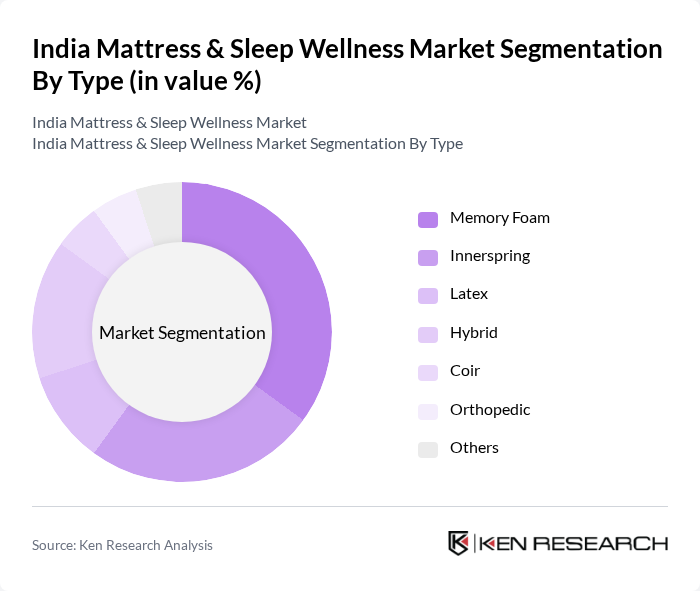

By Type:The mattress market is segmented into various types, including Memory Foam, Innerspring, Latex, Hybrid, Coir, Orthopedic, and Others. Among these, Memory Foam mattresses are gaining significant traction due to their comfort, pressure relief, and support features, appealing to consumers seeking better sleep quality and spinal alignment. Innerspring mattresses remain popular for their traditional feel and affordability, while Hybrid mattresses combine the benefits of both foam and spring technologies, catering to consumers who desire a balance of support and comfort. Orthopedic mattresses are increasingly in demand due to rising health awareness and the aging population .

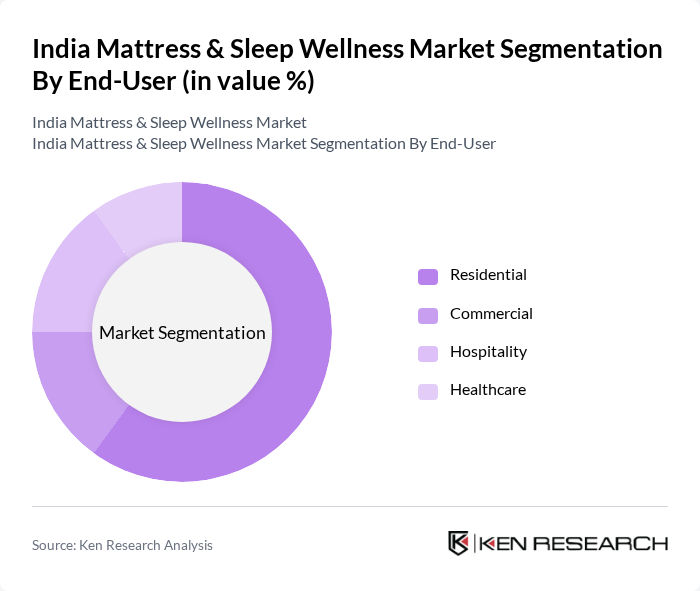

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, and Healthcare sectors. The Residential segment dominates the market, accounting for the majority of revenue, driven by increasing consumer spending on home furnishings, heightened focus on sleep wellness, and the influence of online mattress brands. The Hospitality sector is also significant, as hotels and resorts invest in high-quality mattresses to enhance guest experiences amid a growing tourism pipeline. The Healthcare segment is emerging, with rising demand for specialized orthopedic and pressure-relief mattresses for hospitals and clinics .

India Mattress & Sleep Wellness Market Competitive Landscape

The India Mattress & Sleep Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sleepwell (Sheela Foam Ltd.), Kurlon Enterprises Ltd., Duroflex, Wakefit, Sunday Mattress, Urban Ladder, Sleepyhead, Peps Industries Pvt. Ltd., Tempur Sealy International, Inc., Nilkamal Ltd., Springfit Mattress, Comforto, Coirfit Mattress, Springwel, Wink & Nod contribute to innovation, geographic expansion, and service delivery in this space.

India Mattress & Sleep Wellness Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness about Sleep Wellness:The growing recognition of sleep's impact on health has led to increased consumer interest in sleep wellness products. In future, the Indian sleep wellness market is projected to reach ?15,000 crores, driven by educational campaigns and health initiatives. Reports indicate that 70% of urban consumers are now prioritizing sleep quality, leading to a surge in demand for high-quality mattresses and sleep accessories, reflecting a significant shift in consumer behavior.

- Rising Disposable Incomes:With India's GDP expected to grow by 6.5% in future, disposable incomes are on the rise, particularly in urban areas. The average household income in metropolitan cities has increased by approximately ?1.2 lakhs over the past year. This economic growth enables consumers to invest more in premium sleep products, contributing to a robust demand for high-end mattresses, which are often perceived as essential for improved health and well-being.

- Growth in the Real Estate Sector:The real estate sector in India is projected to grow at a rate of 8% in future, with an estimated 1.2 million new housing units expected to be completed. This expansion is directly influencing the mattress market, as new homeowners are increasingly seeking quality sleep solutions. The demand for mattresses is expected to rise significantly, with an estimated increase of 20% in sales attributed to new residential developments and urban housing projects.

Market Challenges

- Intense Competition among Local and International Brands:The Indian mattress market is characterized by fierce competition, with over 200 brands vying for market share. This saturation leads to price wars, which can erode profit margins. In future, the top five brands hold only 30% of the market share, indicating a fragmented landscape where smaller players can disrupt established brands, making it challenging for companies to maintain pricing power and brand loyalty.

- Fluctuating Raw Material Prices:The mattress industry heavily relies on raw materials such as foam and fabric, which have seen price volatility due to global supply chain disruptions. In future, the cost of polyurethane foam is expected to rise by 15%, impacting production costs. This fluctuation can lead to increased retail prices, potentially deterring price-sensitive consumers and affecting overall sales in a competitive market environment.

India Mattress & Sleep Wellness Market Future Outlook

The India mattress and sleep wellness market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization accelerates, more consumers are expected to prioritize sleep quality, leading to increased demand for innovative sleep solutions. Additionally, the integration of smart technology in mattresses is anticipated to enhance user experience, while eco-friendly products will cater to the growing environmental consciousness among consumers, shaping the future landscape of the industry.

Market Opportunities

- Growing Demand for Eco-Friendly Products:With a rising awareness of environmental issues, the demand for eco-friendly mattresses is increasing. In future, the market for sustainable sleep products is expected to grow by 25%, as consumers seek alternatives made from organic materials. This trend presents a lucrative opportunity for manufacturers to innovate and capture a segment of environmentally conscious buyers.

- Expansion into Tier 2 and Tier 3 Cities:The urbanization trend is extending into tier 2 and tier 3 cities, where disposable incomes are rising. In future, these cities are projected to account for 30% of mattress sales growth. Companies that strategically target these emerging markets can tap into a new customer base, driving sales and brand loyalty in previously underserved regions.