Region:Middle East

Author(s):Rebecca

Product Code:KRAB0837

Pages:94

Published On:December 2025

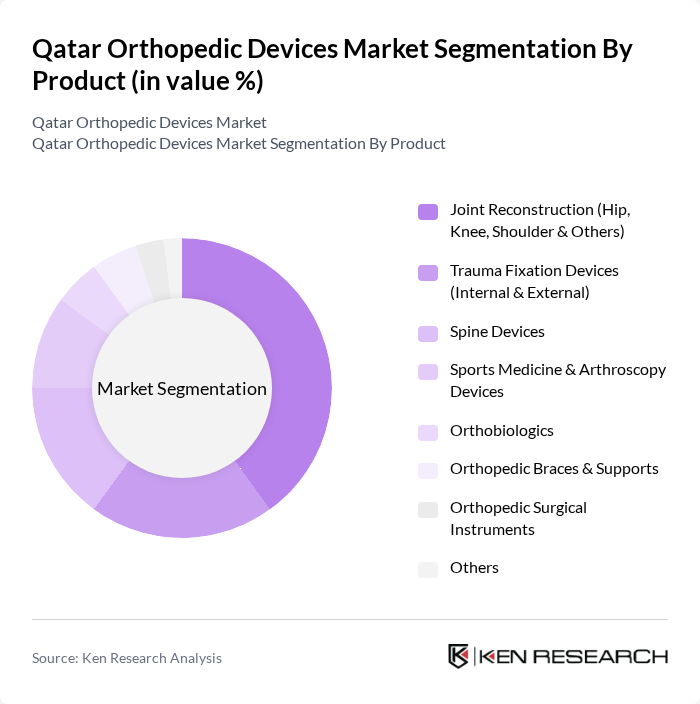

By Product:The orthopedic devices market in Qatar is segmented into various product categories, including joint reconstruction, trauma fixation devices, spine devices, sports medicine and arthroscopy devices, orthobiologics, orthopedic braces and supports, orthopedic surgical instruments, and others. Among these, joint reconstruction devices, particularly hip and knee implants, dominate the market due to the high incidence of joint-related disorders and the aging population. The increasing adoption of minimally invasive surgical techniques also contributes to the growth of this segment.

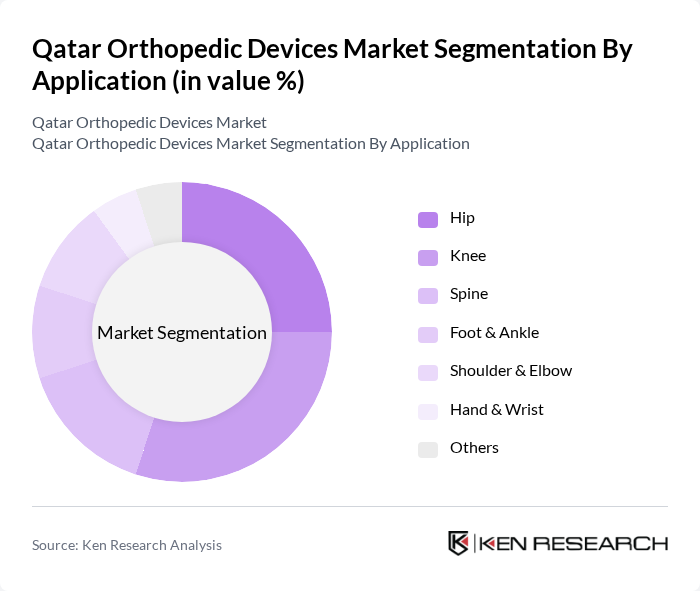

By Application:The applications of orthopedic devices in Qatar include hip, knee, spine, foot and ankle, shoulder and elbow, hand and wrist, and others. The knee application segment is particularly significant due to the high prevalence of knee osteoarthritis and sports injuries, leading to increased demand for knee implants and related surgical procedures. The growing awareness of sports medicine and rehabilitation also drives the demand for devices in the foot and ankle segment.

The Qatar Orthopedic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson MedTech), Smith & Nephew plc, Arthrex, Inc., NuVasive, Inc., Aesculap Implant Systems, LLC (B. Braun Group), Orthofix Medical Inc., B. Braun Melsungen AG, Enovis (DJO Global), CONMED Corporation, Wright Medical Group N.V. (part of Stryker), Exactech, Inc., Medacta International SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar orthopedic devices market appears promising, driven by advancements in technology and increasing healthcare investments. Emerging trends such as minimally invasive surgical techniques, robotic-assisted surgeries, and the integration of smart technologies in orthopedic devices are expected to reshape the landscape. Additionally, the government's commitment to enhancing healthcare infrastructure and digital health initiatives will further support the growth of this sector, ensuring that patients have access to innovative and effective orthopedic solutions.

| Segment | Sub-Segments |

|---|---|

| By Product | Joint Reconstruction (Hip, Knee, Shoulder & Others) Trauma Fixation Devices (Internal & External) Spine Devices Sports Medicine & Arthroscopy Devices Orthobiologics Orthopedic Braces & Supports Orthopedic Surgical Instruments Others |

| By Application | Hip Knee Spine Foot & Ankle Shoulder & Elbow Hand & Wrist Others |

| By End-User | Public Hospitals Private Hospitals Specialty Orthopedic & Sports Medicine Centers Ambulatory Surgery Centers Rehabilitation Centers Others |

| By Distribution Channel | Direct Tender / Institutional Sales Local Distributors & Importers Group Purchasing Organizations (GPOs) Retail & Hospital Pharmacies Online / E?procurement Platforms Others |

| By Material | Metal Alloys Polymers Ceramics Composites & Bioresorbable Materials Others |

| By Procedure Type | Arthroplasty Arthroscopy Fracture Fixation & Trauma Surgery Spinal Surgery Sports Injury Management Others |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| By Region | Doha Al Rayyan Umm Salal Al Wakrah Al Khor & Al Thakhira Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 60 | Orthopedic Surgeons, Medical Directors |

| Healthcare Procurement Managers | 50 | Procurement Managers, Supply Chain Officers |

| Patients Using Orthopedic Devices | 40 | Patients, Caregivers |

| Medical Device Distributors | 40 | Sales Managers, Distribution Heads |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Policy Makers |

The Qatar Orthopedic Devices Market is valued at approximately USD 80 million, driven by the increasing prevalence of musculoskeletal disorders and the expansion of healthcare infrastructure in the region.