Region:Asia

Author(s):Dev

Product Code:KRAB6130

Pages:88

Published On:October 2025

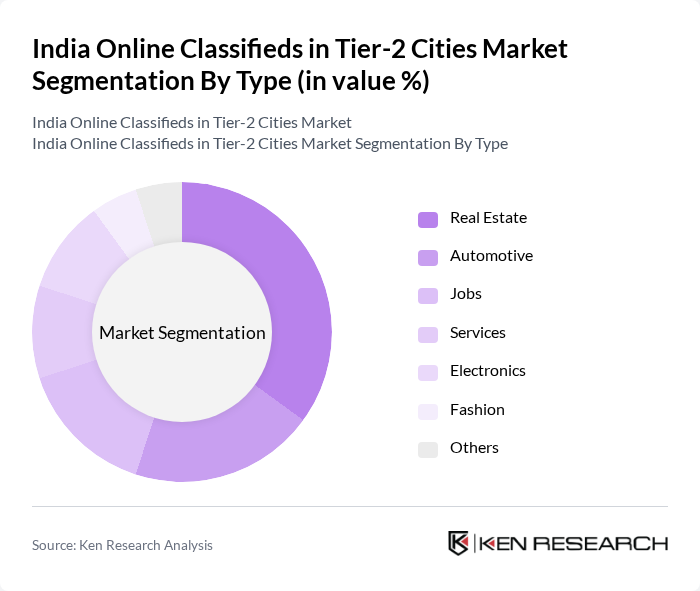

By Type:The market is segmented into various types, including Real Estate, Automotive, Jobs, Services, Electronics, Fashion, and Others. Among these, the Real Estate segment is currently the most dominant, driven by the increasing demand for housing and commercial properties in Tier-2 cities. The growing urbanization and migration to these cities have led to a surge in property listings and transactions, making it a key player in the online classifieds market.

By End-User:The market is segmented by end-users into Individual Sellers, Small Businesses, and Corporates. Individual Sellers dominate the market, as many residents in Tier-2 cities prefer to sell their used goods or services directly to consumers through online platforms. This trend is fueled by the ease of use of these platforms and the growing acceptance of online transactions among the general populace.

The India Online Classifieds in Tier-2 Cities Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX India, Quikr, Sulekha, Facebook Marketplace, MagicBricks, 99acres, CarDekho, Zomato, Justdial, UrbanClap, BookMyShow, Paytm, Snapdeal, Amazon India, Flipkart contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online classifieds market in Tier-2 cities looks promising, driven by technological advancements and changing consumer behaviors. As mobile penetration continues to rise, platforms are likely to enhance their mobile interfaces, making transactions more user-friendly. Additionally, the integration of AI and machine learning will enable personalized user experiences, improving engagement. With the government's Digital India initiative promoting digital literacy, the market is poised for significant growth, attracting more users and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Jobs Services Electronics Fashion Others |

| By End-User | Individual Sellers Small Businesses Corporates |

| By Region | North India South India East India West India |

| By Application | Personal Use Business Use |

| By Sales Channel | Online Platforms Mobile Applications |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Incentives for Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Usage of Online Classifieds | 150 | General Consumers, Online Shoppers |

| Small Business Owners Utilizing Classifieds | 100 | Local Entrepreneurs, Retail Business Owners |

| Real Estate Listings and Transactions | 80 | Real Estate Agents, Property Buyers |

| Automobile Sales and Purchases | 70 | Car Dealers, Individual Sellers |

| Job Listings and Recruitment | 90 | HR Managers, Job Seekers |

The India Online Classifieds market in Tier-2 cities is valued at approximately USD 2.5 billion, driven by increased internet penetration, smartphone adoption, and a growing preference for digital platforms for buying and selling goods and services.