Region:Asia

Author(s):Harsh Saxena

Product Code:KR1544

Pages:90

Published On:July 2025

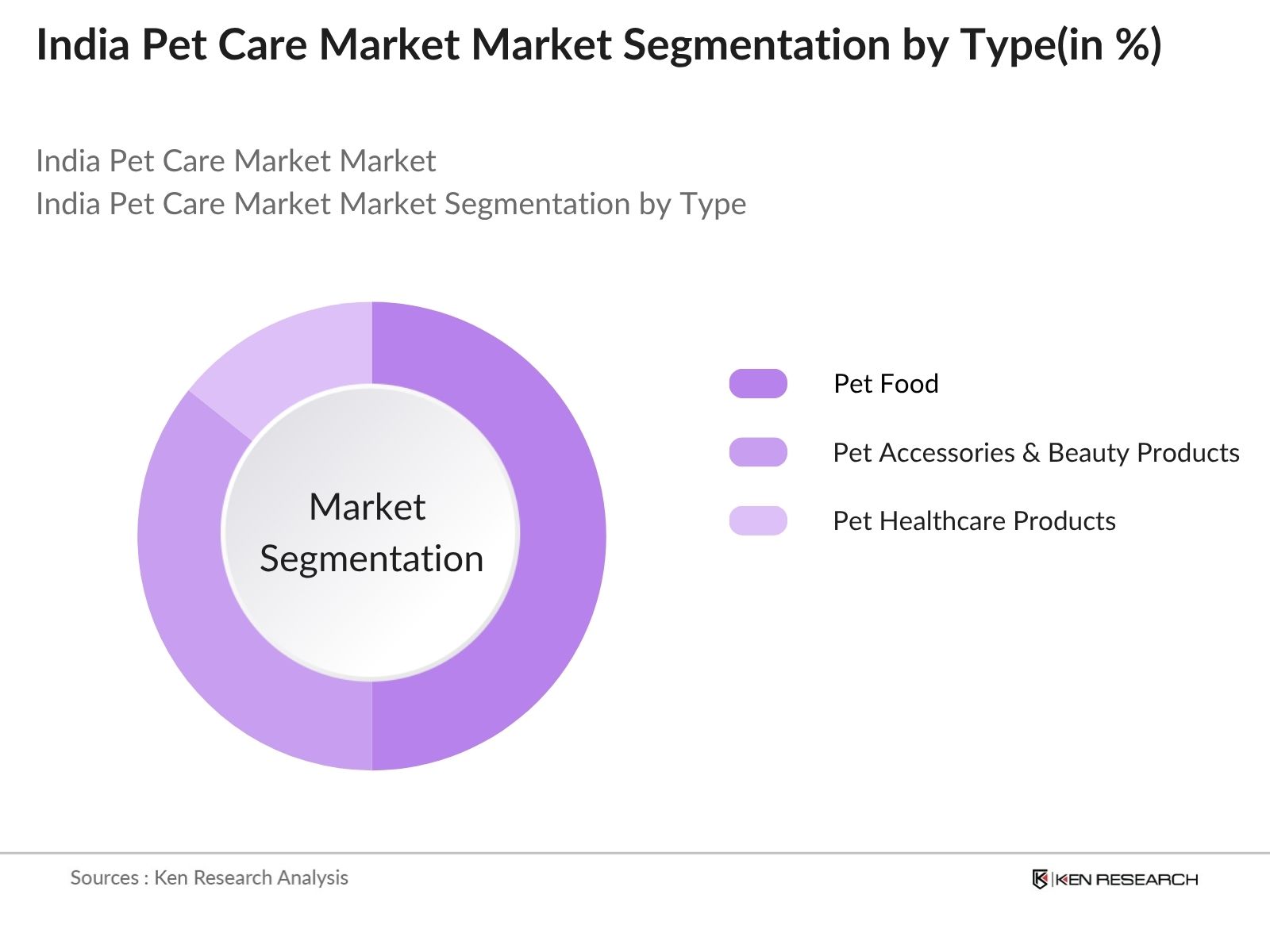

By Type:The pet care market is segmented into Pet Food, Pet Accessories & Beauty Products, and Pet Healthcare Products. Among these, Pet Food holds the largest share, driven by increasing awareness of pet nutrition and rising demand for specialized diets. Pet owners are shifting toward premium, organic, and breed-specific food options to enhance their pets’ health and longevity. Meanwhile, the demand for Accessories & Beauty Products is growing due to rising pet humanization and grooming trends, while Healthcare Products are gaining traction with increased veterinary visits and focus on preventive care.

By Service Type:The market is segmented into Vet Services and Grooming & Boarding Services. Vet Services lead the market owing to the growing emphasis on preventive healthcare, regular vaccinations, and advanced diagnostics for pets. Rising pet insurance penetration and increased veterinary awareness among pet owners further drive this segment. Grooming & Boarding Services are also gaining popularity, fueled by urban lifestyles, increased pet humanization, and demand for premium grooming experiences, especially in metro and tier-1 cities.

The India Pet Care Market is characterized by a competitive landscape with several key players, including Mars International India Pvt Ltd, Indian Broiler Group (Drools Pvt Ltd), Perfect Companion Group, Cuddle Up Diet Products Pvt Ltd, & Farmina Pet Foods Group. These companies are focusing on product innovation, expanding their distribution networks, and enhancing brand recognition to capture a larger market share. The market is also witnessing the entry of new players offering specialized and organic products, further intensifying competition.

The India pet care market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As pet humanization trends continue, companies are likely to innovate with personalized products and services. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of pet care products, enhancing consumer convenience. The focus on sustainability and organic offerings will also shape future market dynamics, catering to the growing demand for health-conscious pet care solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Pet Food Pet Accessories & Beauty Products Pet Healthcare Products |

| By Service Type | Vet Services Grooming & Boarding Services |

| By Price Category of Products | Economy Range Mid Range Premium Range |

| By Pet Type | Dog Cat Others |

| By Distribution Channel | Retail Offline Retail E-Commerce Non-Retail(Vet Clinics) |

| By End Users | Pet Owners Breeders NGO's/Shelters Institutions(Police, Army, Airport Dogs) |

| By State | Karnataka Delhi NCR Maharashta Telangana Tamil Nadu Kerala West Bengal Punjab/Haryana Gujarat Andhra Pradesh Others |

The India Pet Care Market is valued at approximately USD 900 million, reflecting significant growth driven by increased pet adoption, higher disposable incomes, and a cultural shift towards treating pets as family members.