Region:Asia

Author(s):Rebecca

Product Code:KRAC0259

Pages:82

Published On:August 2025

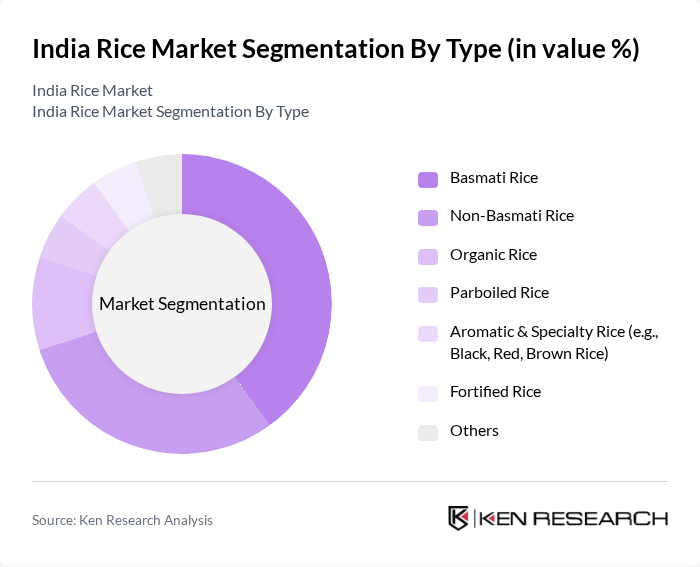

By Type:The rice market can be segmented into various types, including Basmati Rice, Non-Basmati Rice, Organic Rice, Parboiled Rice, Aromatic & Specialty Rice, Fortified Rice, and Others. Among these,Basmati Riceis the most prominent segment due to its unique aroma, long grain, and premium pricing, which appeals to both domestic and international consumers. The demand forOrganic RiceandFortified Riceis also on the rise as health-conscious consumers seek chemical-free and nutritionally enhanced options. Specialty rice varieties such as black, red, and brown rice are gaining traction among urban consumers seeking diverse and healthy alternatives.

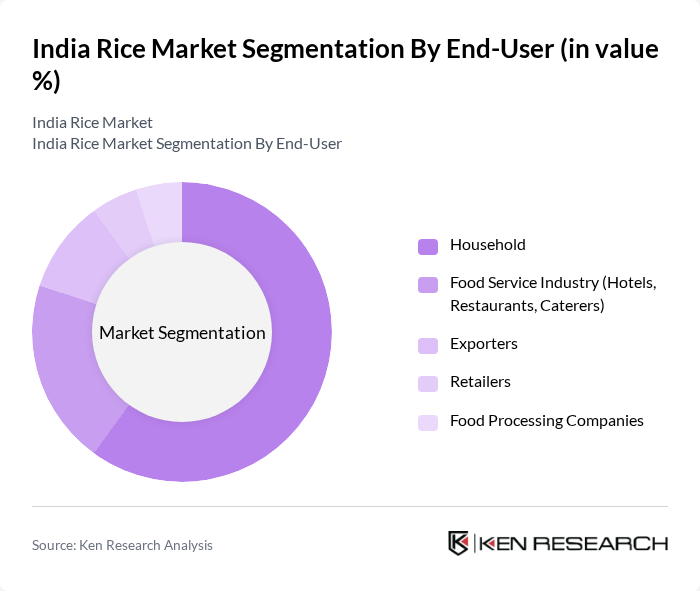

By End-User:The end-user segmentation includes Household, Food Service Industry (Hotels, Restaurants, Caterers), Exporters, Retailers, and Food Processing Companies. TheHouseholdsegment dominates the market as rice is a staple food in Indian households, with increasing consumption patterns driven by population growth, urbanization, and rising disposable incomes. TheFood Service Industryis also significant, as the demand for rice-based dishes in restaurants and catering services continues to rise. Exporters play a crucial role, with India being the world's largest rice exporter, particularly of Basmati and Non-Basmati varieties.

The India Rice Market is characterized by a dynamic mix of regional and international players. Leading participants such as KRBL Limited, LT Foods Limited, Tilda Hain India Pvt. Ltd., Adani Wilmar Limited, Kohinoor Foods Limited, Chaman Lal Setia Exports Ltd., Shree Krishna Rice Mills, Amar Singh Chawal Wala, Mishtann Foods Limited, Patanjali Foods Limited, Sunstar Overseas Limited, Sarveshwar Foods Limited, Bhagat Agro Industries Limited, Sukhbir Agro Energy Limited, and Lal Qilla Rice (Amar Singh Chawal Wala) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India rice market appears promising, driven by increasing health consciousness among consumers and a shift towards sustainable farming practices. As more consumers seek organic and health-oriented food options, the demand for high-quality rice is expected to rise. Additionally, advancements in agricultural technology, such as precision farming, will likely enhance productivity and efficiency, ensuring that the market can meet the growing demands of a changing population landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Basmati Rice Non-Basmati Rice Organic Rice Parboiled Rice Aromatic & Specialty Rice (e.g., Black, Red, Brown Rice) Fortified Rice Others |

| By End-User | Household Food Service Industry (Hotels, Restaurants, Caterers) Exporters Retailers Food Processing Companies |

| By Region | North India (Punjab, Haryana, Uttar Pradesh, Delhi) South India (Andhra Pradesh, Tamil Nadu, Karnataka, Kerala) East India (West Bengal, Odisha, Bihar, Assam) West India (Maharashtra, Gujarat, Rajasthan, Goa) |

| By Quality | Premium Quality Standard Quality Low-Quality |

| By Packaging Type | Bulk Packaging (25kg, 50kg, 100kg) Retail Packaging (1kg, 5kg, 10kg) Eco-Friendly Packaging |

| By Sales Channel | Online Sales (E-commerce Platforms) Offline Retail (Supermarkets, Kirana Stores) Wholesale |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rice Mill Operations | 60 | Mill Owners, Production Managers |

| Farmers' Perspectives | 90 | Rice Farmers, Agricultural Cooperative Members |

| Retail Market Insights | 50 | Retail Store Owners, Grocery Managers |

| Consumer Preferences | 70 | Household Consumers, Nutritionists |

| Export Market Analysis | 40 | Export Managers, Trade Analysts |

The India Rice Market is valued at approximately USD 47 billion, driven by increasing domestic consumption, a rising population, and the growing demand for rice as a staple food. This valuation reflects a five-year historical analysis of market trends.