Region:Asia

Author(s):Shubham

Product Code:KRAB5069

Pages:82

Published On:October 2025

By Type:The market is segmented into various types of smart healthcare devices and wearables, including wearable fitness trackers, smartwatches, smart medical devices, health monitoring sensors, smart glasses, smart clothing, and others. Among these, wearable fitness trackers and smartwatches are leading the market due to their popularity among health-conscious consumers and their ability to provide real-time health data. The increasing trend of fitness and wellness tracking has significantly contributed to the growth of these segments.

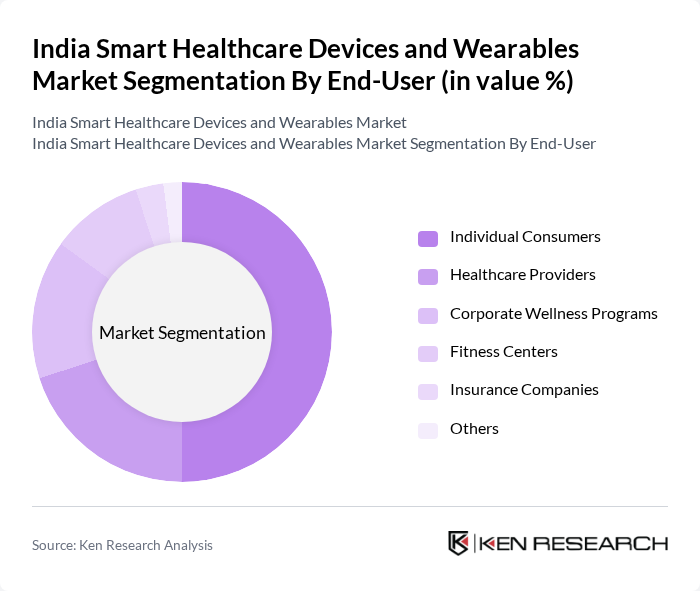

By End-User:The end-user segmentation includes individual consumers, healthcare providers, corporate wellness programs, fitness centers, insurance companies, and others. Individual consumers dominate the market, driven by the growing trend of personal health management and fitness tracking. The increasing adoption of smart devices among consumers for health monitoring and fitness purposes has significantly boosted this segment.

The India Smart Healthcare Devices and Wearables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic, Fitbit, Apple Inc., Samsung Electronics, Xiaomi Corporation, Garmin Ltd., Huawei Technologies, Omron Healthcare, Withings, Abbott Laboratories, Honeywell Life Sciences, Wipro GE Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart healthcare devices and wearables market in India appears promising, driven by technological innovations and increasing consumer demand for personalized health solutions. As telemedicine continues to expand, more individuals will seek integrated health management systems. Additionally, the focus on preventive healthcare will likely lead to a surge in the adoption of wearable devices that monitor vital signs and health metrics, enhancing patient engagement and outcomes in the healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Wearable Fitness Trackers Smartwatches Smart Medical Devices Health Monitoring Sensors Smart Glasses Smart Clothing Others |

| By End-User | Individual Consumers Healthcare Providers Corporate Wellness Programs Fitness Centers Insurance Companies Others |

| By Application | Chronic Disease Management Fitness and Wellness Tracking Remote Patient Monitoring Emergency Health Services Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Healthcare Institutions Others |

| By Price Range | Budget Devices Mid-Range Devices Premium Devices Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| By User Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Wearables Usage in Urban Areas | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Remote Patient Monitoring Systems | 100 | Healthcare Providers, Telehealth Coordinators |

| Mobile Health Application Adoption | 120 | Patients, App Developers, Healthcare IT Specialists |

| Market Trends in Elderly Care Devices | 80 | Caregivers, Geriatric Specialists, Family Members |

| Regulatory Impact on Smart Healthcare Devices | 70 | Regulatory Affairs Managers, Compliance Officers |

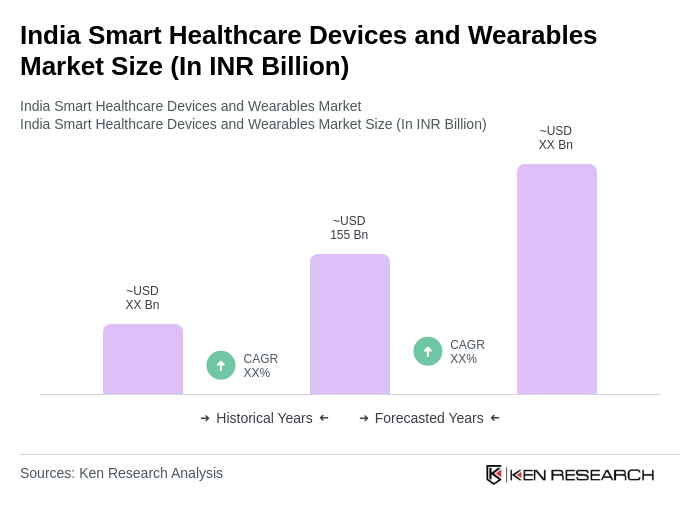

The India Smart Healthcare Devices and Wearables Market is valued at approximately INR 155 billion, driven by the increasing prevalence of chronic diseases, rising health awareness, and technological advancements in healthcare devices.