Region:Asia

Author(s):Geetanshi

Product Code:KRAC3853

Pages:87

Published On:October 2025

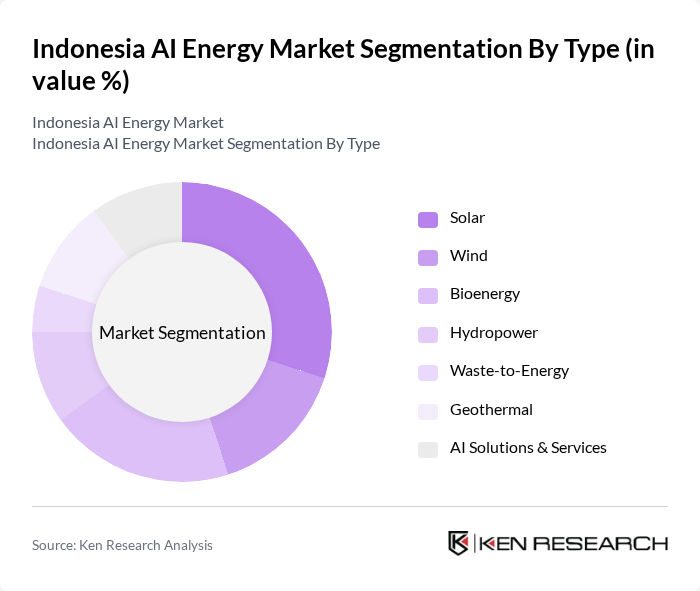

By Type:The market is segmented into Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Geothermal, and AI Solutions & Services. Each segment plays a crucial role in the energy landscape, with AI-driven applications such as predictive maintenance, demand forecasting, and grid optimization accelerating their growth and integration into Indonesia’s energy mix .

TheSolarsegment is currently the dominant player, driven by strong demand for renewable energy, government incentives, and the declining cost of solar technology. The scalability and affordability of solar solutions, combined with AI-enabled predictive analytics and smart grid integration, make solar energy a preferred choice for both residential and commercial users. Heightened environmental awareness and the expansion of distributed energy resources further accelerate solar adoption .

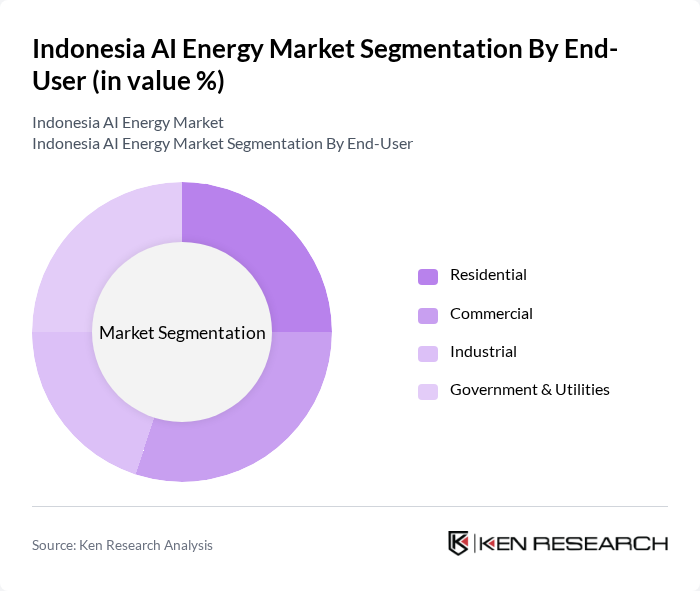

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, and Government & Utilities. Each segment exhibits distinct energy usage patterns and digital maturity, influencing the adoption of AI-powered energy management and optimization solutions .

TheCommercialsegment leads the market, propelled by the need for energy efficiency, operational cost reduction, and compliance with sustainability targets. Businesses are rapidly adopting AI-based solutions for energy optimization, smart building management, and demand response. The proliferation of smart commercial infrastructure and digital transformation initiatives in Indonesia’s urban centers further supports this trend .

The Indonesia AI Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT PLN (Persero), PT Pertamina (Persero), PT Adaro Energy Tbk, PT Indika Energy Tbk, PT Pembangkit Jawa Bali, PT Energi Mega Persada Tbk, PT Medco Energi Internasional Tbk, PT TBS Energi Utama Tbk, PT Cikarang Listrindo Tbk, PT Sumberdaya Sewatama, PT Surya Energi Indotama, PT Sumber Energi Terbarukan, PT Bumi Resources Tbk, PT Supreme Energy, PT Xurya Daya Indonesia, PT Akuo Energy Indonesia, PT Total E&P Indonesie, PT Bayu Buana Energi, PT Kencana Energi Lestari Tbk, PT Pertamina Power Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's AI energy market appears promising, driven by increasing investments in renewable energy and technological advancements. As the government continues to implement supportive policies, the integration of AI in energy management is expected to enhance efficiency and sustainability. Moreover, the rise of decentralized energy systems and smart grid technologies will likely reshape the energy landscape, fostering innovation and attracting further investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Geothermal AI Solutions & Services |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Demand Forecasting Renewables Management Safety, Security & Infrastructure |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Renewable Energy Providers | 60 | CEOs, CTOs, and Operations Managers |

| AI Technology Developers | 50 | Product Managers, Data Scientists, and Engineers |

| Energy Policy Makers | 40 | Government Officials, Regulatory Analysts |

| Energy Consumers (Industrial) | 55 | Facility Managers, Energy Procurement Officers |

| Academic Researchers in Energy | 45 | Professors, Research Fellows, and PhD Candidates |

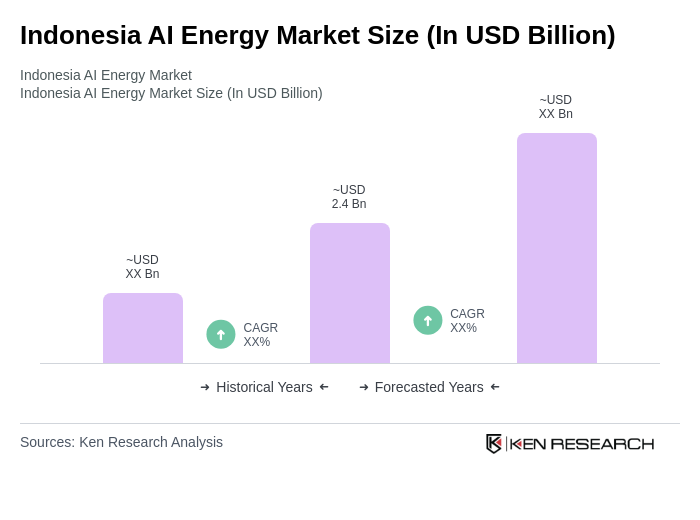

The Indonesia AI Energy Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by the adoption of AI technologies in energy management and the optimization of renewable energy sources.