Region:Asia

Author(s):Geetanshi

Product Code:KRAA4794

Pages:86

Published On:September 2025

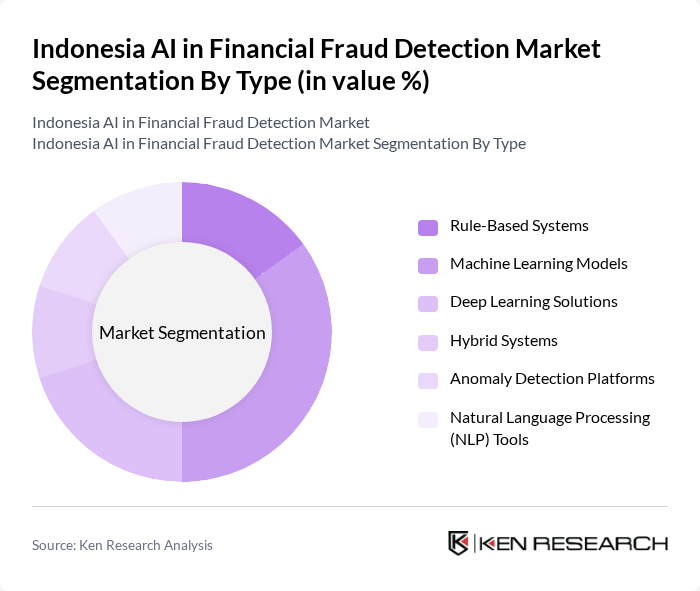

By Type:The market is segmented into various types of AI technologies used for financial fraud detection. The subsegments include Rule-Based Systems, Machine Learning Models, Deep Learning Solutions, Hybrid Systems, Anomaly Detection Platforms, and Natural Language Processing (NLP) Tools.Machine Learning Modelsare gaining the most traction due to their ability to process large volumes of transactional data, adapt to new fraud patterns, and improve detection accuracy over time. The increasing complexity and scale of fraud schemes in Indonesia necessitate the deployment of advanced machine learning and deep learning techniques, making these subsegments the fastest growing in the market .

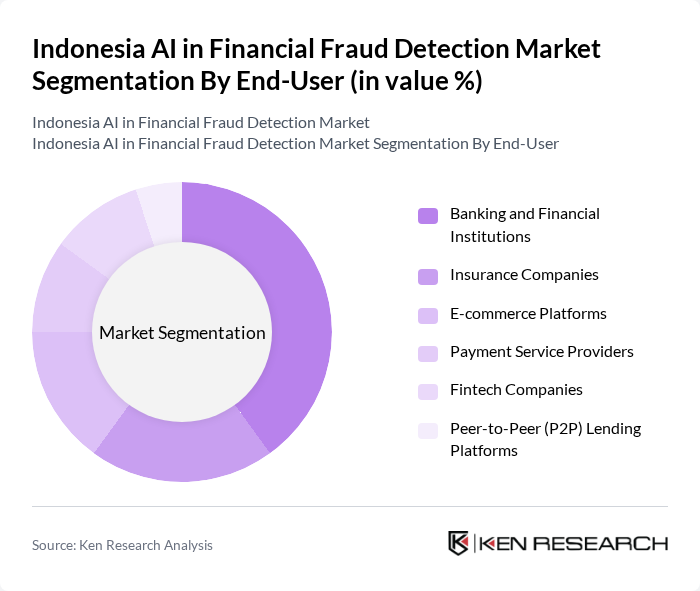

By End-User:The end-user segmentation includes Banking and Financial Institutions, Insurance Companies, E-commerce Platforms, Payment Service Providers, Fintech Companies, and Peer-to-Peer (P2P) Lending Platforms.Banking and Financial Institutionsremain the largest segment, driven by the high transaction volumes and stringent compliance requirements. As these institutions accelerate digital transformation, the demand for robust AI-powered fraud detection solutions is intensifying. Insurance companies and e-commerce platforms are also increasing their adoption of AI to address rising fraud risks in claims processing and digital payments .

The Indonesia AI in Financial Fraud Detection Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Bank Mandiri (Persero) Tbk, PT. Bank Rakyat Indonesia (Persero) Tbk, PT. Bank Central Asia Tbk, PT. Bank Negara Indonesia (Persero) Tbk, PT. BCA Finance, PT. CIMB Niaga Tbk, PT. Bank Danamon Indonesia Tbk, PT. Bank Permata Tbk, PT. Bank Sinarmas Tbk, PT. Bank Mega Tbk, PT. Bank OCBC NISP Tbk, PT. Bank Tabungan Negara (Persero) Tbk, PT. Bank Maybank Indonesia Tbk, PT. Bank Panin Tbk, PT. Bank Syariah Indonesia Tbk, PT. DOKU, PT. Midtrans, PT. Xendit, PT. Indosat Tbk, PT. Telkom Indonesia (Persero) Tbk, PT. Astra International Tbk, PT. Mandiri Sekuritas, PT. Julo Teknologi Finansial, TrustDecision, Flagright contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia AI in financial fraud detection market appears promising, driven by technological advancements and increasing regulatory support. As financial institutions continue to prioritize cybersecurity, the integration of AI technologies will become more prevalent. Moreover, the collaboration between banks and fintech startups is expected to foster innovation, leading to the development of more sophisticated fraud detection solutions. This collaborative environment will likely enhance the overall security framework, ensuring a safer financial landscape for consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Rule-Based Systems Machine Learning Models Deep Learning Solutions Hybrid Systems Anomaly Detection Platforms Natural Language Processing (NLP) Tools |

| By End-User | Banking and Financial Institutions Insurance Companies E-commerce Platforms Payment Service Providers Fintech Companies Peer-to-Peer (P2P) Lending Platforms |

| By Application | Transaction Monitoring Customer Verification (KYC/KYB) Risk Assessment & Scoring Fraud Investigation & Case Management Anti-Money Laundering (AML) Compliance Sanctions & Watchlist Screening |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Fraud Detection | 120 | Fraud Analysts, Risk Management Officers |

| Insurance Fraud Prevention | 90 | Claims Managers, Compliance Officers |

| Fintech Solutions for Fraud Detection | 60 | Product Managers, Technology Officers |

| Regulatory Compliance in Financial Services | 50 | Regulatory Affairs Specialists, Legal Advisors |

| AI Technology Providers | 40 | Business Development Managers, Data Scientists |

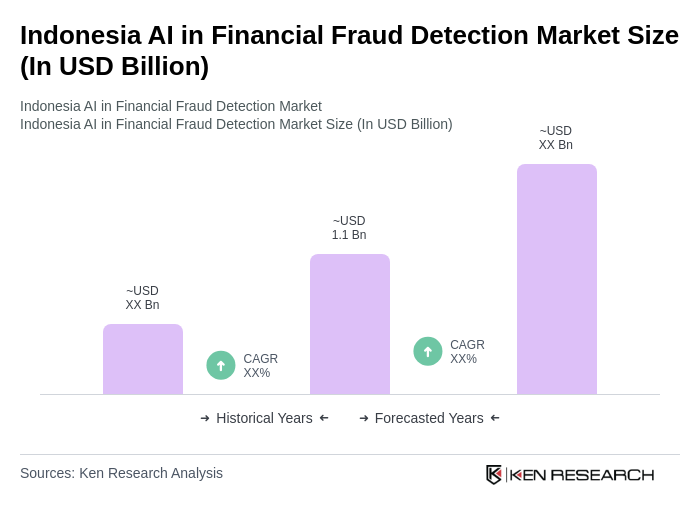

The Indonesia AI in Financial Fraud Detection Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the rise in digital banking, online transactions, and sophisticated financial fraud schemes.