Germany AI in Financial Fraud Detection Market Overview

- The Germany AI in Financial Fraud Detection Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing sophistication of financial fraud schemes, coupled with the rising adoption of AI technologies by financial institutions to enhance their fraud detection capabilities. The market is also supported by the growing regulatory requirements for compliance and risk management in the financial sector.

- Key cities such as Frankfurt, Munich, and Berlin dominate the market due to their status as financial hubs, housing numerous banks, insurance companies, and fintech startups. These cities benefit from a robust technological infrastructure, a skilled workforce, and a collaborative ecosystem that fosters innovation in AI and financial services, making them attractive locations for AI-driven fraud detection solutions.

- In 2023, the German government implemented the Financial Technology Act, which aims to enhance the regulatory framework for fintech companies. This act encourages the use of AI in financial services while ensuring consumer protection and data privacy. It mandates that financial institutions adopt advanced technologies for fraud detection and risk management, thereby promoting the growth of AI solutions in the financial sector.

Germany AI in Financial Fraud Detection Market Segmentation

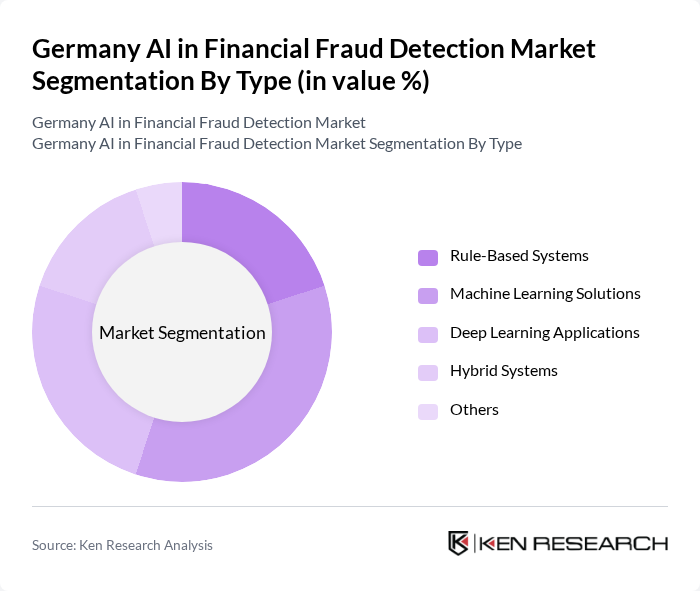

By Type:The market can be segmented into various types, including Rule-Based Systems, Machine Learning Solutions, Deep Learning Applications, Hybrid Systems, and Others. Each of these sub-segments plays a crucial role in addressing different aspects of financial fraud detection.

Among these, Machine Learning Solutions dominate the market due to their ability to analyze vast amounts of data and identify patterns indicative of fraudulent activities. The increasing reliance on data-driven decision-making in financial institutions has led to a surge in the adoption of machine learning technologies. Additionally, the flexibility and adaptability of machine learning algorithms make them suitable for evolving fraud tactics, further solidifying their market leadership.

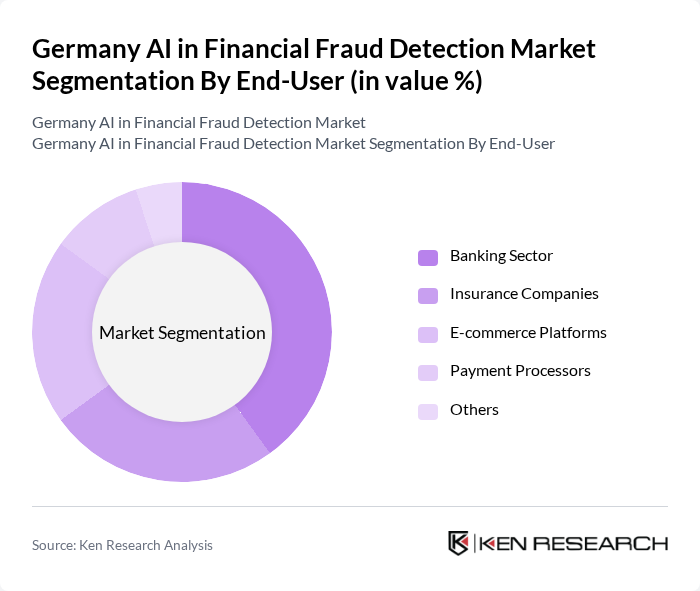

By End-User:The market is segmented by end-users, including the Banking Sector, Insurance Companies, E-commerce Platforms, Payment Processors, and Others. Each segment has unique requirements and challenges in fraud detection.

The Banking Sector is the leading end-user in the market, driven by the need for robust fraud detection mechanisms to protect customer assets and maintain trust. Banks are increasingly investing in AI technologies to enhance their fraud detection capabilities, streamline operations, and comply with regulatory requirements. The high volume of transactions processed by banks necessitates advanced solutions that can efficiently identify and mitigate fraudulent activities.

Germany AI in Financial Fraud Detection Market Competitive Landscape

The Germany AI in Financial Fraud Detection Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, FICO, SAS Institute Inc., ACI Worldwide Inc., NICE Actimize, Palantir Technologies, IBM Corporation, Oracle Corporation, Experian PLC, ThreatMetrix, Verafin, ComplyAdvantage, Feedzai, Zoot Enterprises, InAuth contribute to innovation, geographic expansion, and service delivery in this space.

Germany AI in Financial Fraud Detection Market Industry Analysis

Growth Drivers

- Increasing Cybersecurity Threats:The rise in cybercrime incidents, which reached approximately 1.5 million cases in Germany recently, has heightened the demand for advanced fraud detection solutions. The financial sector reported losses exceeding €100 billion due to fraud-related activities. This alarming trend has prompted financial institutions to invest in AI technologies, which can analyze vast datasets and identify suspicious patterns in real-time, thereby enhancing security measures and protecting consumer assets.

- Regulatory Compliance Requirements:Germany's stringent regulatory landscape, including the implementation of the EU's General Data Protection Regulation (GDPR), mandates financial institutions to adopt robust fraud detection systems. Recently, over 70% of financial organizations reported increased compliance costs, averaging €2 million annually. This regulatory pressure drives the adoption of AI solutions that can efficiently manage compliance requirements while minimizing the risk of penalties associated with non-compliance, thus fostering market growth.

- Advancements in AI Technology:The rapid evolution of AI technologies, particularly in machine learning and natural language processing, has significantly improved fraud detection capabilities. Recently, investments in AI research and development in Germany reached €1.2 billion, reflecting a 15% increase from the previous year. These advancements enable financial institutions to deploy sophisticated algorithms that can analyze transaction data more effectively, leading to quicker identification of fraudulent activities and reduced false positives.

Market Challenges

- High Implementation Costs:The initial investment required for AI-based fraud detection systems can be substantial, often exceeding €500,000 for mid-sized financial institutions. This high cost can deter smaller organizations from adopting these technologies, limiting market penetration. Additionally, ongoing maintenance and updates can add another €100,000 annually, creating a financial burden that many institutions struggle to justify amidst tight budgets and competing priorities.

- Data Privacy Concerns:With the increasing reliance on AI for fraud detection, data privacy issues have become a significant challenge. Recently, approximately 60% of consumers expressed concerns about how their personal data is used, leading to a potential backlash against financial institutions. Compliance with GDPR and other data protection laws requires organizations to implement stringent data handling practices, which can complicate the deployment of AI solutions and slow down market growth.

Germany AI in Financial Fraud Detection Market Future Outlook

The future of the AI in financial fraud detection market in Germany appears promising, driven by technological advancements and increasing digital transactions. As e-commerce continues to grow, projected to reach €100 billion in the near future, financial institutions will increasingly adopt AI solutions to mitigate fraud risks. Furthermore, the integration of AI with blockchain technology is expected to enhance security measures, providing a robust framework for fraud prevention and detection, ultimately fostering consumer trust and market expansion.

Market Opportunities

- Growth in E-commerce Transactions:The surge in e-commerce transactions, expected to exceed 20% growth in the near future, presents a significant opportunity for AI-driven fraud detection solutions. As online shopping becomes more prevalent, the need for effective fraud prevention mechanisms will intensify, encouraging financial institutions to invest in advanced AI technologies to safeguard transactions and enhance customer trust.

- Expansion of Digital Banking Services:The digital banking sector in Germany is projected to grow by €15 billion in the near future, driven by increased consumer demand for online services. This expansion creates a fertile ground for AI-based fraud detection systems, as banks seek to protect their digital platforms from fraudulent activities while ensuring compliance with regulatory standards, thus presenting a lucrative market opportunity.