Region:Asia

Author(s):Rebecca

Product Code:KRAB3530

Pages:84

Published On:October 2025

By Type:The market is segmented into Health Micro-Insurance, Life Micro-Insurance, Property Micro-Insurance, Agricultural Micro-Insurance, Sharia (Takaful) Micro-Insurance, Natural Disaster Micro-Insurance, Travel Micro-Insurance, Event Micro-Insurance, and Others.Health Micro-Insuranceremains the leading sub-segment, driven by rising healthcare costs, increased health risk awareness, and the urgent need for affordable health coverage among urban and rural populations. The expansion of digital health platforms and partnerships with mobile operators have further accelerated the adoption of health-focused micro-insurance products .

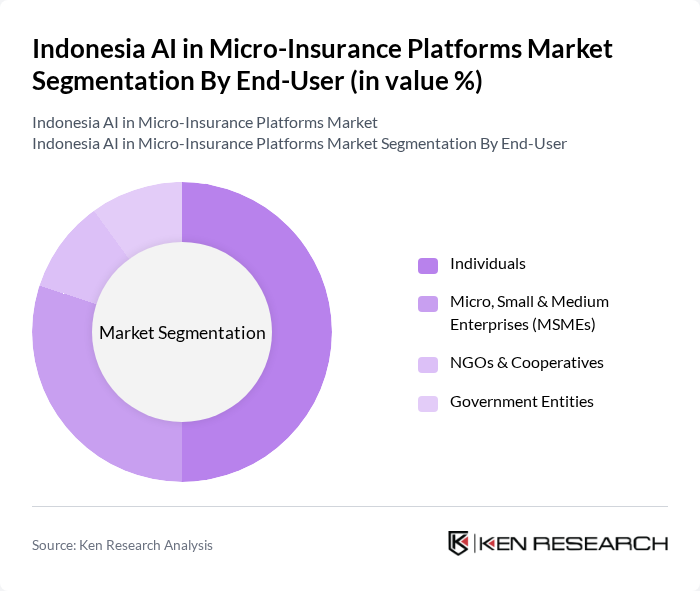

By End-User:The end-user segmentation includes Individuals, Micro, Small & Medium Enterprises (MSMEs), NGOs & Cooperatives, and Government Entities.Individualsrepresent the largest segment, reflecting the growing demand for personal financial protection and the increasing accessibility of micro-insurance through digital platforms. MSMEs are also rapidly adopting micro-insurance to safeguard business continuity, while NGOs and cooperatives play a pivotal role in distributing products to remote and underserved communities .

The Indonesia AI in Micro-Insurance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as PasarPolis, Qoala, Fuse Insurtech, AXA Mandiri, BRI Insurance (PT Asuransi BRI Life), Allianz Indonesia, Prudential Indonesia, FWD Insurance, Sinarmas MSIG, Adira Insurance, Sequis Life, Cigna Indonesia, Tokio Marine Life Indonesia, Tugu Insurance (PT Asuransi Tugu Pratama Indonesia Tbk), Great Eastern Life Indonesia, Manulife Indonesia, Asuransi Sinar Mas, BCA Insurance, and FingerMotion (AI Platform Partner) contribute to innovation, geographic expansion, and service delivery in this space .

The future of Indonesia's AI in micro-insurance platforms appears promising, driven by technological advancements and increasing digital literacy. As more consumers embrace online services, the demand for personalized insurance products is expected to rise. Additionally, partnerships between micro-insurance providers and fintech companies will likely enhance service delivery and customer engagement. The integration of AI technologies will further streamline operations, enabling insurers to offer tailored solutions that meet the unique needs of diverse consumer segments.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Micro-Insurance Life Micro-Insurance Property Micro-Insurance Agricultural Micro-Insurance Sharia (Takaful) Micro-Insurance Natural Disaster Micro-Insurance Travel Micro-Insurance Event Micro-Insurance Others |

| By End-User | Individuals Micro, Small & Medium Enterprises (MSMEs) NGOs & Cooperatives Government Entities |

| By Distribution Channel | Online Platforms Mobile Applications Agents and Brokers Partnerships with Financial Institutions Telco Partnerships |

| By Premium Range | Low Premium (< IDR 100,000) Medium Premium (IDR 100,000 - IDR 500,000) High Premium (> IDR 500,000) |

| By Customer Segment | Low-Income Households Middle-Income Households High-Income Households |

| By Product Features | Customizable Plans Instant Claim Processing Flexible Payment Options Embedded Insurance (Bundled with Other Services) |

| By Policy Duration | Short-Term Policies Long-Term Policies One-Time Coverage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Micro-Insurance Product Awareness | 100 | Potential Policyholders, Financial Advisors |

| AI Integration in Insurance Processes | 60 | IT Managers, Operations Directors |

| Consumer Attitudes Towards Digital Insurance | 90 | General Consumers, Tech-Savvy Individuals |

| Regulatory Impact on Micro-Insurance | 40 | Regulatory Officials, Compliance Officers |

| Market Trends in AI-Driven Insurance | 50 | Industry Analysts, Market Researchers |

The Indonesia AI in Micro-Insurance Platforms Market is valued at approximately USD 370 million, reflecting the growth of microinsurance and the adoption of AI-driven insurtech solutions, driven by increasing digitization and rising insurance awareness among low-income segments.