Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7909

Pages:92

Published On:October 2025

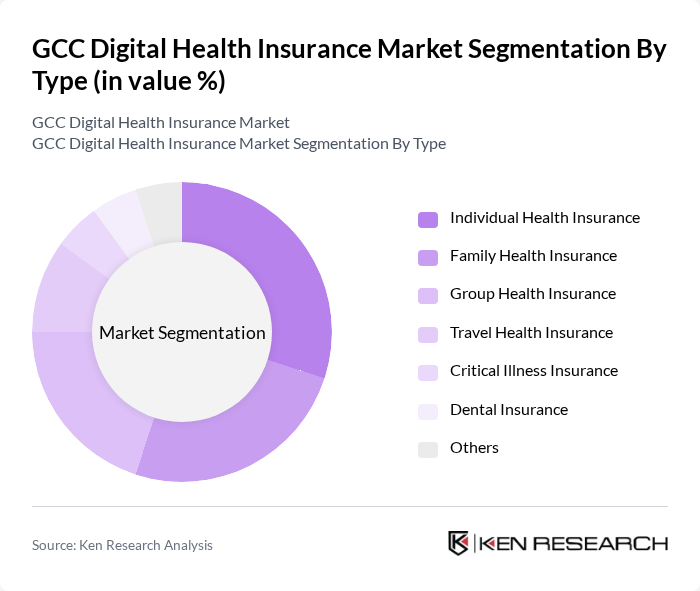

By Type:The segmentation by type includes various subsegments such as Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Each of these subsegments caters to different consumer needs and preferences, with Individual and Family Health Insurance being particularly popular due to the increasing awareness of personal health management.

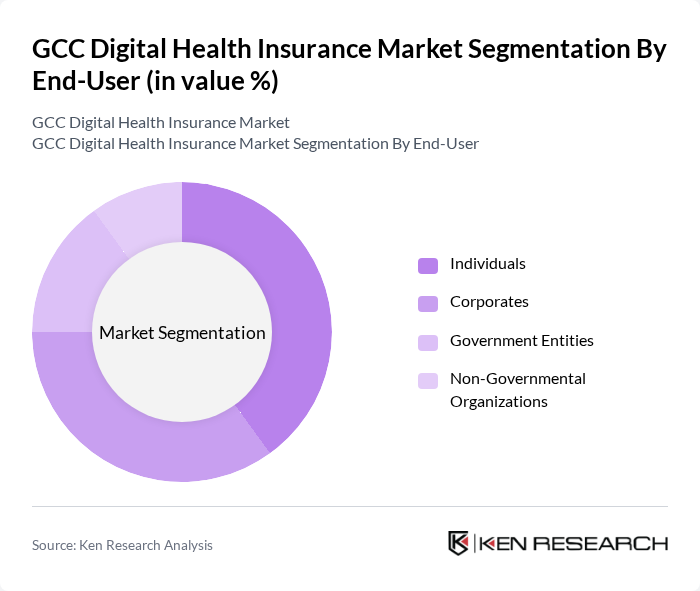

By End-User:The end-user segmentation includes Individuals, Corporates, Government Entities, and Non-Governmental Organizations. Individuals and Corporates dominate this market segment, driven by the increasing need for health coverage and the rising costs of healthcare services. Corporates often provide health insurance as part of employee benefits, which significantly boosts their market share.

The GCC Digital Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Partners, AXA Gulf, Daman, Bupa Arabia, Qatar Insurance Company, Oman Insurance Company, Abu Dhabi National Insurance Company, Saudi Arabian Insurance Company, Medgulf, Emirates Insurance Company, National General Insurance Company, Al Hilal Takaful, Gulf Insurance Group, Takaful Emarat, Al Ain Ahlia Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC digital health insurance market appears promising, driven by technological advancements and increasing consumer demand for personalized healthcare solutions. As telemedicine and AI integration become more prevalent, insurers are likely to enhance their service offerings. Additionally, the focus on preventive healthcare will encourage insurers to develop innovative products that cater to emerging health trends. Overall, the market is poised for significant transformation, fostering a more efficient healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Coverage Type | Comprehensive Coverage Basic Coverage Supplemental Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Duration | Short-term Policies Long-term Policies |

| By Customer Segment | Young Adults Families Seniors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Providers | 150 | CEOs, Product Managers, Underwriters |

| Healthcare Service Providers | 100 | Hospital Administrators, Clinic Managers |

| Digital Health Solution Developers | 80 | CTOs, Product Development Leads |

| Policyholders | 120 | Individual Consumers, Family Plan Holders |

| Regulatory Bodies | 50 | Policy Analysts, Compliance Officers |

The GCC Digital Health Insurance Market is valued at approximately USD 5 billion, reflecting significant growth driven by the adoption of digital health solutions, rising healthcare costs, and a focus on preventive care.