Region:Asia

Author(s):Shubham

Product Code:KRAA8512

Pages:90

Published On:November 2025

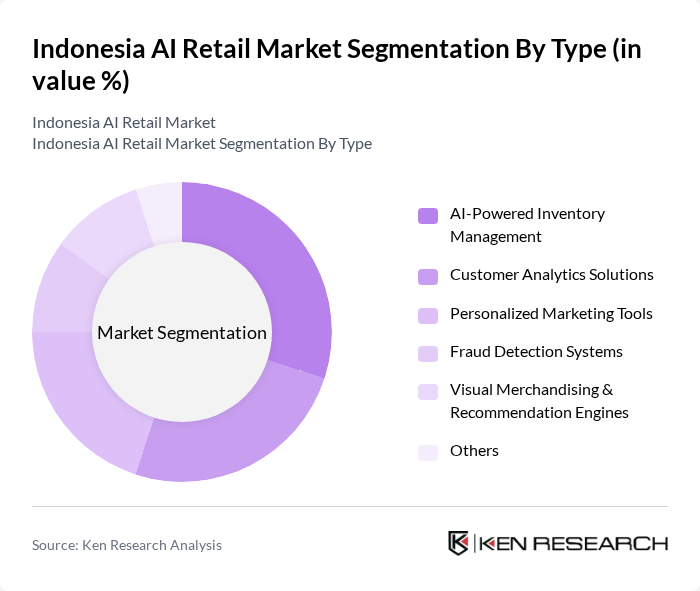

By Type:The market is segmented into various types of AI solutions that address different retail needs. The primary subsegments include AI-Powered Inventory Management, Customer Analytics Solutions, Personalized Marketing Tools, Fraud Detection Systems, Visual Merchandising & Recommendation Engines, and Others. These solutions are integral to boosting operational efficiency, enabling data-driven decision-making, and enhancing customer engagement through personalized experiences and optimized supply chains .

The leading subsegment in the AI retail market is AI-Powered Inventory Management, which is gaining traction due to the increasing need for retailers to optimize stock levels and reduce waste. This technology enables retailers to predict demand accurately, manage supply chains efficiently, and enhance customer satisfaction by ensuring product availability. The ongoing expansion of e-commerce and omnichannel retailing has further amplified the demand for such solutions, as retailers seek to streamline operations and improve service delivery .

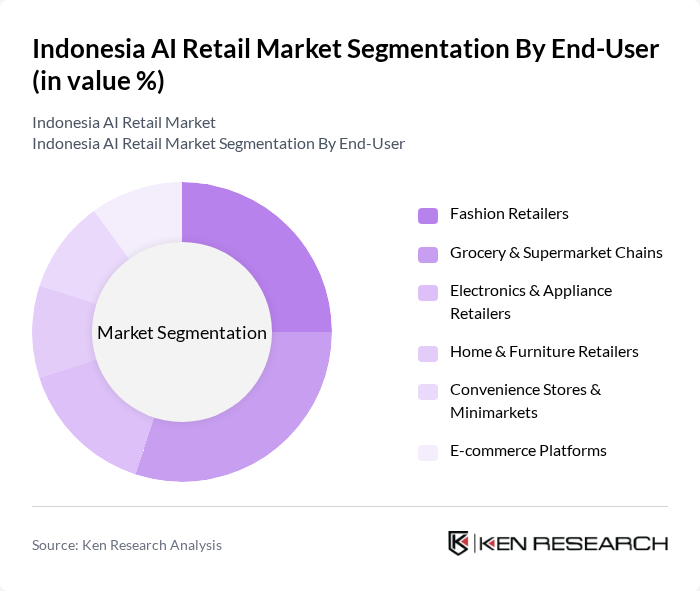

By End-User:The AI retail market is also segmented by end-users, which include Fashion Retailers, Grocery & Supermarket Chains, Electronics & Appliance Retailers, Home & Furniture Retailers, Convenience Stores & Minimarkets, E-commerce Platforms, and Others. Each end-user category presents unique requirements and applications for AI technologies, ranging from personalized marketing and inventory optimization to fraud detection and customer analytics .

Among the end-user segments, Grocery & Supermarket Chains are leading the market due to the increasing demand for efficient inventory management and customer engagement solutions. The rise of online grocery shopping and the need for real-time stock monitoring have necessitated the adoption of AI technologies to enhance operational efficiency and improve customer experiences. Additionally, the trend toward personalized shopping is driving grocery retailers to invest in AI solutions that cater to evolving consumer preferences .

The Indonesia AI Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, Tokopedia, Bukalapak, Blibli, Lazada Indonesia, Shopee Indonesia, Alfamart (PT Sumber Alfaria Trijaya Tbk), Indomaret (PT Indomarco Prismatama), JD.ID, Zalora Indonesia, Bhinneka, Fabelio, Orami, Kudo (now part of GrabKios), HappyFresh, Matahari Department Store, MAP Group (PT Mitra Adiperkasa Tbk), Sociolla, Hypermart (PT Matahari Putra Prima Tbk), IKEA Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian AI retail market appears promising, driven by technological advancements and evolving consumer preferences. As retailers increasingly adopt AI solutions, the focus will shift towards enhancing customer experiences through personalized services and efficient operations. The integration of AI in supply chain management and customer service will likely become standard practice, enabling retailers to respond swiftly to market demands. Additionally, collaboration with tech startups will foster innovation, creating a dynamic retail environment that adapts to changing consumer behaviors and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-Powered Inventory Management Customer Analytics Solutions Personalized Marketing Tools Fraud Detection Systems Visual Merchandising & Recommendation Engines Others |

| By End-User | Fashion Retailers Grocery & Supermarket Chains Electronics & Appliance Retailers Home & Furniture Retailers Convenience Stores & Minimarkets E-commerce Platforms Others |

| By Region | Java Sumatra Bali Sulawesi Kalimantan Others |

| By Technology | Machine Learning Applications Natural Language Processing Computer Vision Solutions Robotic Process Automation Generative AI Others |

| By Application | Customer Engagement & Personalization Sales Forecasting & Demand Planning Supply Chain & Logistics Optimization Dynamic Pricing & Promotion Optimization Fraud Detection & Risk Management Others |

| By Investment Source | Private Investments Venture Capital Government Grants Corporate Investments Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Grants for Research and Development Regulatory Support for Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI Adoption in Grocery Retail | 100 | Store Managers, IT Directors |

| AI in Fashion Retail | 60 | Merchandising Managers, E-commerce Directors |

| AI-Driven Customer Experience | 50 | Customer Experience Managers, Marketing Heads |

| Supply Chain Optimization with AI | 70 | Supply Chain Managers, Operations Directors |

| Consumer Insights and AI Analytics | 45 | Data Analysts, Business Intelligence Managers |

The Indonesia AI Retail Market is valued at approximately USD 1.4 billion, driven by the increasing adoption of AI technologies in retail operations, enhancing customer experiences and optimizing supply chain management.