Region:Asia

Author(s):Geetanshi

Product Code:KRAD1313

Pages:98

Published On:November 2025

By Type:The market is segmented into various types of banking software solutions, including Core Banking Solutions, Digital Banking Platforms, Payment Processing Software, Risk & Compliance Management Software, Customer Relationship Management (CRM) Software, Business Intelligence & Analytics Tools, API Banking & Open Banking Platforms, and Others. Among these, Core Banking Solutions and Digital Banking Platforms are the most prominent, driven by the need for integrated banking services, real-time processing, and enhanced customer engagement .

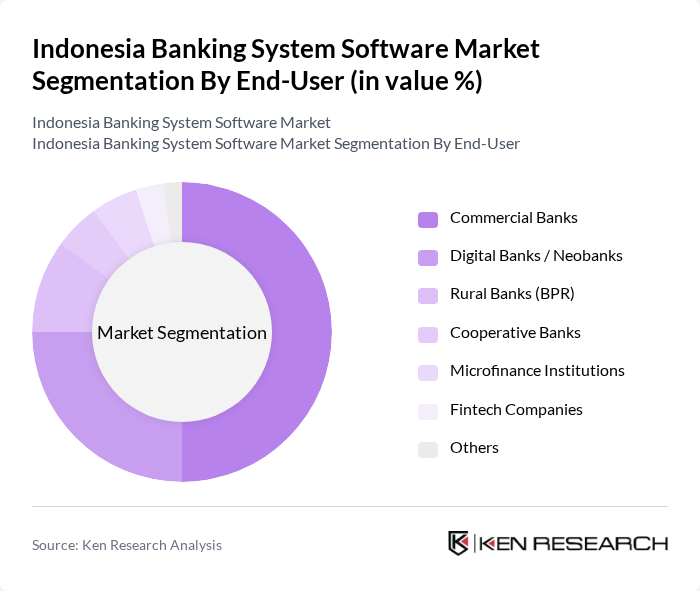

By End-User:The end-user segmentation includes Commercial Banks, Digital Banks / Neobanks, Rural Banks (BPR), Cooperative Banks, Microfinance Institutions, Fintech Companies, and Others. Commercial Banks and Digital Banks are leading this segment, as they increasingly adopt advanced software solutions to enhance operational efficiency, regulatory compliance, and customer service .

The Indonesia Banking System Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Bank Mandiri (Persero) Tbk, PT Bank Central Asia Tbk (BCA), PT Bank Rakyat Indonesia (Persero) Tbk (BRI), PT Bank CIMB Niaga Tbk, PT Bank Danamon Indonesia Tbk, PT Bank OCBC NISP Tbk, PT Bank Maybank Indonesia Tbk, PT Bank Pan Indonesia Tbk (Panin Bank), PT Bank Negara Indonesia (Persero) Tbk (BNI), PT Bank Syariah Indonesia Tbk, PT Bank Permata Tbk, PT Bank Muamalat Indonesia Tbk, PT Bank Victoria International Tbk, PT Bank Pembangunan Daerah Jawa Barat dan Banten Tbk (Bank BJB), PT Bank Sinarmas Tbk, PT Bank Jago Tbk, PT Bank Digital BCA (blu by BCA Digital), PT Bank Aladin Syariah Tbk, PT Akulaku Silvrr Indonesia (Akulaku), PT FinAccel Teknologi Indonesia (Kredivo), PT Investree Radhika Jaya (Investree), PT BukuWarung, PT Mekari, PT Ayoconnect Teknologi Indonesia (Ayoconnect), PT Brick Teknologi Indonesia (Brick) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia banking system software market appears promising, driven by ongoing digital transformation and increasing consumer expectations. As banks continue to invest in innovative technologies, the integration of artificial intelligence and machine learning will enhance operational efficiency and customer engagement. Additionally, the shift towards open banking will foster collaboration between traditional banks and fintech companies, creating a more dynamic financial ecosystem that prioritizes customer-centric solutions and improved service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Core Banking Solutions Digital Banking Platforms Payment Processing Software Risk & Compliance Management Software Customer Relationship Management (CRM) Software Business Intelligence & Analytics Tools API Banking & Open Banking Platforms Others |

| By End-User | Commercial Banks Digital Banks / Neobanks Rural Banks (BPR) Cooperative Banks Microfinance Institutions Fintech Companies Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Functionality | Transaction Management Account Management Reporting and Analytics Customer Support Lending & Credit Management Fraud Detection & Security Others |

| By Size of Institution | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Geographic Presence | Urban Areas Rural Areas Others |

| By Customer Segment | Retail Customers Corporate Customers Government Clients MSMEs (Micro, Small, and Medium Enterprises) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Core Banking Software Adoption | 100 | IT Managers, Chief Technology Officers |

| Mobile Banking Solutions | 80 | Product Managers, Digital Banking Heads |

| Payment Processing Systems | 70 | Operations Managers, Compliance Officers |

| Risk Management Software | 60 | Risk Analysts, Financial Controllers |

| Customer Relationship Management Tools | 90 | Marketing Managers, Customer Experience Directors |

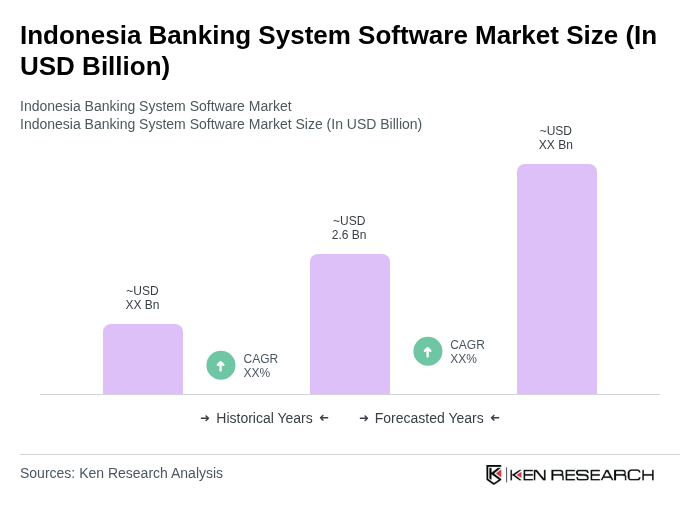

The Indonesia Banking System Software Market is valued at approximately USD 2.6 billion, reflecting significant growth driven by digital banking adoption, regulatory compliance, and enhanced customer experience initiatives.