Region:Asia

Author(s):Rebecca

Product Code:KRAC9818

Pages:80

Published On:November 2025

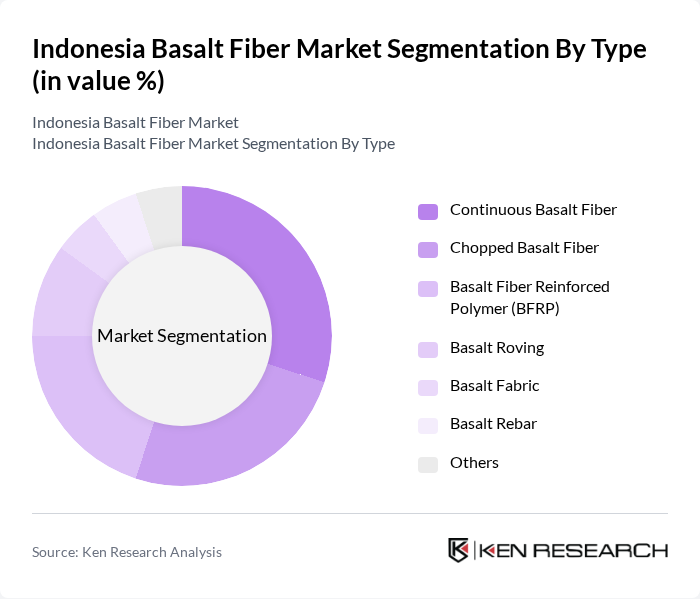

By Type:The market is segmented into various types of basalt fiber products, including Continuous Basalt Fiber, Chopped Basalt Fiber, Basalt Fiber Reinforced Polymer (BFRP), Basalt Roving, Basalt Fabric, Basalt Rebar, and Others. Continuous Basalt Fiber is gaining traction due to its superior mechanical properties, high tensile strength, and versatility in applications such as reinforcement and composites. Chopped Basalt Fiber is also widely used for its easy integration into concrete and polymer matrices. The demand for BFRP is increasing as industries seek lightweight and durable alternatives for construction and automotive applications, driven by the need for corrosion resistance and sustainability .

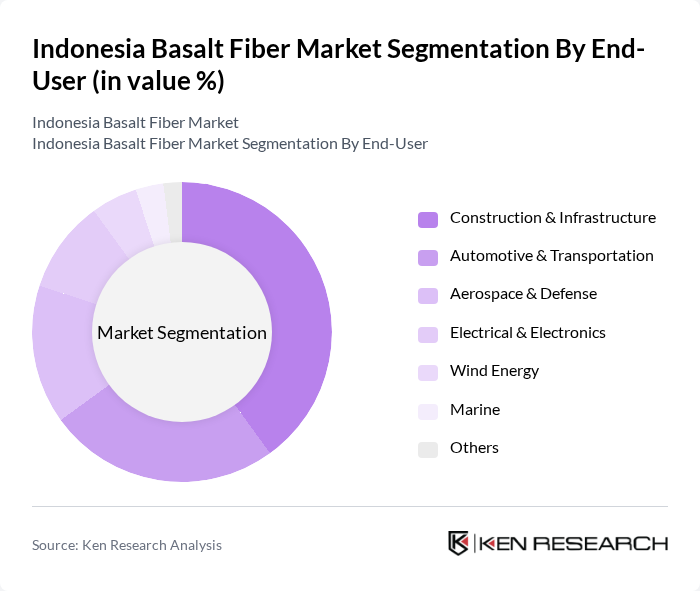

By End-User:The basalt fiber market is segmented by end-user industries, including Construction & Infrastructure, Automotive & Transportation, Aerospace & Defense, Electrical & Electronics, Wind Energy, Marine, and Others. The Construction & Infrastructure sector is the largest consumer of basalt fiber, primarily for concrete reinforcement, insulation, and structural applications. Automotive & Transportation is experiencing notable growth as manufacturers adopt basalt fiber for lightweighting and improved fuel efficiency. The Aerospace & Defense sector is also expanding its use of basalt fiber for high-performance, fire-resistant, and durable components .

The Indonesia Basalt Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Basaltindo Jaya, PT. Indobasalt Sejahtera, PT. Basalt Fiber Nusantara, PT. Basalt Reinforced Composites, PT. Gunung Basalt Fiber, PT. Fibertek Basalt Indonesia, PT. Basalt Mandiri, PT. Basalt Materials Indonesia, PT. Basalt Composite Solutions, PT. Basalt Fiber Manufacturing, PT. Basalt Engineering Indonesia, Basalt Fiber Tech LLP (Indonesia Branch), Kamenny Vek (Indonesia Representative Office), Mafic SA (Indonesia), Technobasalt-Invest (Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the basalt fiber market in Indonesia appears promising, driven by increasing investments in sustainable construction and automotive applications. As the government continues to support eco-friendly initiatives, the adoption of basalt fiber is expected to rise significantly. Additionally, advancements in production technologies will likely reduce costs, making basalt fiber more accessible. The market is poised for growth, with a focus on innovation and collaboration among industry stakeholders to explore new applications and enhance product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Continuous Basalt Fiber Chopped Basalt Fiber Basalt Fiber Reinforced Polymer (BFRP) Basalt Roving Basalt Fabric Basalt Rebar Others |

| By End-User | Construction & Infrastructure Automotive & Transportation Aerospace & Defense Electrical & Electronics Wind Energy Marine Others |

| By Application | Composites Insulation Concrete Reinforcement Road & Bridge Construction Coatings Others |

| By Manufacturing Process | Melt Spinning Pultrusion Filament Winding Weaving Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Product Form | Sheets Rods Fabrics Mesh & Grid Chopped Strands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Utilization | 100 | Project Managers, Procurement Officers |

| Automotive Industry Applications | 80 | Design Engineers, Production Managers |

| Consumer Goods Manufacturing | 60 | Product Development Managers, Quality Assurance Leads |

| Research Institutions and Academia | 50 | Researchers, Professors in Materials Science |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

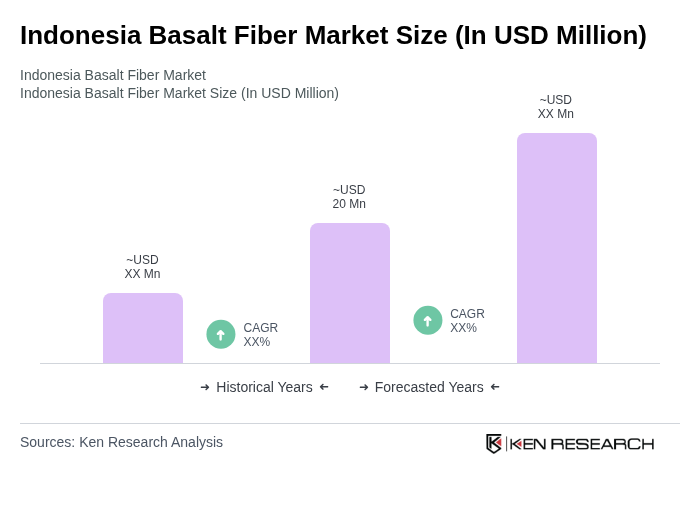

The Indonesia Basalt Fiber Market is valued at approximately USD 20 million, driven by the increasing demand for lightweight and high-strength materials across various industries, including construction, automotive, and aerospace.