Region:Asia

Author(s):Geetanshi

Product Code:KRAB2801

Pages:80

Published On:October 2025

By Type:The market is segmented into Real Estate, Automotive, Electronics, Fashion, Home & Garden, Services, and Others. Each segment addresses distinct consumer needs and preferences, with leading platforms specializing in their respective categories. Real estate and automotive classifieds are driven by high-value transactions and specialized search features, while electronics and fashion segments benefit from high transaction frequency and integration with e-commerce platforms. Home & Garden and Services segments are supported by the rise of urban living and the gig economy, respectively. The Others segment includes community forums and niche marketplaces that cater to unique user groups .

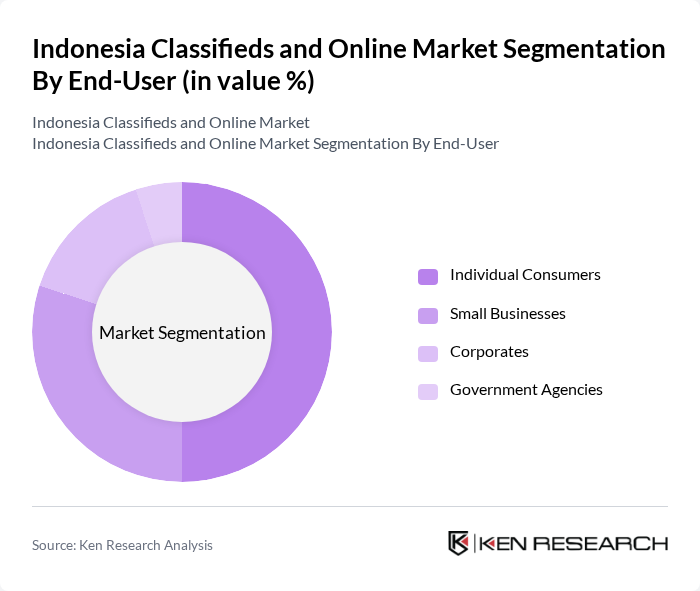

By End-User:The market is segmented by end-users, including Individual Consumers, Small Businesses, Corporates, and Government Agencies. Individual consumers dominate the market, leveraging classifieds for both personal and household needs. Small businesses use online platforms to reach wider audiences and streamline operations, while corporates utilize these channels for recruitment, asset liquidation, and procurement. Government agencies increasingly adopt digital classifieds for public service announcements and procurement processes .

The Indonesia Classifieds and Online Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokopedia, Bukalapak, OLX Indonesia, Shopee Indonesia, Lazada Indonesia, Blibli, Carousell Indonesia, Jualo, Kaskus, FJB Kaskus, Bhinneka, Ralali, Zalora Indonesia, PriceArea, Cintamobil, Rumah123, Lamudi, Mobil123, Elevenia, Facebook Marketplace contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's classifieds and online market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to dominate, platforms will increasingly leverage artificial intelligence to enhance user experiences and streamline transactions. Additionally, the integration of sustainable practices will resonate with environmentally conscious consumers, fostering loyalty. The expansion into rural areas will also present new growth avenues, as internet access improves and more users engage with online marketplaces, reshaping the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate (e.g., Rumah123, Lamudi) Automotive (e.g., Mobil123, Cintamobil) Electronics (e.g., Tokopedia, Bukalapak, OLX Indonesia) Fashion (e.g., Zalora Indonesia, Shopee Indonesia) Home & Garden (e.g., Blibli, OLX Indonesia) Services (e.g., Jualo, Carousell Indonesia) Others (e.g., Kaskus, FJB Kaskus) |

| By End-User | Individual Consumers Small Businesses Corporates Government Agencies |

| By Sales Channel | Online Platforms Mobile Applications Social Media (e.g., Facebook Marketplace, Instagram Shops) Offline Listings |

| By Price Range | Low-End Products Mid-Range Products High-End Products |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Payment Method | Credit/Debit Cards E-Wallets (e.g., GoPay, OVO, Dana) Bank Transfers Cash on Delivery |

| By User Demographics | Age Groups Gender Income Levels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Online Marketplace Users | 120 | Frequent Buyers, Casual Users |

| Small Business Sellers | 60 | Entrepreneurs, Small Business Owners |

| Real Estate Listings | 40 | Real Estate Agents, Property Buyers |

| Automotive Classifieds | 50 | Car Dealers, Private Sellers |

| Consumer Electronics Market | 45 | Tech Enthusiasts, Gadget Buyers |

The Indonesia Classifieds and Online Market is valued at approximately USD 2.5 billion, driven by increased internet and smartphone penetration, along with a growing preference for online shopping among consumers.