Region:Asia

Author(s):Geetanshi

Product Code:KRAA3705

Pages:92

Published On:September 2025

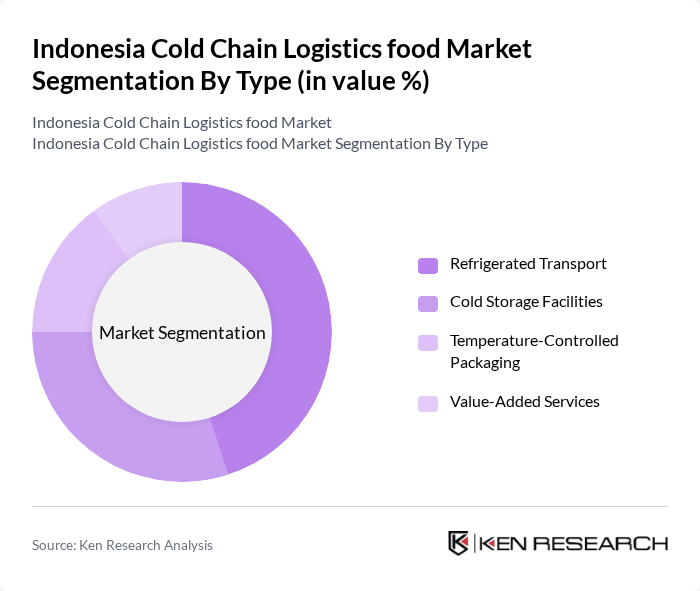

By Type:The cold chain logistics market can be segmented into four main types: Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Value-Added Services. Refrigerated Transport remains the leading sub-segment, driven by the increasing need for efficient movement of perishable goods across the archipelago. The expansion of e-commerce and online grocery shopping has intensified demand for reliable refrigerated transport, ensuring products reach consumers in optimal condition. Cold Storage Facilities are also expanding rapidly, supported by investments in infrastructure and technology upgrades to accommodate growing volumes of processed foods, seafood, and pharmaceuticals .

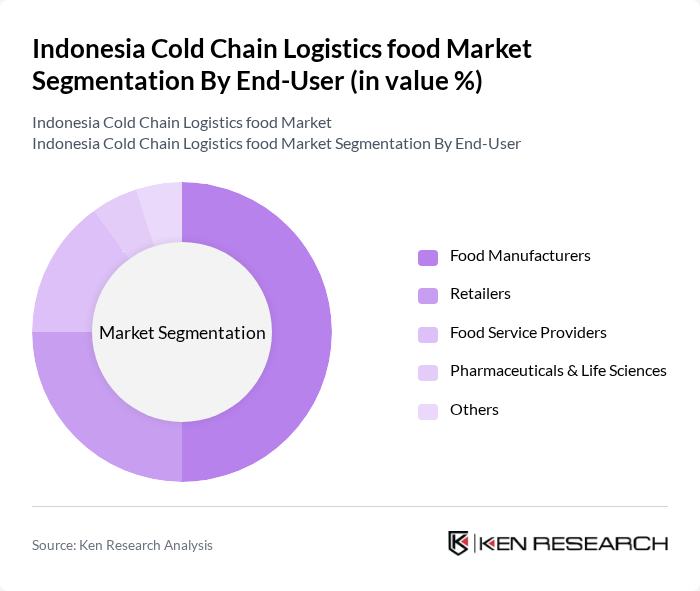

By End-User:The market is segmented by end-users, including Food Manufacturers, Retailers, Food Service Providers, Pharmaceuticals & Life Sciences, and Others. Food Manufacturers dominate this segment, reflecting the need for robust logistics to maintain product quality and safety. The increasing production of processed foods, dairy, and seafood, alongside the growth of the pharmaceutical sector, has driven higher demand for cold chain logistics to ensure products are stored and transported under optimal conditions .

The Indonesia Cold Chain Logistics food Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Pluit Cold Storage, PT MGM Bosco Logistics, PT YCH Indonesia, JNE Express, Tiki, Lion Parcel, Sicepat, GrabExpress, Gojek, DHL Supply Chain, Kuehne + Nagel, DB Schenker, Agility Logistics, Cargill, Indofood, Mayora Indah, Unilever Indonesia, Nestlé Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's cold chain logistics market appears promising, driven by technological advancements and increasing consumer awareness of food safety. The integration of IoT and AI technologies is expected to enhance operational efficiency, reducing waste and improving tracking capabilities. Additionally, as the government continues to invest in infrastructure, the cold chain logistics sector will likely see improved connectivity, enabling better distribution of perishable goods. This evolving landscape presents significant opportunities for growth and innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Value-Added Services |

| By End-User | Food Manufacturers Retailers Food Service Providers Pharmaceuticals & Life Sciences Others |

| By Product Type | Dairy Products Meat, Fish & Seafood Fruits & Vegetables Processed Food Products Bakery & Confectionery Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Others |

| By Service Type | Transportation Services Warehousing Services Packaging Services Value-Added Services Others |

| By Temperature Range | Chilled (0-5°C) Frozen (-18°C and below) Ambient (5-25°C) Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Food Manufacturers | 80 | Production Managers, Supply Chain Coordinators |

| Logistics Service Providers | 70 | Logistics Managers, Business Development Executives |

| Retail Chains with Cold Chain Needs | 60 | Procurement Officers, Store Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Food Safety Inspectors |

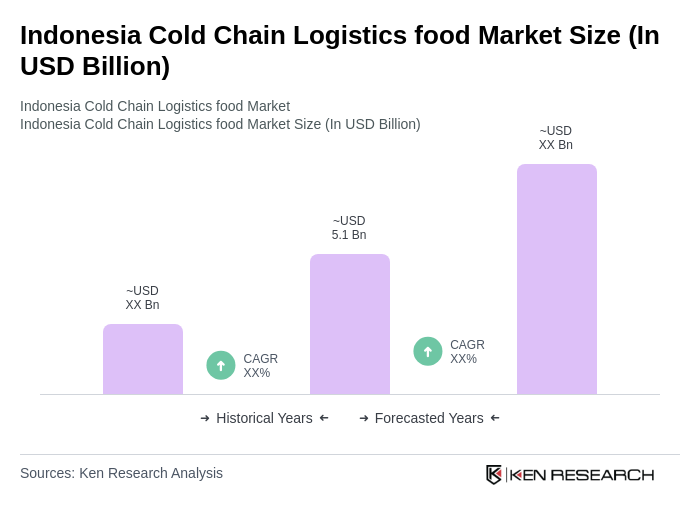

The Indonesia Cold Chain Logistics food market is valued at approximately USD 5.1 billion, driven by the increasing demand for perishable goods, urbanization, and the growth of the food and beverage industry.