Region:Middle East

Author(s):Shubham

Product Code:KRAC2117

Pages:92

Published On:October 2025

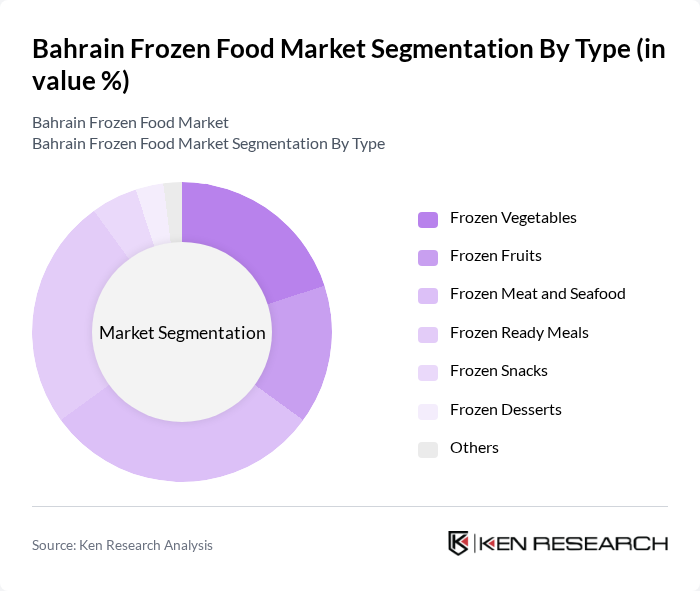

By Type:The Bahrain frozen food market is segmented into frozen vegetables, frozen fruits, frozen meat and seafood, frozen ready meals, frozen snacks, frozen desserts, and others. Frozen ready meals have gained significant traction due to their convenience and variety, appealing to busy consumers seeking quick meal solutions. The demand for frozen vegetables is also notable, driven by health-conscious consumers looking for nutritious options. While frozen meat and seafood remain important, the growth in ready meals and vegetables reflects broader consumer trends toward convenience and health.

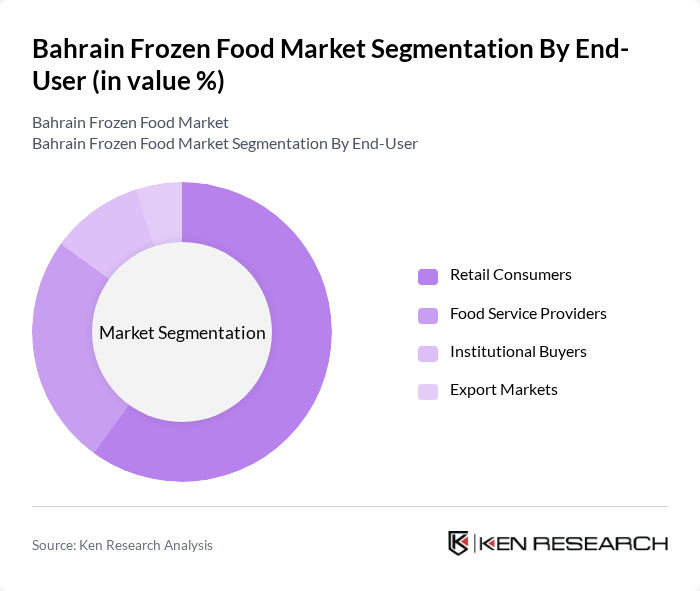

By End-User:The end-user segmentation includes retail consumers, food service providers, institutional buyers, and export markets. Retail consumers dominate the market, driven by the increasing trend of home cooking and the convenience of frozen food products. Food service providers are also significant contributors, as restaurants and cafes increasingly rely on frozen products for their menu offerings, ensuring consistent quality and availability. Institutional buyers and export markets play smaller but notable roles in the overall market structure.

The Bahrain Frozen Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Food & Beverages, Americana Group, Gulf Food Industries, Al Kabeer Group, Almarai Company, Nestlé S.A., Unilever PLC, Al Watania Poultry, Al-Fakher Foods, Al-Maeda Frozen Foods, Al-Safi Danone, Al-Baik Frozen Foods, Al-Jazeera Frozen Foods, Al-Mansoori Frozen Foods, Al-Hokair Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain frozen food market appears promising, driven by evolving consumer preferences and technological advancements. As the population continues to grow and urbanize, the demand for convenient and healthy food options is expected to rise. Innovations in freezing technology and sustainable packaging will likely enhance product offerings. Additionally, the increasing penetration of e-commerce in the food sector will provide new avenues for growth, allowing brands to reach a broader audience and adapt to changing consumer behaviors.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Vegetables Frozen Fruits Frozen Meat and Seafood Frozen Ready Meals Frozen Snacks Frozen Desserts Others |

| By End-User | Retail Consumers Food Service Providers Institutional Buyers Export Markets |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Wholesale Distributors |

| By Packaging Type | Vacuum Sealed Resealable Bags Bulk Packaging Single-Serve Packaging Others |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels |

| By Consumer Demographics | Age Group Income Level Family Size |

| By Product Origin | Local Production Imported Products |

| By Distribution Mode | Direct Distribution Indirect Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Frozen Food Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Frozen Foods | 120 | Household Decision Makers, Health-Conscious Consumers |

| Food Service Industry Insights | 80 | Restaurant Owners, Catering Managers |

| Distribution Channel Effectiveness | 60 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 40 | Product Development Managers, Marketing Executives |

The Bahrain Frozen Food Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing consumer demand for convenience foods and a rise in the number of working professionals.